202109020S Tax Type Motor Vehicle Document Type Statute 2023

Understanding the 2023 ad valorem tax report

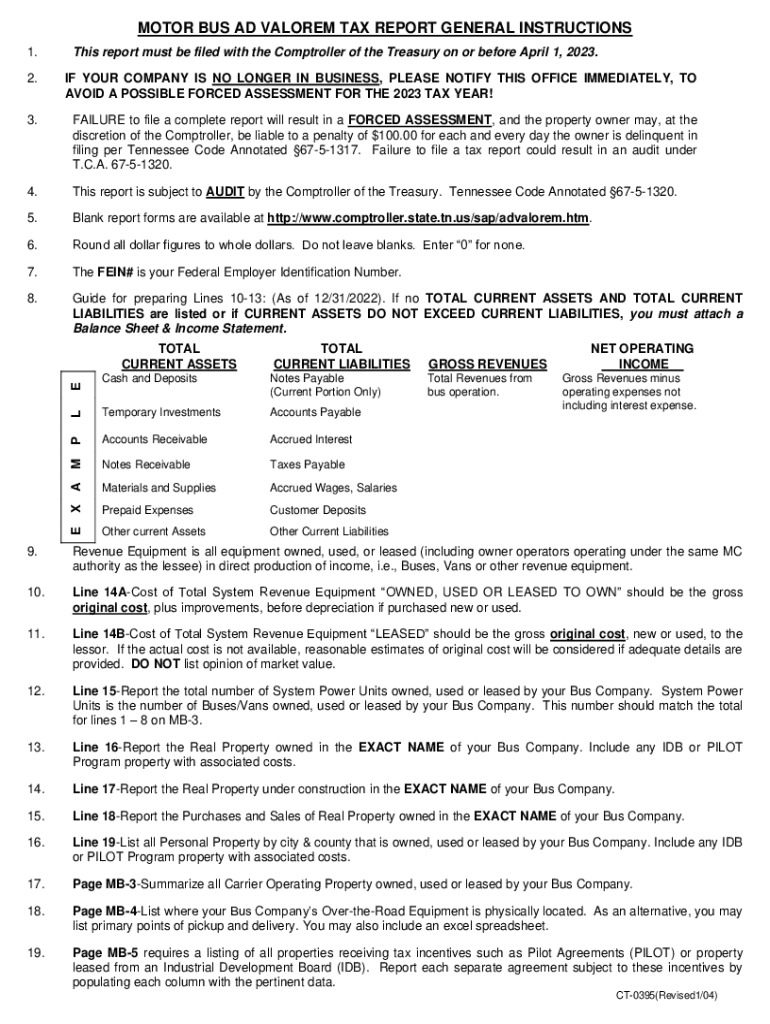

The 2023 ad valorem tax report is a crucial document used to assess property taxes based on the value of real estate. This report provides a detailed account of property values, which local governments use to determine the tax owed by property owners. It is essential for ensuring that property taxes are fairly distributed based on the market value of properties within a jurisdiction.

Steps to complete the 2023 ad valorem tax report

Completing the 2023 ad valorem tax report involves several key steps:

- Gather all necessary property information, including location, size, and improvements.

- Obtain current market value assessments from reliable sources.

- Fill out the report accurately, ensuring all property details are included.

- Review the report for any discrepancies or missing information.

- Submit the completed report to the appropriate local tax authority by the specified deadline.

Required documents for the 2023 ad valorem tax report

To successfully complete the 2023 ad valorem tax report, you will need various documents, including:

- Property deeds and titles

- Recent property tax bills

- Market value appraisals

- Documentation of any property improvements or alterations

Filing deadlines for the 2023 ad valorem tax report

It is important to be aware of the filing deadlines for the 2023 ad valorem tax report, as these can vary by state and local jurisdiction. Generally, property owners should submit their reports by the end of the first quarter of the tax year. Missing the deadline may result in penalties or increased tax assessments.

Who issues the 2023 ad valorem tax report

The 2023 ad valorem tax report is typically issued by local tax assessors or tax authorities. These entities are responsible for determining property values and ensuring compliance with tax regulations. Property owners may contact their local assessor's office for guidance on obtaining and completing the report.

Penalties for non-compliance with the 2023 ad valorem tax report

Failure to file the 2023 ad valorem tax report on time or inaccuracies in the report can lead to significant penalties. These may include fines, increased tax assessments, or legal action by the local tax authority. It is essential to ensure that the report is completed accurately and submitted on time to avoid these consequences.

Digital vs. paper version of the 2023 ad valorem tax report

Property owners have the option to submit the 2023 ad valorem tax report in either digital or paper format. Digital submissions are often preferred for their convenience and speed, allowing for quicker processing by tax authorities. However, some jurisdictions may still require paper submissions, so it is important to check local regulations before filing.

Quick guide on how to complete 202109020s tax type motor vehicle document type statute

Prepare 202109020S Tax Type Motor Vehicle Document Type Statute effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly replacement for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without any delays. Handle 202109020S Tax Type Motor Vehicle Document Type Statute on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign 202109020S Tax Type Motor Vehicle Document Type Statute effortlessly

- Search for 202109020S Tax Type Motor Vehicle Document Type Statute and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you choose. Modify and eSign 202109020S Tax Type Motor Vehicle Document Type Statute and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 202109020s tax type motor vehicle document type statute

Create this form in 5 minutes!

How to create an eSignature for the 202109020s tax type motor vehicle document type statute

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 ad valorem tax report, and why is it important?

The 2023 ad valorem tax report provides essential information regarding property taxes based on the assessed value of real estate. It's crucial for property owners and businesses to understand this report to ensure accurate tax payments and compliance with local regulations.

-

How can airSlate SignNow assist with the 2023 ad valorem tax report?

airSlate SignNow allows users to easily upload and eSign documents, including the 2023 ad valorem tax report, ensuring a smooth and efficient process. This feature eliminates the need for physical signatures and helps expedite the submission of your tax report.

-

What are the pricing options for airSlate SignNow regarding the 2023 ad valorem tax report?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Depending on your usage frequency, you can choose from monthly or yearly subscriptions, making it a cost-effective solution for handling your 2023 ad valorem tax report.

-

Can airSlate SignNow integrate with accounting software for handling tax reports?

Yes, airSlate SignNow seamlessly integrates with leading accounting software, allowing you to manage your 2023 ad valorem tax report easily. This integration streamlines workflows, enabling you to synchronize documents and avoid manual entry errors.

-

What features make airSlate SignNow ideal for managing the 2023 ad valorem tax report?

airSlate SignNow offers features such as document templates, secure storage, and tracking capabilities that enhance the management of the 2023 ad valorem tax report. These tools ensure efficient handling and help keep all necessary documentation organized and easily accessible.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, ensuring that even those who are unfamiliar with eSigning can easily navigate the platform to manage their 2023 ad valorem tax report. Our support resources are also available for any assistance you may need.

-

What are the benefits of eSigning the 2023 ad valorem tax report with airSlate SignNow?

ESigning your 2023 ad valorem tax report with airSlate SignNow eliminates the hassles of printing, signing, and scanning documents. This not only saves time but also ensures you have a secure, verifiable record of your submissions, enhancing workflow efficiency.

Get more for 202109020S Tax Type Motor Vehicle Document Type Statute

- Northern california laborers jatc apprenticeship norcalaborers form

- Spelling menu form

- Jammer referee wftda referee performance evaluation

- Full plans application 30334864 form

- Netflix svod license agreement for animated pictures wikileaks form

- Paediatric respiratory assessment woscor scot nhs form

- 10a104 form

- Follow up soap note form american academy of osteopathy

Find out other 202109020S Tax Type Motor Vehicle Document Type Statute

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer