Retail Income Form

What is the Retail Income Form

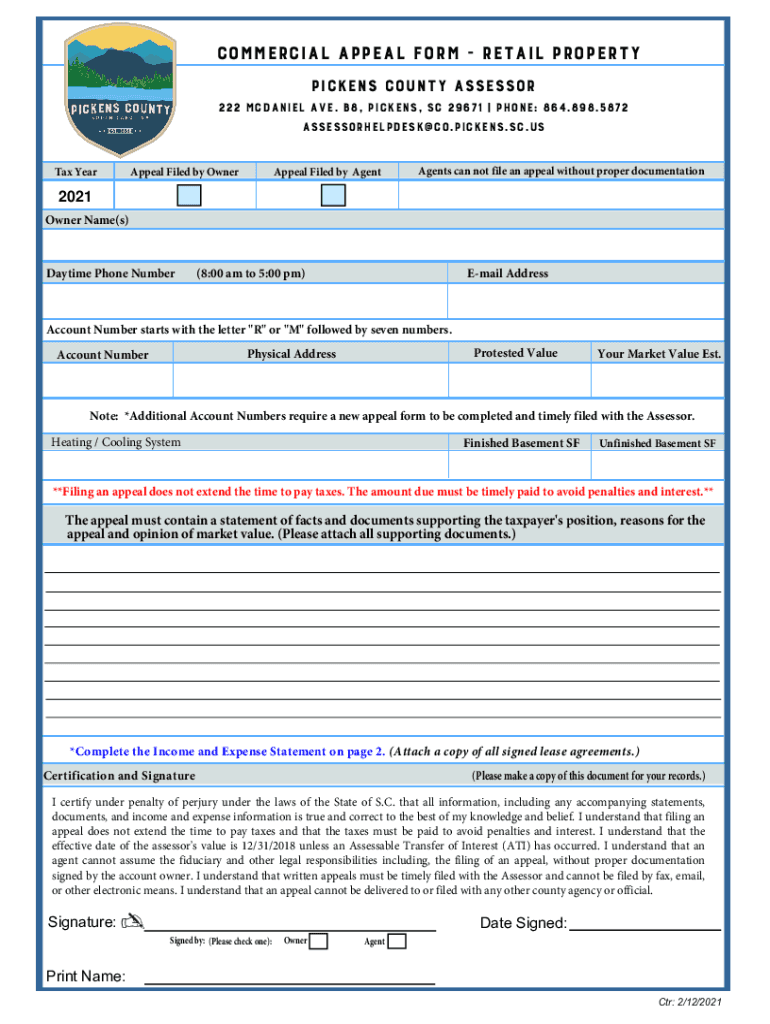

The Retail Income Form is a crucial document used primarily by individuals and businesses to report income generated from retail activities. This form ensures that all earnings are accurately documented for tax purposes, providing transparency and compliance with federal and state regulations. It is essential for self-employed individuals, small business owners, and anyone engaged in retail operations to maintain accurate financial records.

How to use the Retail Income Form

Using the Retail Income Form involves several steps to ensure that all necessary information is accurately captured. First, gather all relevant financial data, including sales receipts, invoices, and any other documentation that reflects your retail income. Next, fill out the form with precise details regarding your earnings, expenses, and any deductions you may qualify for. After completing the form, review it for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Retail Income Form

Completing the Retail Income Form requires careful attention to detail. Follow these steps:

- Collect all financial documents related to your retail income.

- Fill in your personal information, including name, address, and Social Security number.

- Document your total retail sales and any returns or allowances.

- List all relevant expenses associated with your retail operations.

- Calculate your net income by subtracting expenses from total sales.

- Review the completed form for accuracy.

- Submit the form to the appropriate tax authority.

Legal use of the Retail Income Form

The Retail Income Form is legally binding when filled out correctly and submitted according to IRS guidelines. It is essential to comply with all relevant tax laws to avoid penalties. The form must be signed and dated, and any electronic submissions should utilize secure eSignature solutions to ensure authenticity and compliance with regulations such as the ESIGN Act and UETA.

Key elements of the Retail Income Form

Several key elements must be included in the Retail Income Form to ensure its validity:

- Personal Information: Name, address, and taxpayer identification number.

- Total Sales: Accurate reporting of gross sales before any deductions.

- Expenses: Detailed listing of all business-related expenses.

- Net Income: Calculation of income after expenses.

- Signature: Required to validate the form submission.

Who Issues the Form

The Retail Income Form is typically issued by the Internal Revenue Service (IRS) in the United States. However, specific versions or additional forms may be required depending on state regulations. It is important to verify that you are using the correct form for your specific situation and jurisdiction to ensure compliance with all applicable laws.

Quick guide on how to complete retail income form

Effortlessly Prepare Retail Income Form on Any Device

Managing documents online has gained traction with businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to locate the appropriate template and securely keep it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly and without delays. Handle Retail Income Form on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-driven task today.

How to Modify and eSign Retail Income Form Without Any Hassle

- Locate Retail Income Form and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or missing files, time-consuming form searches, or errors requiring new prints. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you choose. Edit and eSign Retail Income Form and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the retail income form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Retail Income Form, and how does it work?

A Retail Income Form is a document designed to capture and organize income information for retail businesses. Using airSlate SignNow, you can easily create, send, and eSign this form, streamlining your income tracking processes. Our platform ensures that you maintain accurate records while saving time and reducing paperwork.

-

What are the benefits of using airSlate SignNow for Retail Income Forms?

Using airSlate SignNow for Retail Income Forms provides numerous benefits, including quick eSigning, cost-effective document management, and enhanced workflow efficiency. You can access your forms from anywhere, ensuring seamless collaboration among team members. Additionally, our solution helps maintain compliance and reduces the risk of errors associated with manual entries.

-

What features does airSlate SignNow offer for creating a Retail Income Form?

airSlate SignNow offers a range of features for creating Retail Income Forms, such as customizable templates, drag-and-drop functionality, and easy eSignature options. You can also add fields for specific data collection, ensuring that all necessary information is captured effortlessly. Our integration capabilities allow you to connect with other tools you already use for better workflow management.

-

How much does it cost to use airSlate SignNow for Retail Income Forms?

Pricing for using airSlate SignNow to manage Retail Income Forms is competitive and varies based on your chosen plan. We offer several tiers, each suited for different business sizes and needs. Visit our website for detailed pricing information and to select the best option for your retail business.

-

Can I integrate airSlate SignNow with other tools for Retail Income Forms?

Yes, airSlate SignNow allows seamless integration with a variety of tools and applications, enhancing your workflow when using Retail Income Forms. Integrate with CRM systems, cloud storage solutions, and project management tools for a streamlined process. This means you can automatically compile data from multiple sources, improving efficiency and data accuracy.

-

Is it easy to eSign a Retail Income Form with airSlate SignNow?

Absolutely! eSigning a Retail Income Form with airSlate SignNow is quick and straightforward. Users can sign documents electronically in just a few clicks, eliminating the need for printing and scanning. This feature not only saves time but also enhances document security and compliance.

-

What types of Retail Income Forms can be created using airSlate SignNow?

With airSlate SignNow, you can create various types of Retail Income Forms tailored to your business needs, including income disclosure forms, sales reports, and transaction logs. Our platform allows full customization, so you can design each form to collect the specific information necessary for your retail operations. This flexibility makes tracking income straightforward and efficient.

Get more for Retail Income Form

- Spot the dog picture quiz form

- Sc3 form 400403915

- Science fair proposal form

- Iep 102 parent information for iep fairfax county public schools fcps

- Application for the grant or renewal of an alcoholic retail drinks license doc nairobi go form

- Application for provident benefits claim form

- Prevention of harassment letter form

- Nc 125 order to show cause change of name to conform to gender identity judicial council forms

Find out other Retail Income Form

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document