Non Qualified Claimant's Statement Lincoln Financial Form

What is the Non Qualified Claimant's Statement Lincoln Financial?

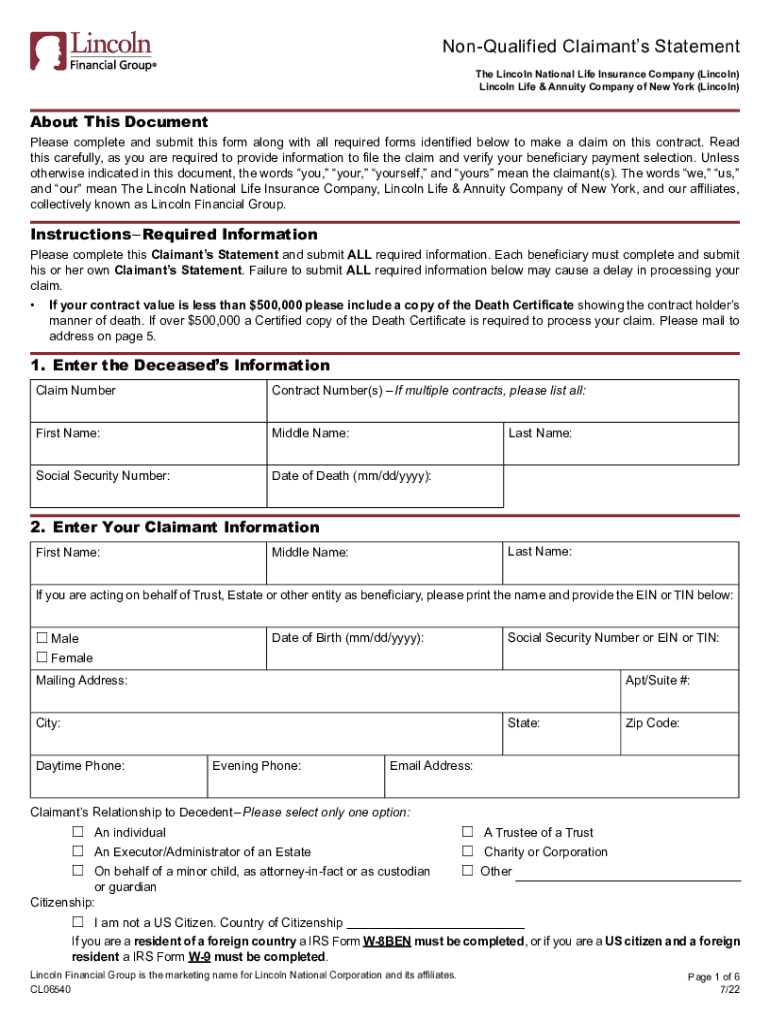

The Non Qualified Claimant's Statement from Lincoln Financial is a crucial document used in the processing of disability buyouts. It serves as a formal declaration by the claimant, detailing their circumstances and eligibility for benefits under a non-qualified plan. This statement is essential for ensuring that the claims process adheres to the specific guidelines set forth by Lincoln Financial, allowing for a streamlined review and approval of benefits. Understanding the purpose and requirements of this form is vital for anyone navigating the complexities of disability buyouts.

Steps to Complete the Non Qualified Claimant's Statement Lincoln Financial

Completing the Non Qualified Claimant's Statement requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary personal information, including your Social Security number and contact details.

- Provide a clear description of your disability, including the onset date and any relevant medical documentation.

- Detail your employment history, including your job title, duties, and the duration of employment before the disability.

- Sign and date the form, ensuring that all information is accurate and complete.

Following these steps will help facilitate a smoother claims process with Lincoln Financial.

Legal Use of the Non Qualified Claimant's Statement Lincoln Financial

The Non Qualified Claimant's Statement has significant legal implications. It is a binding document that must be filled out truthfully to avoid potential legal repercussions. Misrepresentation or omission of information can lead to denial of benefits or legal action. Moreover, this statement must comply with relevant laws and regulations governing disability benefits in the United States. Understanding the legal weight of this document is essential for claimants to protect their rights and ensure compliance with Lincoln Financial's requirements.

Key Elements of the Non Qualified Claimant's Statement Lincoln Financial

Several key elements must be included in the Non Qualified Claimant's Statement to ensure its validity:

- Claimant Information: Full name, address, and contact information.

- Disability Details: A comprehensive description of the disability, including medical diagnoses.

- Employment History: Information about job roles and responsibilities prior to the disability.

- Signature: The claimant's signature, confirming the accuracy of the information provided.

Including these elements is crucial for the successful processing of the claim.

How to Obtain the Non Qualified Claimant's Statement Lincoln Financial

Obtaining the Non Qualified Claimant's Statement is a straightforward process. Claimants can request the form directly from Lincoln Financial's website or customer service. It may also be available through your employer if they offer Lincoln Financial's disability benefits. Ensure you have the correct version of the form to avoid delays in processing your claim.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Non Qualified Claimant's Statement can be done through various methods:

- Online: Many claimants prefer to submit their forms electronically through Lincoln Financial's secure portal.

- Mail: You can print the completed form and send it via postal service to the designated address provided by Lincoln Financial.

- In-Person: Some claimants may choose to deliver the form in person at a local Lincoln Financial office.

Selecting the appropriate submission method can help expedite the claims process.

Quick guide on how to complete non qualified claimants statement lincoln financial

Prepare Non Qualified Claimant's Statement Lincoln Financial effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Non Qualified Claimant's Statement Lincoln Financial on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Non Qualified Claimant's Statement Lincoln Financial effortlessly

- Locate Non Qualified Claimant's Statement Lincoln Financial and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight necessary sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Non Qualified Claimant's Statement Lincoln Financial and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the non qualified claimants statement lincoln financial

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Non Qualified Claimant's Statement Lincoln Financial?

A Non Qualified Claimant's Statement Lincoln Financial is a crucial document needed when filing certain claims. It helps ensure clarity and compliance with the terms of the Lincoln Financial policies. Understanding this statement can facilitate smoother handling of your claims process.

-

How can airSlate SignNow assist with creating a Non Qualified Claimant's Statement Lincoln Financial?

airSlate SignNow provides an intuitive platform that allows users to easily create and customize a Non Qualified Claimant's Statement Lincoln Financial. With user-friendly templates and eSignature capabilities, you can streamline the document preparation and signing process efficiently.

-

What are the costs associated with using airSlate SignNow for the Non Qualified Claimant's Statement Lincoln Financial?

airSlate SignNow offers competitive pricing plans to cater to various business needs, making it cost-effective for handling the Non Qualified Claimant's Statement Lincoln Financial. You can choose a plan based on your expected document volume and requirements, ensuring you only pay for what you need.

-

Are there any integrations available for airSlate SignNow regarding the Non Qualified Claimant's Statement Lincoln Financial?

Yes, airSlate SignNow seamlessly integrates with various platforms to enhance your workflow when handling the Non Qualified Claimant's Statement Lincoln Financial. You can easily connect it with CRM systems, cloud storage services, and more for a cohesive documentation process.

-

What benefits does airSlate SignNow offer for managing the Non Qualified Claimant's Statement Lincoln Financial?

Using airSlate SignNow for your Non Qualified Claimant's Statement Lincoln Financial brings substantial benefits, including faster document turnaround times and enhanced security. The eSignature feature ensures compliance and expedites the entire claims process, ultimately saving you time.

-

Is it easy to eSign the Non Qualified Claimant's Statement Lincoln Financial with airSlate SignNow?

Absolutely! airSlate SignNow provides a straightforward eSigning process for the Non Qualified Claimant's Statement Lincoln Financial. Users can sign documents electronically from any device, making it convenient and efficient.

-

Can I track the status of my Non Qualified Claimant's Statement Lincoln Financial submissions with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your submissions for the Non Qualified Claimant's Statement Lincoln Financial. You will receive real-time notifications and updates on the document's progress, ensuring you stay informed throughout the entire process.

Get more for Non Qualified Claimant's Statement Lincoln Financial

Find out other Non Qualified Claimant's Statement Lincoln Financial

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document