MOTOR CARRIER AD VALOREM TAX REPORT GENERAL 2024-2026

What is the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL

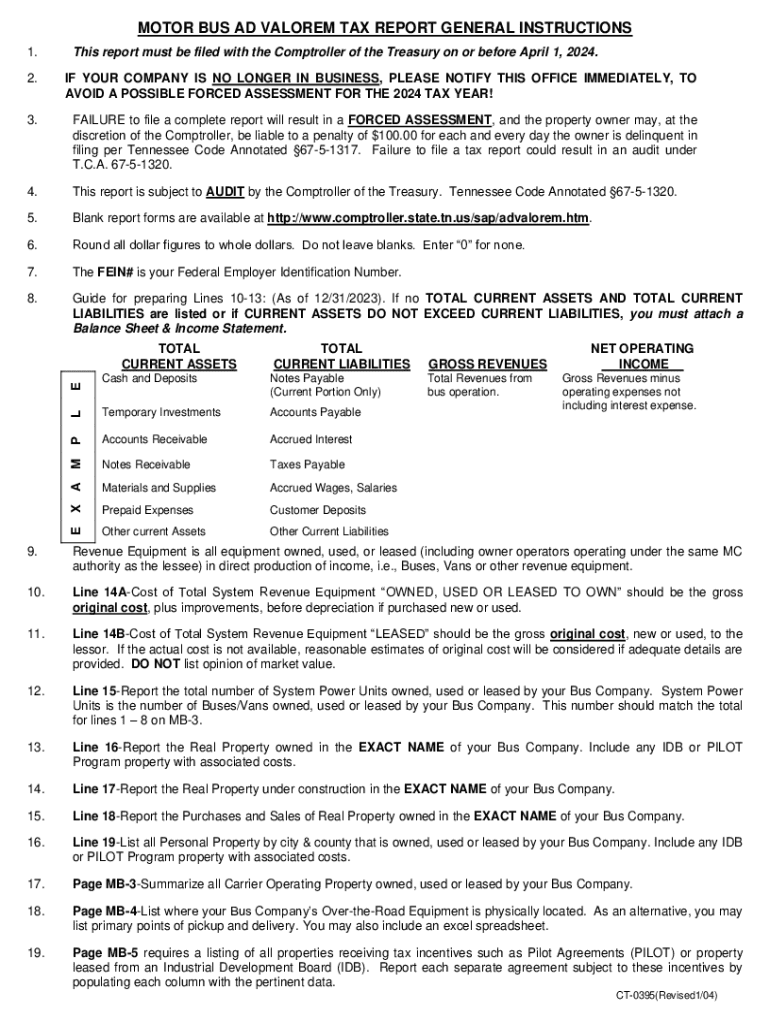

The MOTOR CARRIER AD VALOREM TAX REPORT GENERAL is a specific tax form used by motor carriers in the United States to report ad valorem taxes. These taxes are based on the value of the property used in the transportation of goods. This form is essential for compliance with state and local tax regulations, ensuring that motor carriers accurately report their taxable assets.

This report typically includes information about the carrier's fleet, including the number of vehicles, their value, and any other relevant assets. Understanding this form is crucial for motor carriers to avoid penalties and ensure proper tax reporting.

How to use the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL

Using the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL involves several steps to ensure accurate completion. First, gather all necessary information regarding your fleet and assets. This includes vehicle identification numbers, purchase prices, and current market values. Next, fill out the form with the required details, ensuring that all information is accurate and up-to-date.

After completing the form, review it for any errors or omissions. Once verified, submit the report to the appropriate state or local tax authority. Keep a copy of the submitted form for your records, as it may be needed for future reference or audits.

Steps to complete the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL

Completing the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL involves a systematic approach:

- Collect all relevant data about your fleet, including vehicle values and identification.

- Obtain the latest version of the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL form.

- Carefully fill out the form, ensuring accuracy in all reported values.

- Review the completed form for any inconsistencies or missing information.

- Submit the form to the designated tax authority by the specified deadline.

Filing Deadlines / Important Dates

Filing deadlines for the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL can vary by state. It is crucial to be aware of these dates to avoid penalties. Generally, most states require the report to be filed annually, with deadlines typically falling at the end of the fiscal year or specific dates set by the state tax authority.

To ensure compliance, motor carriers should mark these important dates on their calendars and prepare their reports in advance. Checking with the local tax authority for any updates or changes to deadlines is also advisable.

Required Documents

When preparing to file the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL, certain documents are essential:

- Vehicle registration documents for each vehicle in the fleet.

- Purchase invoices or bills of sale for all vehicles.

- Current market value assessments or appraisals.

- Any previous tax reports filed for reference.

Having these documents readily available can streamline the process and ensure all necessary information is accurately reported.

Penalties for Non-Compliance

Failure to file the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL on time or providing inaccurate information can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from tax authorities. Additionally, non-compliance can damage a motor carrier's reputation and lead to increased scrutiny in future filings.

To avoid these consequences, it is vital for motor carriers to adhere to filing deadlines and ensure the accuracy of their reports.

Create this form in 5 minutes or less

Find and fill out the correct motor carrier ad valorem tax report general

Create this form in 5 minutes!

How to create an eSignature for the motor carrier ad valorem tax report general

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL?

The MOTOR CARRIER AD VALOREM TAX REPORT GENERAL is a document required for motor carriers to report the value of their vehicles for tax purposes. This report helps ensure compliance with state tax regulations and can impact your overall tax liability. Understanding this report is crucial for maintaining accurate financial records.

-

How can airSlate SignNow help with the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL?

airSlate SignNow simplifies the process of preparing and submitting the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL by providing an easy-to-use platform for eSigning and document management. With our solution, you can quickly gather necessary signatures and ensure that your reports are submitted on time. This streamlines your workflow and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the preparation and submission of the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all designed to enhance your experience with the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL. These tools help you manage your documents efficiently and ensure compliance with tax regulations. Additionally, our user-friendly interface makes it easy to navigate through the process.

-

Are there any integrations available with airSlate SignNow for the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL?

Yes, airSlate SignNow integrates seamlessly with various applications and software that can assist in managing the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL. This includes accounting software and document management systems, allowing you to streamline your workflow and enhance productivity. Our integrations help you maintain a cohesive system for your business operations.

-

What benefits can I expect from using airSlate SignNow for the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL?

Using airSlate SignNow for the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform allows you to complete your tax reports quickly and accurately, minimizing the risk of errors. Additionally, the ability to eSign documents remotely saves time and resources.

-

Is airSlate SignNow secure for handling the MOTOR CARRIER AD VALOREM TAX REPORT GENERAL?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your MOTOR CARRIER AD VALOREM TAX REPORT GENERAL and other sensitive documents are protected. We utilize advanced encryption and security protocols to safeguard your data. You can trust our platform to handle your documents securely and confidentially.

Get more for MOTOR CARRIER AD VALOREM TAX REPORT GENERAL

Find out other MOTOR CARRIER AD VALOREM TAX REPORT GENERAL

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later