REQUEST to REMOVE PROPERTY TAX EXEMPTIONS 2019

Understanding the request to remove property tax exemptions

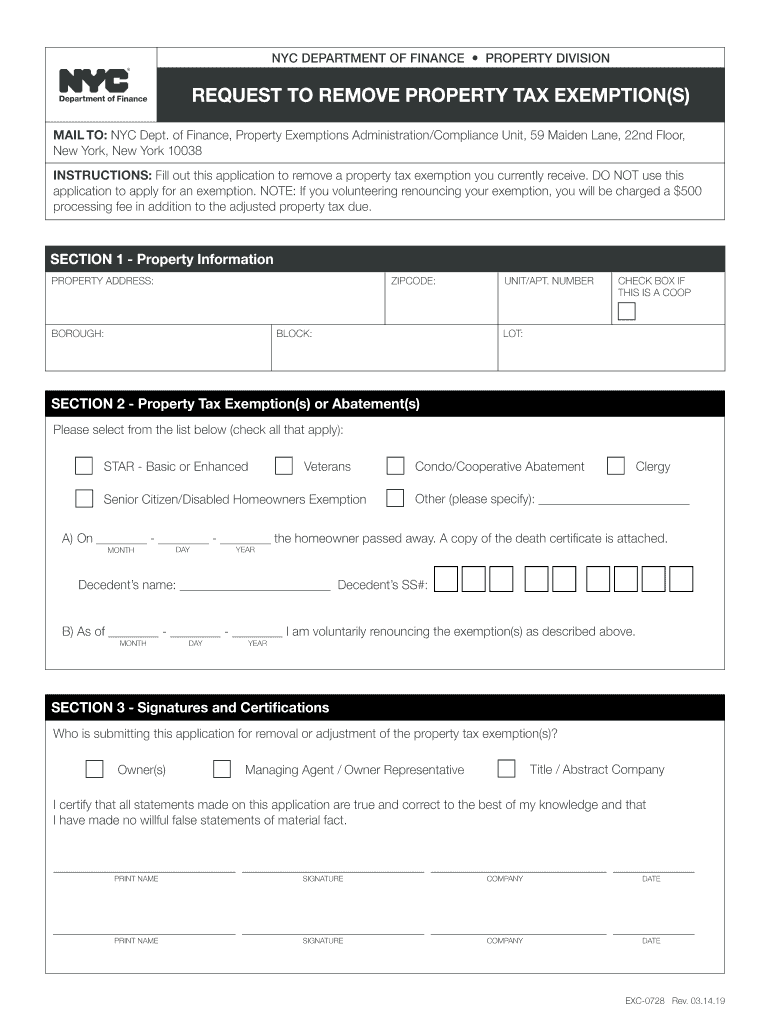

The request to remove property tax exemptions is a formal document submitted by property owners seeking to eliminate certain tax benefits associated with their property. These exemptions may have been granted for various reasons, such as primary residence status or eligibility for senior citizen discounts. When a property owner no longer qualifies for these exemptions, they must submit this request to ensure that their property tax assessment reflects the current status of their property.

Steps to complete the request to remove property tax exemptions

Completing the request to remove property tax exemptions involves several key steps:

- Gather necessary documentation, such as proof of ownership and any relevant previous tax exemption approvals.

- Obtain the official request form from your local tax authority or municipal office.

- Fill out the form accurately, providing all required information, including property details and reasons for the removal request.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the specified deadline, either online, by mail, or in person, depending on local regulations.

Required documents for the request

To successfully process the request to remove property tax exemptions, certain documents are typically required. These may include:

- A copy of the property deed or title showing ownership.

- Previous tax exemption approval letters, if applicable.

- Identification documents, such as a driver's license or state ID.

- Any additional documentation that supports the reason for the removal request.

Eligibility criteria for the request

Eligibility for submitting a request to remove property tax exemptions generally depends on specific criteria set by local tax authorities. Common factors include:

- Changes in property use, such as converting a primary residence to a rental property.

- Failure to meet the requirements for the exemption, such as no longer qualifying as a senior citizen.

- Changes in ownership that may affect exemption status.

Form submission methods

Property owners can submit their request to remove property tax exemptions through various methods, depending on local regulations:

- Online submission via the local tax authority's website, if available.

- Mailing the completed form and required documents to the appropriate tax office.

- In-person submission at the local tax authority's office during business hours.

Legal use of the request to remove property tax exemptions

The request to remove property tax exemptions is a legal document that must be completed accurately to avoid potential penalties. It is important for property owners to understand their rights and obligations regarding property taxes. Misrepresentation or failure to comply with local laws can lead to fines or other legal consequences.

Important deadlines for submission

Each jurisdiction may have specific deadlines for submitting the request to remove property tax exemptions. Property owners should be aware of these dates to ensure timely processing of their request. Missing a deadline could result in the continuation of the exemption or additional penalties. It is advisable to check with local tax authorities for the exact submission timeline.

Create this form in 5 minutes or less

Find and fill out the correct request to remove property tax exemptions

Create this form in 5 minutes!

How to create an eSignature for the request to remove property tax exemptions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS using airSlate SignNow?

To REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS using airSlate SignNow, simply create a document outlining your request and send it for eSignature. Our platform allows you to easily customize your request and track its status in real-time, ensuring a smooth process.

-

Are there any fees associated with REQUESTING TO REMOVE PROPERTY TAX EXEMPTIONS?

airSlate SignNow offers a cost-effective solution for managing your documents, including those related to REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS. Pricing plans are designed to fit various business needs, and you can choose a plan that best suits your volume of requests.

-

What features does airSlate SignNow provide for managing property tax exemption requests?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities, all of which streamline the process to REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS. These tools help ensure that your requests are processed efficiently and securely.

-

Can I integrate airSlate SignNow with other software for managing property tax exemption requests?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage your documents and REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS. This ensures that your workflow remains uninterrupted and efficient across different platforms.

-

How does airSlate SignNow ensure the security of my property tax exemption requests?

Security is a top priority at airSlate SignNow. When you REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS, your documents are protected with advanced encryption and secure access controls, ensuring that sensitive information remains confidential throughout the process.

-

Is there customer support available for assistance with property tax exemption requests?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any questions or issues related to REQUESTING TO REMOVE PROPERTY TAX EXEMPTIONS. Our team is available to guide you through the process and ensure you have a positive experience.

-

What are the benefits of using airSlate SignNow for property tax exemption requests?

Using airSlate SignNow to REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform simplifies the entire process, allowing you to focus on what matters most for your business.

Get more for REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS

Find out other REQUEST TO REMOVE PROPERTY TAX EXEMPTIONS

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement