Skip Loan Pay Application 2021-2026

What is the Skip Loan Pay Application

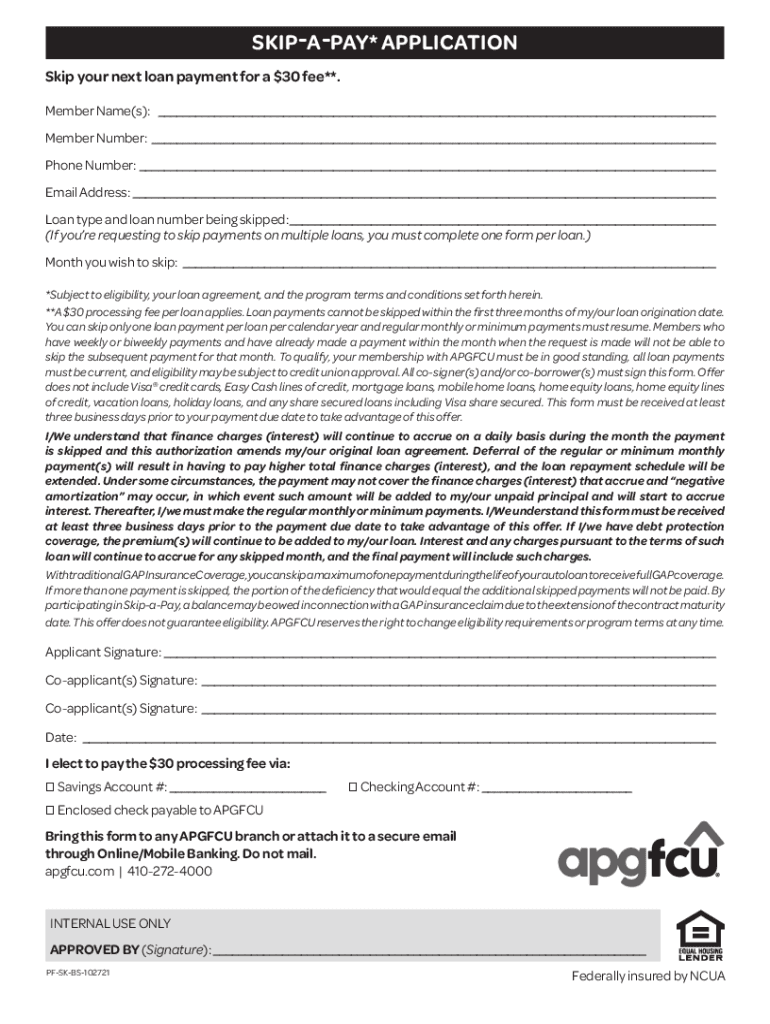

The skip loan pay application is a financial document used by borrowers to request a temporary suspension of loan payments. This form is particularly relevant for individuals facing financial hardship, allowing them to manage their repayment obligations more effectively. By submitting this application, borrowers can seek relief from their payment schedule, which can be crucial during unexpected financial challenges.

Steps to complete the Skip Loan Pay Application

Completing the skip loan pay application involves several key steps to ensure accuracy and compliance. Here is a straightforward process to follow:

- Gather necessary financial documents, including income statements and loan details.

- Fill out the application form with accurate personal and loan information.

- Provide a clear explanation of your financial situation and the reason for the request.

- Review the application for completeness and accuracy.

- Submit the application through the designated method, whether online, by mail, or in person.

How to use the Skip Loan Pay Application

Using the skip loan pay application effectively requires understanding its purpose and the information needed. Borrowers should first assess their financial situation to determine if a payment suspension is necessary. Once the decision is made, they can access the application form, either digitally or in print, and provide the required information. It is essential to keep a copy of the submitted application for personal records.

Legal use of the Skip Loan Pay Application

The skip loan pay application is legally binding when completed and submitted according to the lender's guidelines. To ensure its validity, borrowers must follow all legal requirements, including providing truthful information and adhering to deadlines. Additionally, lenders are required to review the application in accordance with applicable laws, ensuring that the borrower's rights are protected throughout the process.

Eligibility Criteria

Eligibility for the skip loan pay application varies by lender, but common criteria include:

- Proof of financial hardship, such as job loss or medical expenses.

- Current standing with loan payments prior to the request.

- Compliance with the lender's specific requirements for application submission.

Borrowers should check with their lender for specific eligibility requirements to increase the chances of approval.

Required Documents

When applying for a skip loan pay application, borrowers typically need to provide several documents to support their request. These may include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of expenses that demonstrate financial hardship.

- Loan account information, including account number and loan type.

Having these documents ready can streamline the application process and improve the likelihood of a favorable outcome.

Form Submission Methods

The skip loan pay application can usually be submitted through various methods, depending on the lender's policies. Common submission methods include:

- Online submission via the lender's website or mobile app.

- Mailing a printed version of the application to the lender's address.

- In-person submission at a local branch or office.

Choosing the appropriate submission method can help ensure timely processing of the application.

Quick guide on how to complete skip loan pay application

Complete Skip Loan Pay Application effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents quickly and efficiently. Manage Skip Loan Pay Application on any platform with airSlate SignNow's Android or iOS applications and streamline any document-oriented process today.

The easiest way to modify and electronically sign Skip Loan Pay Application with ease

- Find Skip Loan Pay Application and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device of your choice. Edit and eSign Skip Loan Pay Application and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct skip loan pay application

Create this form in 5 minutes!

How to create an eSignature for the skip loan pay application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the skip loan pay application and how does it work?

The skip loan pay application allows borrowers to defer one of their loan payments without penalty. By using this application, users can manage cash flow more effectively during financial difficulties. It is a straightforward process that can be completed online using our platform.

-

What are the costs associated with the skip loan pay application?

Using the skip loan pay application may involve certain fees, which can vary depending on the lender. It's essential to check with your financial institution for specific pricing information. Generally, this application is designed to be cost-effective, providing a valuable service without excessive charges.

-

Can the skip loan pay application be integrated with other software?

Yes, the skip loan pay application can seamlessly integrate with various financial management software and accounting tools. This integration helps streamline operations and ensures that you have quick access to your loan status. This versatile approach enhances the overall user experience.

-

What features does the skip loan pay application offer?

The skip loan pay application features an intuitive user interface, easy navigation for submitting requests, and instant approval notifications. Users can track their application status in real-time, ensuring transparency throughout the process. These features are designed to make managing your loan easier.

-

How do I apply for the skip loan pay application?

Applying for the skip loan pay application is simple and can be done online through our platform. Users need to fill out the required information, submit their application, and wait for approval. The process is designed to be fast and efficient to meet urgent financial needs.

-

What benefits does the skip loan pay application provide?

The skip loan pay application provides signNow benefits, including improved cash flow and reduced financial stress. By allowing you to defer payments temporarily, it gives you breathing room during tough times. This application is an essential tool for effective financial management.

-

Is the skip loan pay application available to all borrowers?

Not all borrowers may qualify for the skip loan pay application as it depends on the lender's policies and your current loan status. It's advisable to check with your lender for eligibility criteria. Many lenders offer this option as a way to assist their borrowers in times of need.

Get more for Skip Loan Pay Application

- Peds formulario para respuestas bcmcpediatricsbbcomb

- Fsco form

- Temtrol ahu manual form

- Form ucc1ad

- Joint agreement to affirm independent relationship for certain building and construction workers form

- Affidavit annual financial report form

- Levitin family endowed scholarship norfolk state university nsu form

- Consultant agreement template form

Find out other Skip Loan Pay Application

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document