Federal General Business Credit from a Non Passive Activity from Federal Form 3800, Part 2024-2026

What is the Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part

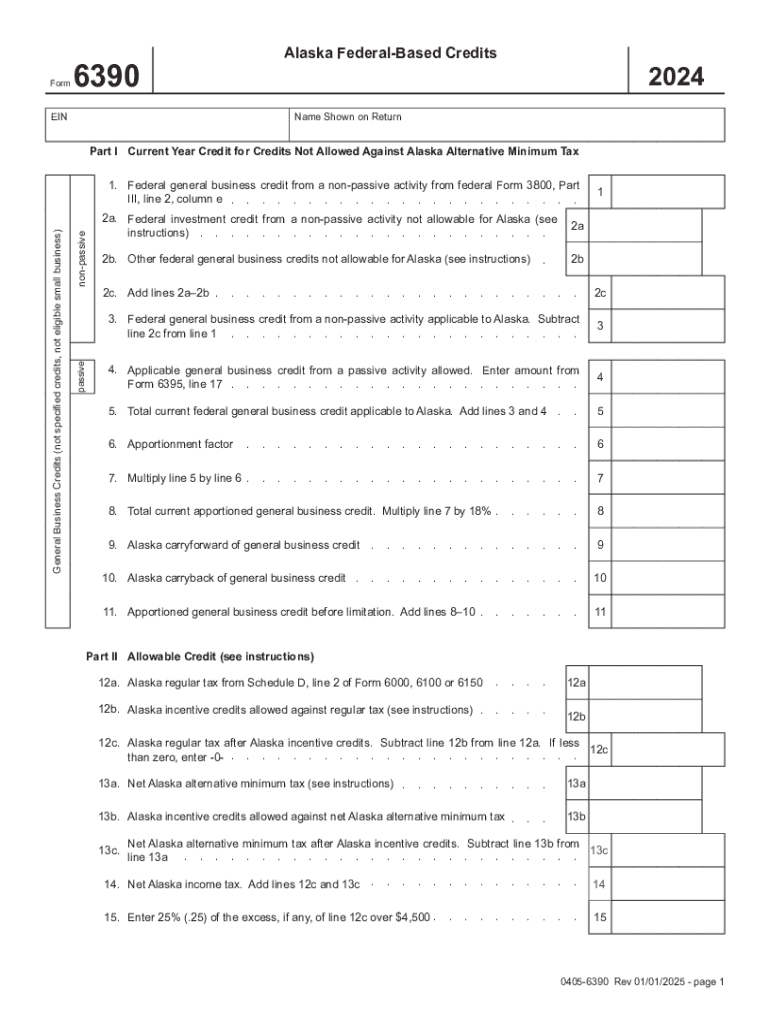

The Federal General Business Credit from a non-passive activity is a tax credit that allows businesses to reduce their federal tax liability. This credit is reported on Federal Form 3800, Part, which consolidates various business credits into a single form. The non-passive aspect indicates that the credit is applicable to income generated from active business operations, rather than passive investments. This distinction is crucial for businesses as it determines eligibility and the extent of the credit available.

How to use the Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part

To utilize the Federal General Business Credit, businesses must first ensure they qualify based on their income and activities. The credit can be applied against various tax liabilities, effectively lowering the amount owed to the IRS. When filling out Form 3800, Part, businesses must accurately report their qualifying activities and calculate the credit based on the guidelines provided by the IRS. Proper documentation and record-keeping are essential to substantiate the credit claimed.

Steps to complete the Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part

Completing the Federal Form 3800, Part, involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Determine eligibility for the general business credit based on active business operations.

- Fill out the relevant sections of Form 3800, Part, detailing the qualifying activities.

- Calculate the total credit amount based on the IRS guidelines provided in the form instructions.

- Review the completed form for accuracy before submission.

Eligibility Criteria

Eligibility for the Federal General Business Credit from a non-passive activity is contingent upon several factors. Businesses must be engaged in active trade or business activities, as passive income does not qualify for this credit. Additionally, the credit is typically available to various business entities, including corporations, partnerships, and sole proprietorships. It is essential for businesses to assess their activities and ensure they meet the IRS criteria for claiming the credit.

Required Documents

To successfully claim the Federal General Business Credit, businesses must prepare and submit several documents. These typically include:

- Federal Form 3800, Part, accurately completed.

- Supporting documentation that verifies qualifying business activities.

- Financial statements that demonstrate income and expenses related to the business.

- Any additional forms or schedules required by the IRS based on specific credit types.

IRS Guidelines

The IRS provides comprehensive guidelines for claiming the Federal General Business Credit. These guidelines outline the types of activities that qualify, the calculation methods for the credit, and the documentation required for substantiation. Businesses should refer to the latest IRS publications and instructions related to Form 3800 to ensure compliance with current regulations and maximize their credit claims.

Create this form in 5 minutes or less

Find and fill out the correct federal general business credit from a non passive activity from federal form 3800 part

Create this form in 5 minutes!

How to create an eSignature for the federal general business credit from a non passive activity from federal form 3800 part

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part?

The Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part is a tax credit that allows businesses to reduce their tax liability based on certain qualifying activities. This credit is designed to incentivize businesses to invest in activities that contribute to economic growth. Understanding this credit can help you maximize your tax benefits.

-

How can airSlate SignNow help me with the Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part?

airSlate SignNow provides an efficient platform for managing and signing documents related to the Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part. With our easy-to-use interface, you can streamline the documentation process, ensuring that all necessary forms are completed and submitted accurately. This can save you time and reduce the risk of errors.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans are designed to provide cost-effective solutions for managing documents, including those related to the Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part. You can choose a plan that best fits your needs and budget.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features such as eSignature capabilities, document templates, and real-time collaboration tools. These features are particularly useful for managing documents related to the Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part. Our platform ensures that you can handle all your documentation efficiently and securely.

-

Are there any benefits to using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those for the Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part, offers numerous benefits. You can ensure compliance, reduce processing time, and enhance security with our encrypted platform. This allows you to focus on your business while we handle your documentation needs.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow offers integrations with various software tools to enhance your workflow. This includes accounting and tax software that can help you manage the Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part more effectively. Our integrations ensure that you can work seamlessly across different platforms.

-

How secure is airSlate SignNow for handling sensitive documents?

airSlate SignNow prioritizes security and compliance, ensuring that all documents, including those related to the Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part, are handled with the utmost care. We utilize advanced encryption and security protocols to protect your sensitive information. You can trust us to keep your documents safe.

Get more for Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part

- Orea form 401

- Ett n2 textbook pdf form

- Grade 8 natural science exam papers and memos 2020 form

- Cooperative membership form pdf

- Sample of agreement between car owner and driver doc form

- Jawapan modul fizik tingkatan 5 form

- State records and dos ny form

- Straight note interest only chicago title connection home form

Find out other Federal General Business Credit From A Non passive Activity From Federal Form 3800, Part

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free