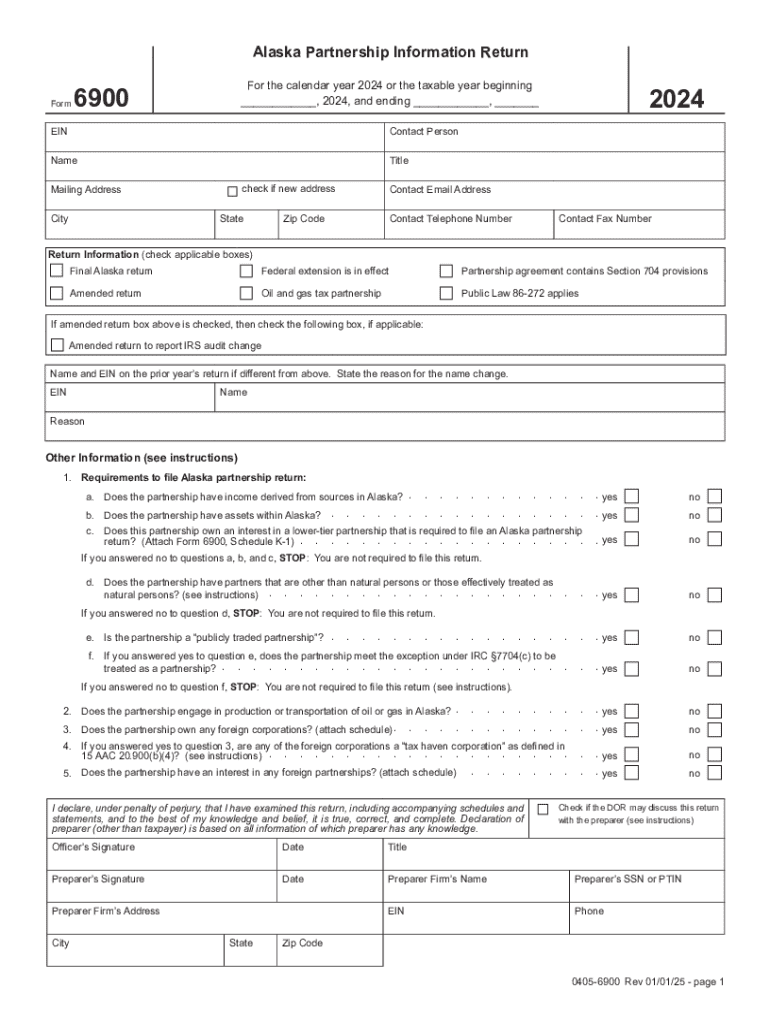

for the Calendar Year or the Taxable Year Beginning 2024-2026

What is the For The Calendar Year Or The Taxable Year Beginning

The term "For The Calendar Year Or The Taxable Year Beginning" refers to the specific time frame used for reporting income and expenses for tax purposes. This designation is crucial for individuals and businesses when preparing their tax returns, as it determines the period for which income is calculated and tax obligations are assessed. The calendar year runs from January first to December thirty-first, while a taxable year can vary based on the entity's chosen fiscal year. Understanding this distinction helps ensure accurate reporting and compliance with IRS regulations.

How to use the For The Calendar Year Or The Taxable Year Beginning

Using the "For The Calendar Year Or The Taxable Year Beginning" designation involves selecting the appropriate time frame for your tax reporting. For individuals, this typically aligns with the calendar year. Businesses may choose a fiscal year that best reflects their operational cycle. When filling out tax forms, you will indicate this period to specify the income and expenses that fall within that timeframe. Accurate reporting is essential for determining tax liability and ensuring compliance with federal and state regulations.

Steps to complete the For The Calendar Year Or The Taxable Year Beginning

Completing the "For The Calendar Year Or The Taxable Year Beginning" section of your tax forms involves several key steps:

- Determine your reporting period: Decide if you will use the calendar year or a fiscal year based on your business structure or personal preference.

- Gather financial records: Collect all income and expense documentation for the selected period.

- Fill out the appropriate tax form: Indicate the chosen year on your tax return, ensuring it matches your financial records.

