Ftb 3514 Instructions 2021-2026

What is the Ftb 3514 Instructions

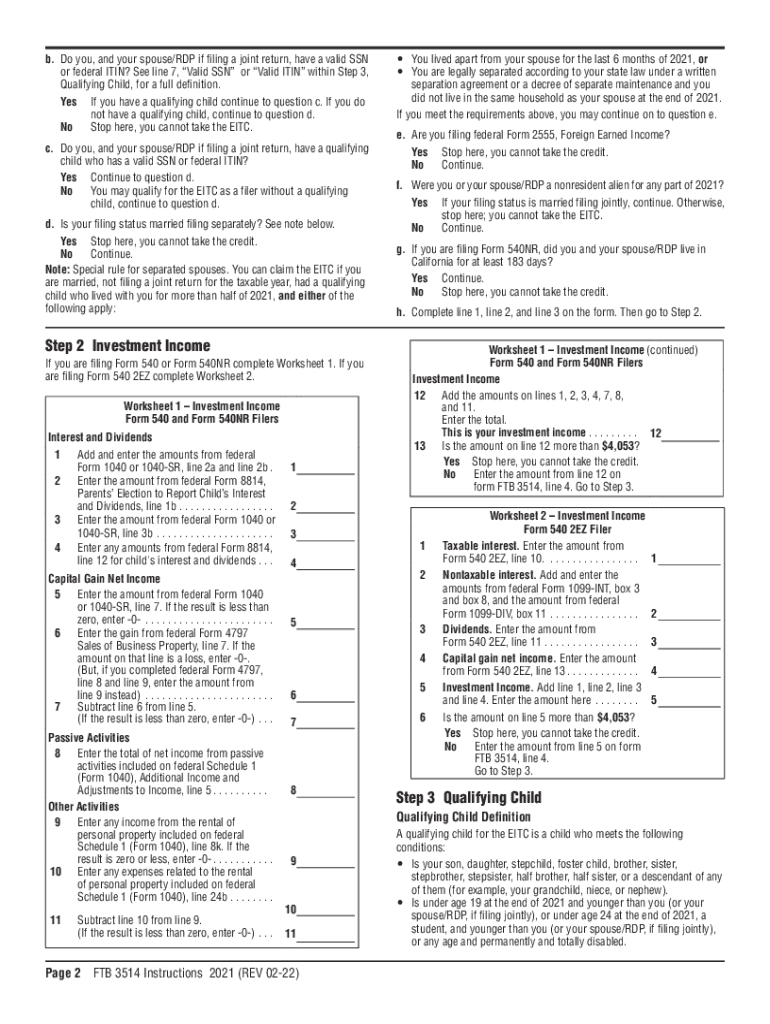

The Ftb 3514 instructions provide guidance for California taxpayers on how to complete the California Earned Income Tax Credit (EITC) worksheet. This form is essential for individuals and families who may qualify for the EITC, which can significantly reduce their tax liability or increase their refund. Understanding the Ftb 3514 instructions is crucial for ensuring accurate completion of the form and maximizing potential tax benefits.

Steps to Complete the Ftb 3514 Instructions

Completing the Ftb 3514 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including your Social Security number, income statements, and any relevant tax information.

- Review the eligibility criteria outlined in the instructions to ensure you qualify for the EITC.

- Fill out the worksheet, entering your income and family information as required.

- Calculate your potential credit based on the guidelines provided in the instructions.

- Double-check all entries for accuracy before submission.

Legal Use of the Ftb 3514 Instructions

The Ftb 3514 instructions are legally binding documents that must be adhered to when claiming the California EITC. Compliance with these instructions ensures that taxpayers meet the legal requirements set forth by the California Franchise Tax Board. Failure to follow the instructions may result in delays, penalties, or disqualification from receiving the credit.

Key Elements of the Ftb 3514 Instructions

Several key elements are crucial to successfully completing the Ftb 3514:

- Eligibility Criteria: Understand the income limits and filing status that qualify you for the EITC.

- Documentation: Ensure you have all necessary documentation ready, including proof of income and identification.

- Calculation Methods: Familiarize yourself with how to calculate the credit based on your specific situation.

Form Submission Methods

The Ftb 3514 can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online Submission: Use the California Franchise Tax Board's e-filing system to submit your form electronically.

- Mail: Print and send the completed form to the address specified in the instructions.

- In-Person: Visit a local tax office to submit your form directly.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Ftb 3514. Typically, the deadline for submitting your California state tax return, including the Ftb 3514, coincides with the federal tax deadline. For 2023, ensure your forms are submitted by April 15 to avoid penalties.

Quick guide on how to complete ftb 3514 instructions

Complete Ftb 3514 Instructions effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Ftb 3514 Instructions on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Ftb 3514 Instructions seamlessly

- Locate Ftb 3514 Instructions and press Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and select the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document requirements with just a few clicks from any device you prefer. Edit and eSign Ftb 3514 Instructions and ensure effective communication at any stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ftb 3514 instructions

Create this form in 5 minutes!

How to create an eSignature for the ftb 3514 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for managing FTB 3514 instructions?

airSlate SignNow offers a user-friendly interface that simplifies the signing process for FTB 3514 instructions. Features such as customizable templates, secure cloud storage, and easy integration with other applications ensure that businesses can manage their documentation efficiently while adhering to necessary compliance requirements.

-

How can airSlate SignNow help with the completion of FTB 3514 instructions?

With airSlate SignNow, completing FTB 3514 instructions becomes a seamless process. The platform enables users to fill out forms electronically, add signatures, and track document progress in real-time, ensuring that all necessary details are captured accurately and promptly.

-

What pricing plans are available for airSlate SignNow, especially for those focusing on FTB 3514 instructions?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Whether you're a small business or a large enterprise needing to handle FTB 3514 instructions, there is a suitable plan that provides ample features without straining your budget.

-

Are there any integrations available with airSlate SignNow for processing FTB 3514 instructions?

Yes, airSlate SignNow supports numerous integrations with popular applications such as Google Drive, Salesforce, and Microsoft 365, making it easier to manage FTB 3514 instructions alongside other business processes. This flexibility ensures that you can streamline your workflow and improve overall efficiency.

-

What benefits does airSlate SignNow provide for users handling FTB 3514 instructions?

Users of airSlate SignNow can enjoy numerous benefits when dealing with FTB 3514 instructions, including increased productivity, reduced paperwork, and enhanced security. The electronic signature capability ensures that documents are signed promptly, facilitating quicker turnaround times and better service for clients.

-

Is airSlate SignNow compliant with regulations for FTB 3514 instructions?

Absolutely, airSlate SignNow ensures compliance with industry-recognized standards for electronic signatures, making it suitable for managing FTB 3514 instructions. The platform’s security features and audit trails provide peace of mind that your documents meet regulatory requirements.

-

Can I customize FTB 3514 instructions forms within airSlate SignNow?

Yes, airSlate SignNow allows users to customize FTB 3514 instructions forms to suit their specific needs. You can create templates that reflect your branding and include instruction fields tailored to your unique processes, which enhances the overall user experience.

Get more for Ftb 3514 Instructions

- Akc barn hunt title application form

- Brief addiction monitor scoring form

- Borger management form

- Christian brothers university transcript request form

- Anskan om tillstnd att arbeta i sverige form

- Intercompany current account agreement template form

- Engagement photography contract template form

- Orthodontic contract template 787753462 form

Find out other Ftb 3514 Instructions

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form