MOTOR BUS AD VALOREM TAX REPORT GENERAL INSTRUCTIONSVehicle TaxesTitle Ad Valorem Tax TAVT and Annual AdMOTOR BUS AD VALOREM TAX 2022

Understanding the Tennessee Motor Carrier Ad Valorem Tax

The Tennessee motor carrier ad valorem tax is a property tax assessed on motor vehicles used in transportation. This tax is based on the value of the vehicle and is applicable to commercial vehicles, including trucks and buses. The tax is designed to ensure that motor carriers contribute to the infrastructure they utilize. It is essential for carriers to understand how this tax impacts their operations and financial planning.

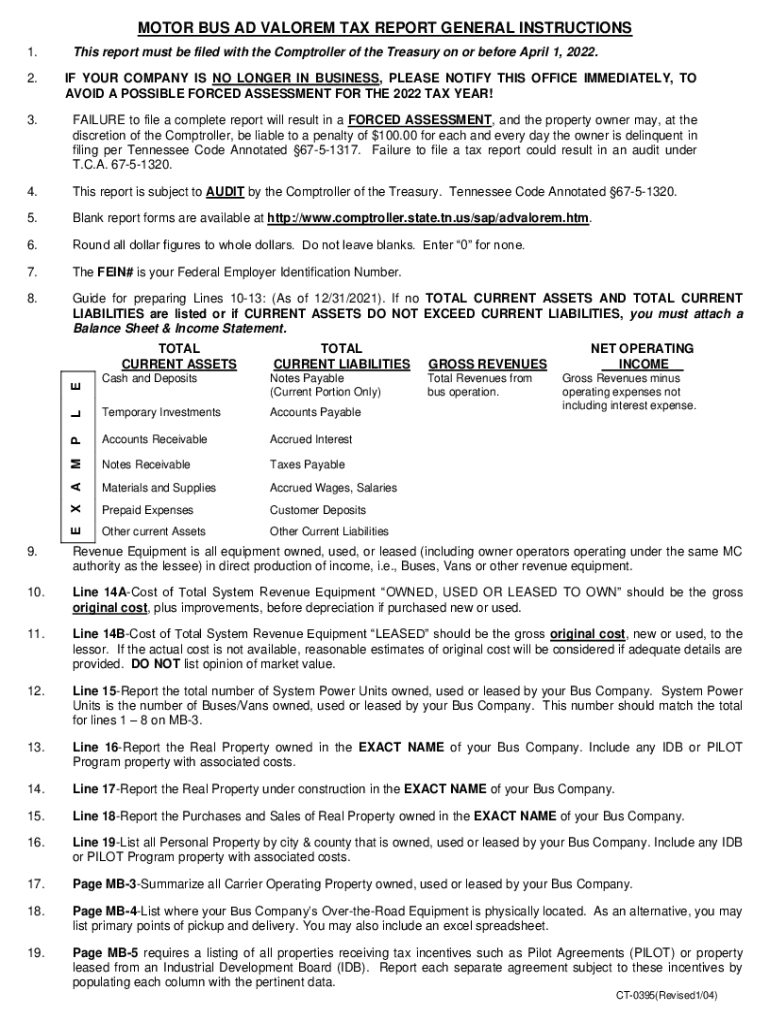

Steps to Complete the Motor Carrier Ad Valorem Tax Report

Completing the motor carrier ad valorem tax report involves several key steps. First, gather all necessary documentation regarding the vehicle's value, including purchase invoices and any prior tax assessments. Next, fill out the appropriate forms, ensuring that all information is accurate and complete. After completing the forms, submit them to the designated state authority, either online or by mail. It is crucial to keep copies of all submitted documents for your records.

Required Documents for Filing the Tax Report

When filing the motor carrier ad valorem tax report, specific documents are required to substantiate the vehicle's value and ownership. These typically include:

- Proof of vehicle ownership, such as a title or bill of sale.

- Previous tax assessments, if applicable.

- Documentation of any modifications or improvements made to the vehicle.

- Any relevant financial statements that may be required by the state.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines for the motor carrier ad valorem tax report. Typically, the deadline falls on the last day of the month following the end of the tax year. Failure to file by this deadline may result in penalties or interest on the unpaid tax. Keeping a calendar with important dates can help ensure timely compliance.

Penalties for Non-Compliance

Non-compliance with the Tennessee motor carrier ad valorem tax requirements can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for motor carriers to stay informed about their tax obligations to avoid these consequences.

Legal Use of the Motor Carrier Ad Valorem Tax Report

The motor carrier ad valorem tax report serves as a legal document that outlines the tax obligations of motor carriers. Properly completing and submitting this report is crucial for compliance with state tax laws. Additionally, maintaining accurate records can protect carriers in the event of an audit or dispute regarding their tax status.

Quick guide on how to complete motor bus ad valorem tax report general instructionsvehicle taxestitle ad valorem tax tavt and annual admotor bus ad valorem

Prepare MOTOR BUS AD VALOREM TAX REPORT GENERAL INSTRUCTIONSVehicle TaxesTitle Ad Valorem Tax TAVT And Annual AdMOTOR BUS AD VALOREM TAX seamlessly on any device

Online document management has gained traction among organizations and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage MOTOR BUS AD VALOREM TAX REPORT GENERAL INSTRUCTIONSVehicle TaxesTitle Ad Valorem Tax TAVT And Annual AdMOTOR BUS AD VALOREM TAX on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The simplest way to alter and eSign MOTOR BUS AD VALOREM TAX REPORT GENERAL INSTRUCTIONSVehicle TaxesTitle Ad Valorem Tax TAVT And Annual AdMOTOR BUS AD VALOREM TAX effortlessly

- Locate MOTOR BUS AD VALOREM TAX REPORT GENERAL INSTRUCTIONSVehicle TaxesTitle Ad Valorem Tax TAVT And Annual AdMOTOR BUS AD VALOREM TAX and click Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to store your changes.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device of your choice. Modify and eSign MOTOR BUS AD VALOREM TAX REPORT GENERAL INSTRUCTIONSVehicle TaxesTitle Ad Valorem Tax TAVT And Annual AdMOTOR BUS AD VALOREM TAX and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct motor bus ad valorem tax report general instructionsvehicle taxestitle ad valorem tax tavt and annual admotor bus ad valorem

Create this form in 5 minutes!

How to create an eSignature for the motor bus ad valorem tax report general instructionsvehicle taxestitle ad valorem tax tavt and annual admotor bus ad valorem

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tennessee motor carrier ad valorem tax?

The Tennessee motor carrier ad valorem tax is a tax imposed on motor carriers operating within the state. It is calculated based on the value of the vehicles used for transport. Understanding this tax is essential for compliance and accurate financial planning.

-

How does airSlate SignNow help with Tennessee motor carrier ad valorem tax documentation?

airSlate SignNow simplifies the process of managing documents related to Tennessee motor carrier ad valorem tax. With our eSignature capabilities, users can quickly sign and send tax-related documents, ensuring timely compliance and reducing paperwork mishaps.

-

Is airSlate SignNow cost-effective for managing Tennessee motor carrier ad valorem tax documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing Tennessee motor carrier ad valorem tax documents. Our pricing plans are competitive, providing businesses with the tools they need to handle their tax documentation without breaking the bank.

-

What features does airSlate SignNow offer for Tennessee motor carrier ad valorem tax management?

airSlate SignNow offers features such as customizable templates, document tracking, and secure electronic signatures. These tools streamline the Tennessee motor carrier ad valorem tax process, making document management easier and more efficient.

-

Can airSlate SignNow integrate with other software for handling Tennessee motor carrier ad valorem tax?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, enhancing your workflow for handling Tennessee motor carrier ad valorem tax management. This allows you to connect with tools you already use for greater efficiency.

-

What benefits does airSlate SignNow provide for businesses dealing with Tennessee motor carrier ad valorem tax?

Using airSlate SignNow offers several benefits, including time savings, improved compliance, and reduced administrative burdens. By simplifying the Tennessee motor carrier ad valorem tax process, businesses can focus on their core operations while ensuring tax documents are managed efficiently.

-

Is training available for using airSlate SignNow for Tennessee motor carrier ad valorem tax?

Yes, airSlate SignNow provides comprehensive training resources to help users understand how to manage Tennessee motor carrier ad valorem tax documents efficiently. Our support team is also available to guide you through the features and answer any questions.

Get more for MOTOR BUS AD VALOREM TAX REPORT GENERAL INSTRUCTIONSVehicle TaxesTitle Ad Valorem Tax TAVT And Annual AdMOTOR BUS AD VALOREM TAX

- National verifier household worksheet form

- Lease agreement stocker preston form

- Residence certificate format in word

- Request to executive director for expired license renewal texas form

- Joint controller data processing agreement template form

- Joint copyright agreement template form

- Joint copyright ownership agreement template form

- Joint controllership agreement template form

Find out other MOTOR BUS AD VALOREM TAX REPORT GENERAL INSTRUCTIONSVehicle TaxesTitle Ad Valorem Tax TAVT And Annual AdMOTOR BUS AD VALOREM TAX

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free