- Review for accuracy: Double-check all entries to confirm they reflect the correct period and financial data.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the "For The Calendar Year Or The Taxable Year Beginning" designation. Taxpayers must adhere to these rules to avoid penalties and ensure compliance. The IRS allows individuals to use the calendar year for reporting, while businesses can select a fiscal year if it aligns with their operational needs. It's important to consult the IRS publications or guidelines relevant to your specific situation to understand the implications of your chosen reporting period.

Filing Deadlines / Important Dates

Filing deadlines related to the "For The Calendar Year Or The Taxable Year Beginning" designation are critical for compliance. For individuals, the deadline is typically April fifteenth of the following year. Businesses may have different deadlines based on their fiscal year. It's essential to be aware of these dates to avoid late filing penalties. Additionally, extensions may be available, but they must be requested prior to the original deadline.

Key elements of the For The Calendar Year Or The Taxable Year Beginning

Key elements associated with the "For The Calendar Year Or The Taxable Year Beginning" designation include:

- Definition of the reporting period: Understanding the difference between calendar and fiscal years.

- Documentation requirements: Keeping accurate records of income and expenses for the designated period.

- IRS compliance: Adhering to IRS rules regarding the selection and reporting of the taxable year.

- Impact on tax liability: Recognizing how the chosen period affects overall tax calculations.

Create this form in 5 minutes or less

Find and fill out the correct for the calendar year or the taxable year beginning

Create this form in 5 minutes!

How to create an eSignature for the for the calendar year or the taxable year beginning

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the difference between 'For The Calendar Year Or The Taxable Year Beginning' in terms of document signing?

The distinction between 'For The Calendar Year Or The Taxable Year Beginning' primarily affects how documents are dated and processed for tax purposes. Understanding this difference is crucial for ensuring compliance and accurate record-keeping. airSlate SignNow allows you to easily manage and eSign documents relevant to either timeframe.

-

How does airSlate SignNow handle pricing for businesses operating 'For The Calendar Year Or The Taxable Year Beginning'?

Our pricing model is designed to be flexible and cost-effective, accommodating businesses that operate 'For The Calendar Year Or The Taxable Year Beginning.' We offer various plans that cater to different needs, ensuring you only pay for what you use while maximizing your document management efficiency.

-

What features does airSlate SignNow offer for managing documents 'For The Calendar Year Or The Taxable Year Beginning'?

airSlate SignNow provides a range of features tailored for businesses managing documents 'For The Calendar Year Or The Taxable Year Beginning.' These include customizable templates, automated workflows, and secure eSigning capabilities, all designed to streamline your document processes and enhance productivity.

-

Can airSlate SignNow integrate with other software for businesses focused 'For The Calendar Year Or The Taxable Year Beginning'?

Yes, airSlate SignNow offers seamless integrations with various software solutions that are essential for businesses operating 'For The Calendar Year Or The Taxable Year Beginning.' This includes CRM systems, accounting software, and more, allowing for a cohesive workflow and improved efficiency.

-

What are the benefits of using airSlate SignNow for documents related to 'For The Calendar Year Or The Taxable Year Beginning'?

Using airSlate SignNow for documents related to 'For The Calendar Year Or The Taxable Year Beginning' provides numerous benefits, including enhanced security, faster turnaround times, and improved compliance. Our platform simplifies the eSigning process, making it easier for businesses to manage their documentation effectively.

-

Is airSlate SignNow suitable for small businesses dealing with 'For The Calendar Year Or The Taxable Year Beginning'?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal solution for small businesses managing documents 'For The Calendar Year Or The Taxable Year Beginning.' Our platform scales with your needs, ensuring you have the tools necessary for efficient document management.

-

How does airSlate SignNow ensure compliance for documents signed 'For The Calendar Year Or The Taxable Year Beginning'?

airSlate SignNow prioritizes compliance by providing features that ensure all documents signed 'For The Calendar Year Or The Taxable Year Beginning' meet legal standards. Our platform includes audit trails, secure storage, and customizable signing workflows to help you maintain compliance effortlessly.

Get more for For The Calendar Year Or The Taxable Year Beginning

Find out other For The Calendar Year Or The Taxable Year Beginning

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile