Ftb 3514 Form 2015

What is the Ftb 3514 Form

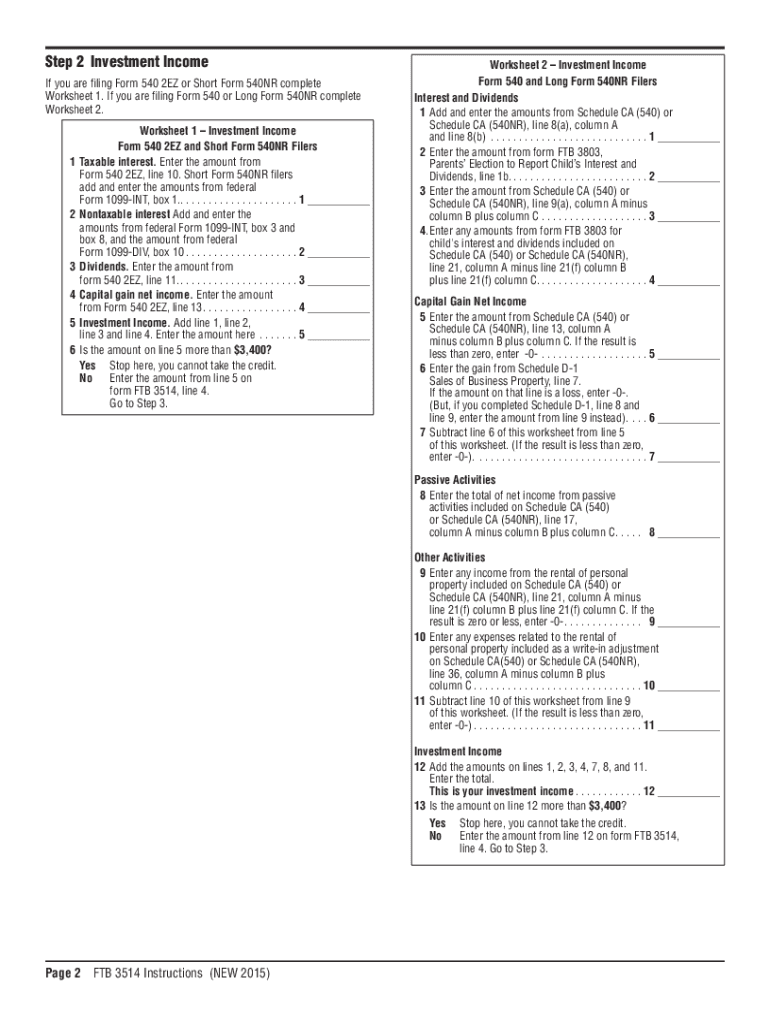

The Ftb 3514 form, also known as the California Earned Income Tax Credit (EITC) form, is designed for California residents to claim the state's earned income tax credit. This form allows eligible taxpayers to receive a tax credit that reduces their overall tax liability, potentially resulting in a refund. The credit aims to support low-to-moderate income working individuals and families, enhancing their financial stability.

Steps to Complete the Ftb 3514 Form

Completing the Ftb 3514 form involves several key steps to ensure accuracy and compliance with California tax regulations. Begin by gathering necessary documentation, including your Social Security number, income statements, and any relevant tax documents. Next, carefully follow the instructions provided on the form, entering your personal information and income details as required. Make sure to check your eligibility for the credit based on your income and family size. After filling out the form, review it for completeness and accuracy before submitting it to the appropriate tax authority.

Legal Use of the Ftb 3514 Form

The legal use of the Ftb 3514 form is governed by California tax laws, which stipulate the requirements for claiming the earned income tax credit. To ensure the form is legally valid, it must be completed accurately and submitted within the designated filing period. Additionally, taxpayers must provide truthful information regarding their income and eligibility. Failure to comply with these legal requirements may result in penalties or denial of the credit.

Filing Deadlines / Important Dates

Filing deadlines for the Ftb 3514 form align with the general tax filing deadlines in California. Typically, individual tax returns must be filed by April 15 of each year. However, it is essential to verify specific dates each tax year, as they may vary slightly due to weekends or holidays. Taxpayers should also be aware of any extensions that may apply, ensuring they submit the form on time to avoid penalties.

Required Documents

To complete the Ftb 3514 form, several documents are necessary. These include:

- Social Security numbers for all qualifying individuals

- Income statements such as W-2s or 1099s

- Proof of residency in California

- Any other relevant tax documents that support your claim

Having these documents ready will streamline the completion process and help ensure accuracy.

Examples of Using the Ftb 3514 Form

Examples of using the Ftb 3514 form include scenarios where individuals or families with low-to-moderate income can benefit from the earned income tax credit. For instance, a single parent working part-time may qualify for the credit, allowing them to reduce their tax liability and receive a refund. Similarly, a married couple with children who meet the income criteria can also use the form to claim the credit, enhancing their financial situation. These examples illustrate the form's purpose in providing financial relief to eligible taxpayers.

Quick guide on how to complete ftb 3514 form

Complete Ftb 3514 Form effortlessly on any device

Internet-based document management has gained traction among organizations and individuals alike. It presents an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely preserve it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without holdups. Manage Ftb 3514 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to adjust and eSign Ftb 3514 Form effortlessly

- Locate Ftb 3514 Form and click Get Form to initiate the process.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent paragraphs in your documents or obscure sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your updates.

- Select your preferred method of submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Ftb 3514 Form and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ftb 3514 form

Create this form in 5 minutes!

How to create an eSignature for the ftb 3514 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FTB3514 and how does it relate to airSlate SignNow?

FTB3514 refers to a specific form used by Californians for tax reporting. airSlate SignNow allows businesses to easily complete and eSign FTB3514 documents online, streamlining the process for users needing to submit these tax forms efficiently.

-

How can I eSign the FTB3514 form using airSlate SignNow?

To eSign the FTB3514 form with airSlate SignNow, simply upload the document to the platform, use the intuitive tools to fill in the necessary information, and add your electronic signature. Our user-friendly interface makes it easy to handle all aspects of this process seamlessly.

-

Is airSlate SignNow a cost-effective solution for managing FTB3514 forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing various documents, including FTB3514 forms. Our competitive pricing plans cater to all business sizes, ensuring you save both time and money while managing tax documentation.

-

What features does airSlate SignNow offer for FTB3514 document management?

airSlate SignNow provides a range of features for FTB3514 document management, including customizable templates, secure storage, and audit trails. These features ensure that your documents are easily accessible, legally binding, and well-organized throughout the signing process.

-

Does airSlate SignNow integrate with other software for handling FTB3514?

Absolutely! airSlate SignNow offers integrations with numerous popular software platforms, helping you manage FTB3514 forms alongside your existing business applications. This integration capability allows for a smoother workflow, enhancing productivity and efficiency.

-

Can I share the FTB3514 form with multiple signers on airSlate SignNow?

Yes, airSlate SignNow allows you to easily share the FTB3514 form with multiple signers. You can set up the signing order, send reminders, and track the completion status of each signer to ensure that all necessary parties can review and eSign the document promptly.

-

What are the benefits of using airSlate SignNow for FTB3514?

Using airSlate SignNow for FTB3514 offers numerous benefits, including efficient processing, enhanced security, and improved compliance with tax regulations. Our platform simplifies the eSigning process, making it faster and more reliable, which is crucial during tax season.

Get more for Ftb 3514 Form

- Dearborn national long term disability claim form clover park

- Ebpa form

- Wellcare injectable infusion form

- Ngl claim form

- Lifeguard services swimming pool management amp servicing bb form

- Medical records release form alicia chen md

- Prescription for physical andor occupational therapy ioniaisd form

- Boys town application form

Find out other Ftb 3514 Form

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template