Instructions for Form FTB 3514, California Earned Income Tax Credit 2020

Overview of Form FTB 3514 Instructions

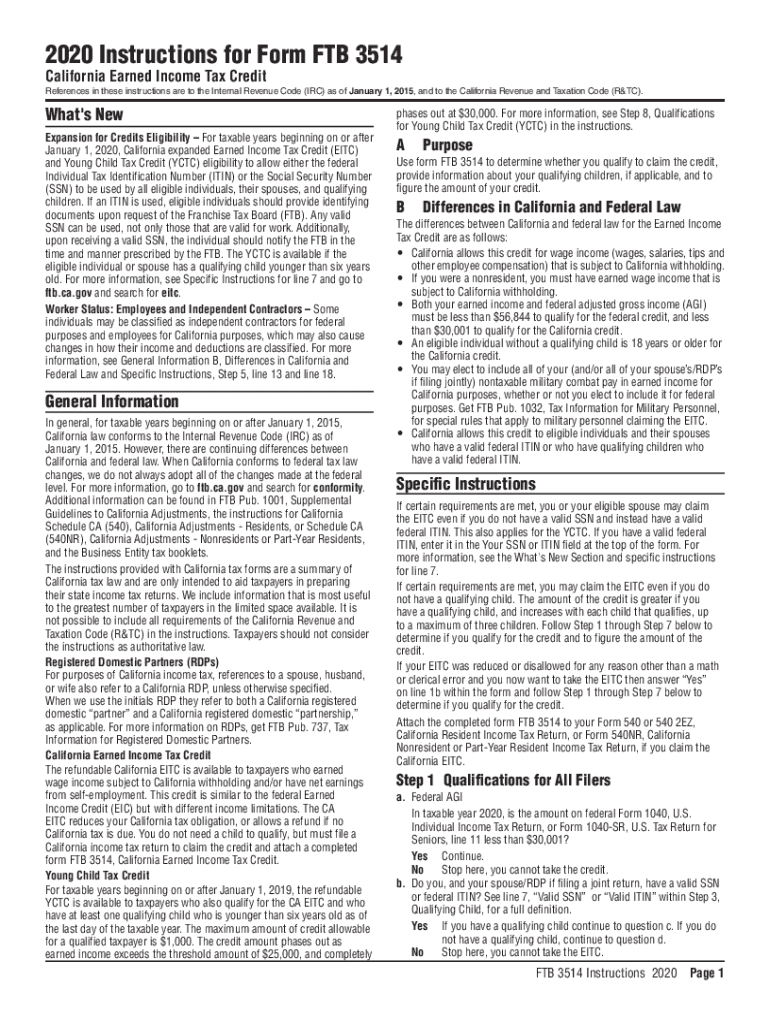

The Instructions For Form FTB 3514 provide essential guidance for taxpayers claiming the California Earned Income Tax Credit (EITC). This form is specifically designed for individuals and families who meet certain income requirements and are looking to benefit from tax credits that can significantly reduce their tax liability. Understanding the instructions is crucial to ensure accurate completion and compliance with state regulations.

Steps to Complete Form FTB 3514

Completing the Instructions For Form FTB 3514 involves a series of straightforward steps:

- Gather necessary documents, including income statements and identification.

- Review the eligibility criteria to confirm qualification for the EITC.

- Follow the detailed instructions provided for each section of the form.

- Double-check all entries for accuracy before submission.

- Submit the completed form either electronically or via mail, as per the guidelines.

Eligibility Criteria for Form FTB 3514

To qualify for the California Earned Income Tax Credit using Form FTB 3514, taxpayers must meet specific eligibility criteria, including:

- Filing status must be single, married filing jointly, or head of household.

- Income must fall within the limits set by the California Franchise Tax Board.

- Taxpayers must have qualifying children or meet the criteria for claiming the credit without children.

Reviewing these criteria ensures that applicants can accurately assess their eligibility before proceeding with the form.

Required Documents for Form FTB 3514

When filling out Form FTB 3514, it is important to have the following documents ready:

- W-2 forms from employers.

- 1099 forms for any additional income.

- Records of any other income sources, such as self-employment earnings.

- Social Security numbers for all qualifying children.

Having these documents on hand will facilitate a smoother completion process and ensure that all necessary information is provided.

Form Submission Methods for FTB 3514

Taxpayers have several options for submitting Form FTB 3514:

- Online: The form can be submitted electronically through the California Franchise Tax Board's website.

- Mail: Completed forms can be sent to the designated address provided in the instructions.

- In-Person: Taxpayers may also visit local tax offices for assistance with submission.

Choosing the right submission method can help ensure timely processing of the claim.

Legal Use of Form FTB 3514

The Instructions For Form FTB 3514 are designed to comply with California tax laws. Properly completing and submitting this form allows taxpayers to legally claim the Earned Income Tax Credit. It is essential to follow all instructions carefully to avoid issues with compliance, which could lead to penalties or delays in processing.

Quick guide on how to complete instructions for form ftb 3514 california earned income tax credit

Complete Instructions For Form FTB 3514, California Earned Income Tax Credit seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage Instructions For Form FTB 3514, California Earned Income Tax Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Instructions For Form FTB 3514, California Earned Income Tax Credit effortlessly

- Locate Instructions For Form FTB 3514, California Earned Income Tax Credit and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes mere moments and holds the same legal validity as a handwritten signature.

- Review all the details and click on the Done button to preserve your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Instructions For Form FTB 3514, California Earned Income Tax Credit and ensure superior communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ftb 3514 california earned income tax credit

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ftb 3514 california earned income tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 3514 instructions?

Form 3514 instructions provide detailed guidance on how to complete the California income tax credit form effectively. Following the form 3514 instructions ensures that you accurately report your credits and avoid delays in processing your tax returns. Familiarizing yourself with these instructions is crucial for achieving maximum benefits.

-

How can airSlate SignNow help with form 3514 instructions?

airSlate SignNow offers an intuitive platform that simplifies the process of completing forms, including the form 3514 instructions. With our eSigning features, you can quickly fill out and send documents for signature, ensuring compliance with all necessary guidelines outlined in the form 3514 instructions. This streamlined process saves you time and reduces the likelihood of errors.

-

Is there a cost associated with using airSlate SignNow for form 3514 instructions?

Yes, there is a pricing structure for using airSlate SignNow, but it remains cost-effective, especially when handling forms like the form 3514 instructions. Our plans offer various features to fit different business needs, allowing you to choose the best option for managing your document workflows. Plus, you can benefit from our free trial to evaluate the service.

-

What features does airSlate SignNow offer that assist with form 3514 instructions?

AirSlate SignNow is equipped with powerful features, including customizable templates and automated workflows that make following form 3514 instructions easier. You can create, edit, and send documents for eSigning in a manner that aligns with these instructions, ensuring compliance and accuracy. Additionally, our robust document management capabilities help you keep track of your submissions.

-

Can I integrate airSlate SignNow with other applications for form 3514 instructions?

Absolutely! AirSlate SignNow offers seamless integrations with various applications, enhancing your ability to manage form 3514 instructions and other documents effectively. Whether you're using CRM systems or accounting software, our integrations ensure that your document workflows are efficient and cater to your specific needs.

-

How does airSlate SignNow enhance the benefits of following form 3514 instructions?

By using airSlate SignNow, you can enhance the benefits of following form 3514 instructions through efficiency and accuracy in document handling. Our platform reduces time spent on administrative tasks, allowing you to focus on what's important—submitting accurate tax information. With streamlined eSigning, you can ensure that your submissions are timely and compliant.

-

Are there any customer support options for assistance with form 3514 instructions on airSlate SignNow?

Yes, airSlate SignNow provides comprehensive customer support to assist you with any questions related to form 3514 instructions. Our support team is available through multiple channels, including chat, email, and phone, to guide you through the process of utilizing our platform. We ensure that you have the help you need for an effective document submission experience.

Get more for Instructions For Form FTB 3514, California Earned Income Tax Credit

- Fire watch procedure template form

- Replacement form

- New mexico new hire reporting form

- Spring creek bbq application form

- Peak generalization data sheet form

- A bit of news we have today form

- St clair county notary forms alabama notary public underwriters

- Tire stewardship british columbia association tsbc form

Find out other Instructions For Form FTB 3514, California Earned Income Tax Credit

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe