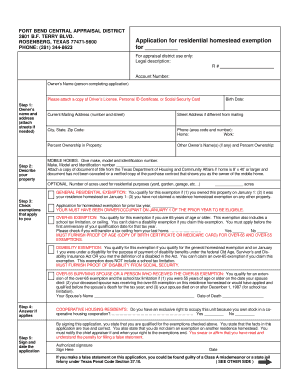

Residential Homestead Exemption Form

What is the Residential Homestead Exemption Form

The Residential Homestead Exemption Form is a crucial document that allows homeowners in Licking County, Ohio, to apply for property tax reductions on their primary residence. This exemption is designed to provide financial relief to eligible homeowners by reducing the taxable value of their property. By completing this form, residents can potentially lower their annual property tax bills, making homeownership more affordable.

Steps to complete the Residential Homestead Exemption Form

Completing the Residential Homestead Exemption Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your property details, proof of residency, and any required identification. Next, fill out the form accurately, ensuring that all sections are completed. It's important to double-check the information for any errors or omissions. Once completed, submit the form to the appropriate county office either online, by mail, or in person, depending on the submission methods available in Licking County.

Eligibility Criteria

To qualify for the Residential Homestead Exemption in Licking County, applicants must meet specific eligibility criteria. Generally, the applicant must be the owner of the property and occupy it as their primary residence. Additionally, the applicant should not have an annual income exceeding a certain threshold, which may vary based on current regulations. It is essential to review the latest guidelines to ensure compliance and eligibility before applying.

Required Documents

When applying for the Residential Homestead Exemption, several documents are typically required to support your application. These may include proof of ownership, such as a deed or tax bill, identification documents like a driver's license, and evidence of residency, such as utility bills or bank statements. Collecting these documents beforehand can streamline the application process and help avoid delays.

Form Submission Methods

The Residential Homestead Exemption Form can be submitted through various methods in Licking County. Homeowners may choose to complete the application online via the county's official website, which often provides a convenient and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate county office or delivered in person. Each method has its own advantages, so residents should select the one that best suits their needs.

Legal use of the Residential Homestead Exemption Form

The legal use of the Residential Homestead Exemption Form is governed by state laws and regulations. It is essential for applicants to ensure that the information provided is truthful and accurate, as any discrepancies may lead to penalties or denial of the exemption. Understanding the legal implications of submitting this form is crucial, as it not only affects property tax obligations but also ensures compliance with local property tax laws.

Quick guide on how to complete residential homestead exemption form

Complete Residential Homestead Exemption Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, amend, and eSign your documents quickly without delays. Manage Residential Homestead Exemption Form on any device using the airSlate SignNow Android or iOS apps and enhance any document-related task today.

How to edit and eSign Residential Homestead Exemption Form effortlessly

- Locate Residential Homestead Exemption Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Residential Homestead Exemption Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the residential homestead exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a residential homestead exemption form?

A residential homestead exemption form is a legal document that allows homeowners to reduce their property tax liability on their primary residence. By completing this form, you can claim a tax exemption, which can lead to signNow savings. It's essential to file this form correctly to ensure you receive the benefits.

-

How do I fill out the residential homestead exemption form?

Filling out the residential homestead exemption form typically requires information about your property, your ownership status, and other personal details. It's important to follow the instructions provided by your local tax authority. Taking advantage of airSlate SignNow can streamline this process by allowing you to eSign and submit your form electronically.

-

Can airSlate SignNow help with submitting the residential homestead exemption form?

Absolutely! airSlate SignNow provides an efficient platform to create, sign, and submit your residential homestead exemption form. The user-friendly interface simplifies document management, ensuring that your forms are filled out correctly and submitted on time.

-

What are the benefits of using airSlate SignNow for the residential homestead exemption form?

Using airSlate SignNow for your residential homestead exemption form can save you time and reduce errors. It allows for easy eSigning and document tracking, ensuring you always know the status of your submission. Additionally, our cost-effective solution supports seamless collaboration with agents or family members during the filing process.

-

Are there any fees associated with using airSlate SignNow for my residential homestead exemption form?

AirSlate SignNow offers a variety of pricing plans tailored to fit different needs, making it a cost-effective choice for managing documents like the residential homestead exemption form. Depending on your usage, you can find a plan that offers essential features without breaking the bank. Evaluate our plans to find the best option that suits your requirements.

-

What features does airSlate SignNow offer for document management like the residential homestead exemption form?

AirSlate SignNow provides robust features including customizable templates, eSignature capabilities, and secure cloud storage for document management. These tools streamline the completion of forms like the residential homestead exemption form, making the entire process more efficient and organized. You can also track document status and receive real-time notifications.

-

Can I integrate airSlate SignNow with other software for managing my residential homestead exemption form?

Yes, airSlate SignNow supports integrations with various software applications, enhancing your ability to manage documents like the residential homestead exemption form seamlessly. Whether you use accounting, CRM, or other document management tools, our integrations can help streamline your workflow. This makes it easier to access and prepare all necessary documentation.

Get more for Residential Homestead Exemption Form

- D888 form

- Da form 4755 21054731

- Strengtheningmedicare form

- Building permit application city of largo form

- Dfs h2 1544 limited surety professional bail bond agent appointing entity form

- Boundary line agreement template form

- Brand ambassador agreement template form

- Brand endorsement agreement template form

Find out other Residential Homestead Exemption Form

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT