REQUEST to REMOVE PROPERTY TAX EXEMPTIONS New York City 2021-2026

What is the request to remove property tax exemptions in New York City

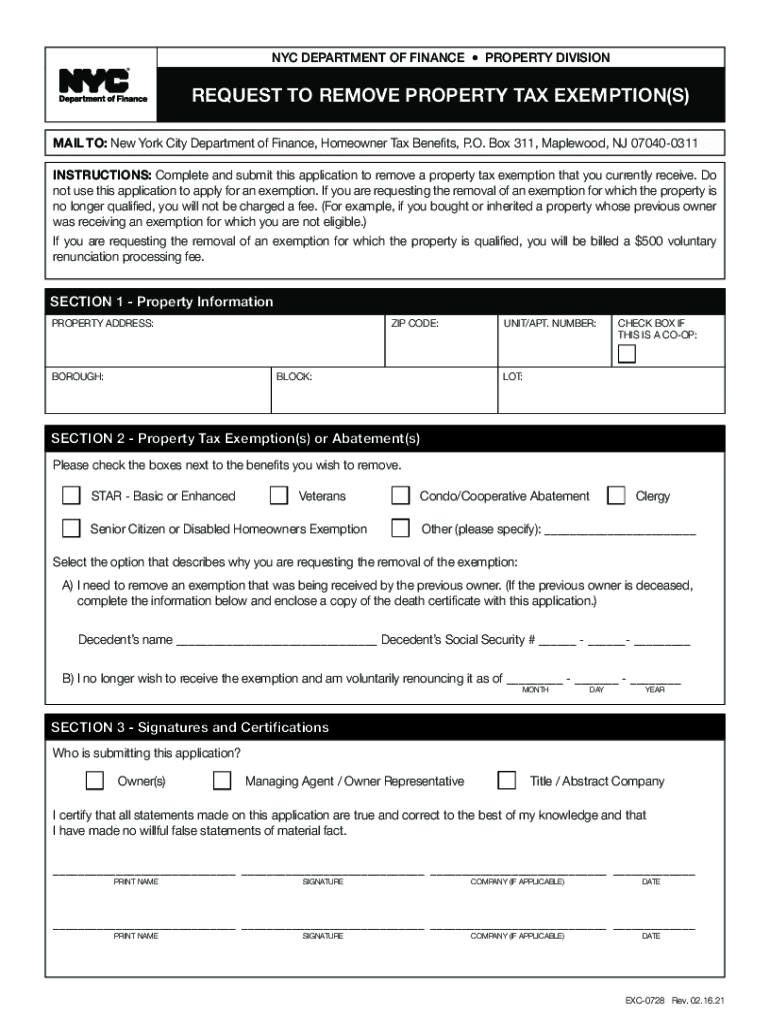

The request to remove property tax exemptions in New York City is a formal document that property owners submit to the local tax authority. This form is necessary when a property owner wishes to revoke an existing tax exemption, which could be due to changes in property use, ownership, or eligibility criteria. Understanding the implications of this request is crucial, as it can affect the overall tax liability and financial planning of the property owner.

Steps to complete the request to remove property tax exemptions in New York City

Completing the request to remove property tax exemptions involves several important steps:

- Gather necessary information about the property, including the current exemption status and reasons for removal.

- Obtain the official form from the New York City Department of Finance or relevant local authority.

- Fill out the form accurately, ensuring all required fields are completed.

- Provide any supporting documentation that may be needed, such as proof of property use changes.

- Review the completed form for accuracy before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Required documents for the request to remove property tax exemptions in New York City

When submitting the request to remove property tax exemptions, certain documents may be required to support the application. These can include:

- Proof of property ownership, such as a deed or title.

- Documentation outlining the reasons for the exemption removal, which may include changes in property use or ownership.

- Any previous correspondence with the tax authority regarding the exemption.

Eligibility criteria for the request to remove property tax exemptions in New York City

Eligibility for submitting a request to remove property tax exemptions typically depends on specific factors, including:

- Changes in property ownership, such as a sale or transfer.

- Alterations in the use of the property that no longer meet exemption requirements.

- Failure to comply with the terms of the exemption, which may trigger the need for removal.

Form submission methods for the request to remove property tax exemptions in New York City

Property owners can submit the request to remove property tax exemptions through various methods, ensuring flexibility and convenience:

- Online submission via the New York City Department of Finance website, if available.

- Mailing the completed form to the appropriate local tax authority.

- Visiting the local tax office in person to submit the form directly.

Legal use of the request to remove property tax exemptions in New York City

The legal use of the request to remove property tax exemptions is governed by local tax laws and regulations. It is essential for property owners to understand their rights and obligations when filing this request. Properly completing and submitting the form ensures compliance with legal requirements and helps avoid potential penalties or issues with property tax assessments.

Quick guide on how to complete request to remove property tax exemptions new york city

Effortlessly Prepare REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS New York City on Any Device

The management of documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and eSign your documents without any holdups. Manage REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS New York City on any device using the airSlate SignNow applications for Android or iOS, and streamline your document-centric processes today.

How to Edit and eSign REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS New York City with Ease

- Find REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS New York City, then click Get Form to initiate the process.

- Utilize the tools provided to fill out your form.

- Emphasize key sections of your documents or conceal sensitive information with specialized tools from airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of sending the form, whether by email, SMS, or invitation link, or download it to your computer.

Forget the hassle of lost or disorganized files, tedious form searching, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from your chosen device. Edit and eSign REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS New York City and ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct request to remove property tax exemptions new york city

Create this form in 5 minutes!

How to create an eSignature for the request to remove property tax exemptions new york city

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to make a request to remove property tax exemption?

To request to remove property tax exemption, you typically need to submit a formal application to your local tax authority outlining the reasons for the removal. It's important to include any necessary documentation that supports your request. Using airSlate SignNow, you can easily create, send, and eSign your request, streamlining the process.

-

Are there any fees associated with the request to remove property tax exemption?

Fees for a request to remove property tax exemption vary by jurisdiction. Some areas may charge a processing fee, while others might require payment only if the request is approved. Using airSlate SignNow ensures that you can manage and track any associated fees straightforwardly.

-

How can airSlate SignNow help with the request to remove property tax exemption?

airSlate SignNow simplifies the request to remove property tax exemption by allowing you to prepare your documents quickly and securely. The platform provides templates and easy eSigning features, making it user-friendly for both individuals and businesses. This ensures a seamless experience from preparation to submission.

-

What documents are needed to support the request to remove property tax exemption?

Common documents required for a request to remove property tax exemption may include proof of ownership, previous tax exemption certificates, and a statement explaining why the exemption should be removed. It's advisable to contact your local tax office for specific requirements. airSlate SignNow allows you to collect and organize these documents efficiently.

-

How long does it take to process a request to remove property tax exemption?

The processing time for a request to remove property tax exemption varies depending on the local tax authority's procedures. Typically, it can take anywhere from a few weeks to a couple of months. AirSlate SignNow enables you to track the status of your submission, providing updates and reminders.

-

Can I cancel my request to remove property tax exemption?

In many cases, you can cancel your request to remove property tax exemption if you change your mind before it is processed. It is best to contact your local tax authority for their specific cancellation policies. With airSlate SignNow, you maintain control over your documents and correspondence.

-

Is it possible to submit a request to remove property tax exemption online?

Yes, many local tax authorities now allow you to submit a request to remove property tax exemption online to expedite the process. Using airSlate SignNow, you can create, eSign, and submit your request digitally from the comfort of your home or office, making it both convenient and efficient.

Get more for REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS New York City

Find out other REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS New York City

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free