NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom Form

What is the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom

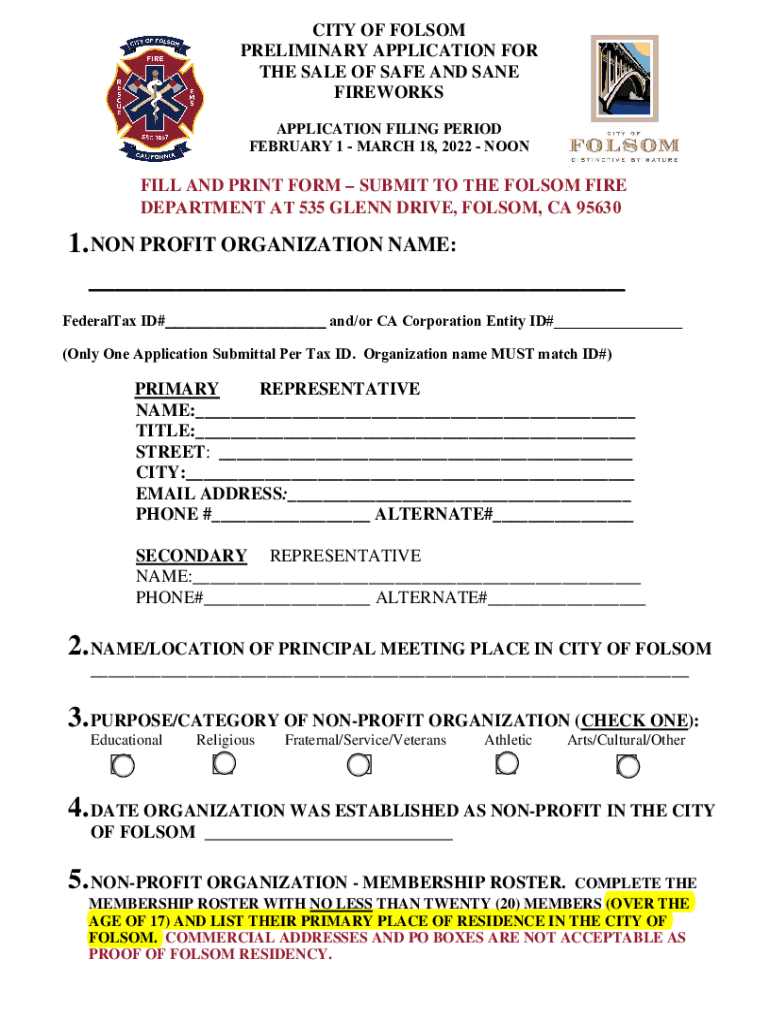

The NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom is a specific form used by non-profit organizations in Folsom to apply for a Tax Identification Number (TIN). This number is essential for tax purposes, allowing the organization to operate legally and fulfill its obligations under U.S. tax law. The form collects necessary information about the organization, including its legal name, address, and structure, ensuring compliance with federal regulations.

Steps to complete the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom

Completing the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom involves several key steps:

- Gather required information, including the organization's legal name, address, and structure.

- Fill out the application form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on the preferred method.

How to use the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom

Using the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom is straightforward. Organizations must fill out the form with accurate details and submit it to the IRS. Once processed, the IRS will issue a Tax ID number, which is crucial for opening bank accounts, applying for grants, and fulfilling tax obligations. It is advisable to keep a copy of the completed form for the organization's records.

Legal use of the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom

The legal use of the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom is governed by IRS regulations. This form ensures that non-profit organizations are recognized for tax purposes, allowing them to operate without incurring certain federal taxes. Failure to use the form correctly can lead to penalties or the inability to receive tax-exempt status.

Required Documents

When completing the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom, certain documents are typically required:

- Proof of the organization's legal structure, such as articles of incorporation.

- Identification of the principal officer or responsible party.

- Any relevant state registration documents.

Application Process & Approval Time

The application process for the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom generally takes a few weeks. After submission, the IRS reviews the application and issues the Tax ID number if all information is correct. Organizations can check the status of their application through the IRS website or by contacting the agency directly.

Quick guide on how to complete non profit organization name tax id only one application folsom

Complete NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom effortlessly on any device

Digital document management has become increasingly favorable for both organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to generate, modify, and eSign your documents promptly without delays. Manage NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to alter and eSign NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom with ease

- Locate NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom and click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to secure your changes.

- Choose how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Alter and eSign NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the non profit organization name tax id only one application folsom

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom?

The NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom is a streamlined solution offered by airSlate SignNow to help non-profit organizations easily manage and eSign important documents. This application simplifies the process of obtaining and using a Tax ID for your nonprofit organization, ensuring compliance and efficiency.

-

How does the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom work?

The NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom works by providing a user-friendly interface where organizations can submit their application electronically. After completion, the application is securely sent for processing, allowing organizations to track their status in real-time.

-

What are the pricing options for the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom?

Pricing for the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom is competitive, offering affordable subscription plans suitable for non-profits. Our plans ensure that you receive the full benefits of airSlate SignNow's features without straining your budget.

-

What features are included with the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom?

The NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom includes features such as eSigning, document storage, real-time tracking, and secure sharing capabilities. These features are designed to enhance your organization's document management processes.

-

What are the benefits of using the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom?

Using the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom allows organizations to save time and reduce paperwork. The ease of eSigning and document management simplifies operations, enabling non-profits to focus more on their mission rather than administrative tasks.

-

Can I integrate the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom with other software?

Yes, the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom can be seamlessly integrated with various applications such as CRM systems, project management tools, and document storage services. This flexibility allows organizations to enhance their existing workflows.

-

Is there customer support available for the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom?

Absolutely! Our customer support team is dedicated to assisting users of the NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom. We offer guidance through our help center, as well as live support options to resolve any questions or issues that arise.

Get more for NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom

- Dole baguio job vacancies form

- Car wash a thon pledge form virginia beach young

- Cover letter examples asu form

- Massdot form t21516 1011

- Business permit checklist bformbpdf san carlos city sancarloscity gov

- The old spaghetti factory employment application form

- Cro master service agreement template form

- Call center agreement template form

Find out other NON PROFIT ORGANIZATION NAME Tax ID Only One Application Folsom

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online