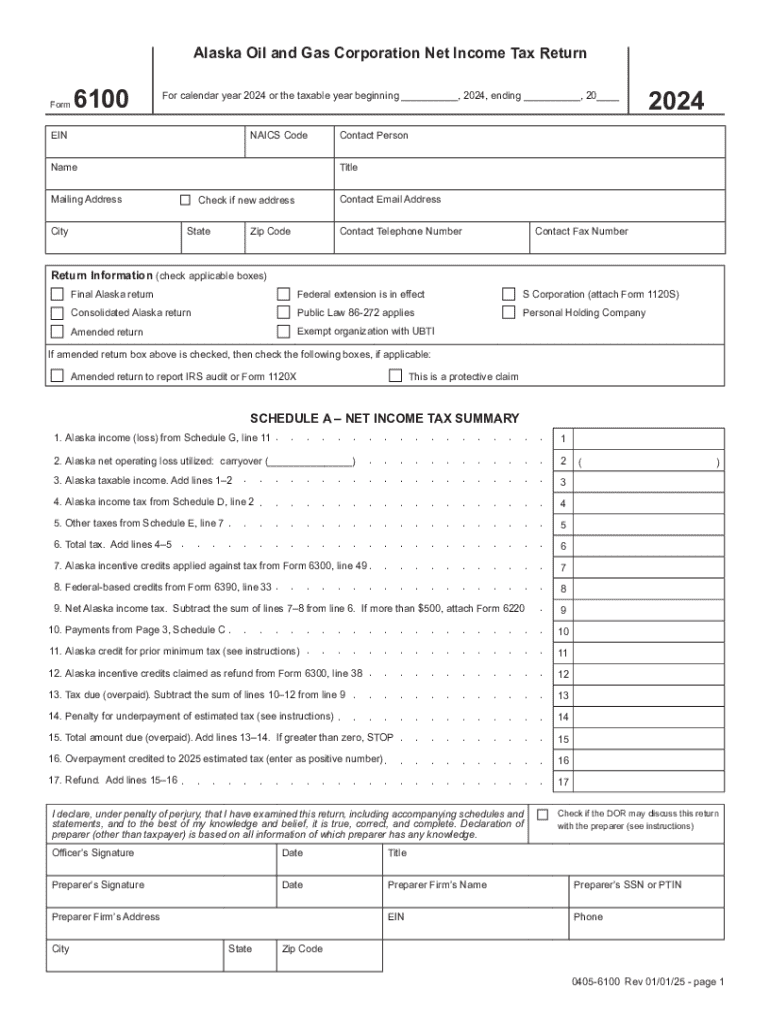

for Calendar Year or the Taxable Year Beginning , , Ending , 20 2024-2026

What is the For Calendar Year Or The Taxable Year Beginning , , Ending , 20

The form "For Calendar Year Or The Taxable Year Beginning , , Ending , 20" is used primarily for tax reporting purposes. It allows individuals and businesses to specify the time frame for which they are reporting income, expenses, and other relevant financial information. This form is essential for ensuring that all taxable income is accurately reported to the Internal Revenue Service (IRS) within the designated tax year.

Understanding the distinction between a calendar year and a fiscal year is crucial. A calendar year runs from January first to December thirty-first, while a fiscal year can vary, beginning on any date and lasting for twelve consecutive months. This form helps clarify which type of year is being used for tax reporting, impacting how income is assessed and taxed.

How to use the For Calendar Year Or The Taxable Year Beginning , , Ending , 20

Using the form "For Calendar Year Or The Taxable Year Beginning , , Ending , 20" involves filling out specific details regarding the tax period. Users must enter the starting and ending dates of the taxable year, ensuring accuracy to avoid any potential issues with the IRS.

Once the dates are filled in, the form can be included with other tax documents when filing. It is important to keep a copy for personal records. This form is often used in conjunction with other tax forms, such as the 1040 for individuals or the 1120 for corporations, to provide a complete picture of financial activity during the specified year.

Steps to complete the For Calendar Year Or The Taxable Year Beginning , , Ending , 20

Completing the form "For Calendar Year Or The Taxable Year Beginning , , Ending , 20" requires several straightforward steps:

- Gather all necessary financial documents for the specified year.

- Determine whether you are using a calendar year or a fiscal year for reporting.

- Fill in the starting date and ending date of the taxable year accurately.

- Review all entries for accuracy to ensure compliance with IRS guidelines.

- Attach the completed form to your primary tax return and retain a copy for your records.

Following these steps carefully will help ensure that your tax filings are complete and accurate.

IRS Guidelines

The IRS provides specific guidelines for using the form "For Calendar Year Or The Taxable Year Beginning , , Ending , 20". It is essential to follow these guidelines to avoid penalties and ensure compliance. The IRS requires that taxpayers report income based on the year they receive it, which means understanding the timing of income and expenses is vital.

Additionally, the IRS may have different requirements depending on the type of entity filing the form, whether it is an individual, partnership, or corporation. Always refer to the latest IRS publications or consult a tax professional for the most accurate and relevant information.

Filing Deadlines / Important Dates

Filing deadlines for the form "For Calendar Year Or The Taxable Year Beginning , , Ending , 20" are critical to ensure compliance with IRS regulations. Generally, individual tax returns are due on April fifteenth of the following year, while corporate returns may have different deadlines depending on the entity type.

It is important to be aware of any extensions that may apply and to mark your calendar for these dates. Missing a deadline can result in penalties and interest on any taxes owed, so staying informed about these important dates is essential for all taxpayers.

Required Documents

To complete the form "For Calendar Year Or The Taxable Year Beginning , , Ending , 20", several documents may be required. These typically include:

- Income statements, such as W-2s or 1099s.

- Records of expenses and deductions.

- Previous year’s tax return for reference.

- Any relevant financial statements for businesses.

Having these documents organized and readily accessible will streamline the process of completing the form and ensure that all necessary information is reported accurately.

Create this form in 5 minutes or less

Find and fill out the correct for calendar year or the taxable year beginning ending 20 771887627

Create this form in 5 minutes!

How to create an eSignature for the for calendar year or the taxable year beginning ending 20 771887627

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the difference between the calendar year and the taxable year for tax purposes?

The calendar year runs from January 1 to December 31, while the taxable year can vary based on a business's fiscal schedule. Understanding whether to use 'For Calendar Year Or The Taxable Year Beginning , , Ending , 20.' is crucial for accurate tax reporting. Choosing the right year can impact your tax obligations and financial planning.

-

How does airSlate SignNow support document signing for tax-related documents?

airSlate SignNow provides a secure platform for eSigning tax documents, ensuring compliance with legal standards. Users can easily send and sign documents related to 'For Calendar Year Or The Taxable Year Beginning , , Ending , 20.' This streamlines the process, making it faster and more efficient for businesses.

-

What pricing plans does airSlate SignNow offer for businesses?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Each plan includes features that facilitate document management and eSigning, especially for 'For Calendar Year Or The Taxable Year Beginning , , Ending , 20.' You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow integrates seamlessly with various software tools, enhancing your workflow. This is particularly beneficial for managing documents related to 'For Calendar Year Or The Taxable Year Beginning , , Ending , 20.' Integrations with CRM and accounting software can streamline your processes.

-

What are the key features of airSlate SignNow that benefit businesses?

Key features of airSlate SignNow include customizable templates, secure eSigning, and real-time tracking of document status. These features are designed to simplify the signing process for documents related to 'For Calendar Year Or The Taxable Year Beginning , , Ending , 20.' This ensures that businesses can operate efficiently and stay organized.

-

Is airSlate SignNow compliant with legal standards for eSigning?

Absolutely, airSlate SignNow complies with all legal standards for electronic signatures, ensuring that your documents are legally binding. This compliance is essential when dealing with tax documents for 'For Calendar Year Or The Taxable Year Beginning , , Ending , 20.' You can trust that your signed documents will hold up in legal situations.

-

How can airSlate SignNow improve my business's efficiency?

By using airSlate SignNow, businesses can signNowly reduce the time spent on document management and signing processes. This efficiency is particularly important for documents related to 'For Calendar Year Or The Taxable Year Beginning , , Ending , 20.' Faster turnaround times mean you can focus more on your core business activities.

Get more for For Calendar Year Or The Taxable Year Beginning , , Ending , 20

Find out other For Calendar Year Or The Taxable Year Beginning , , Ending , 20

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later