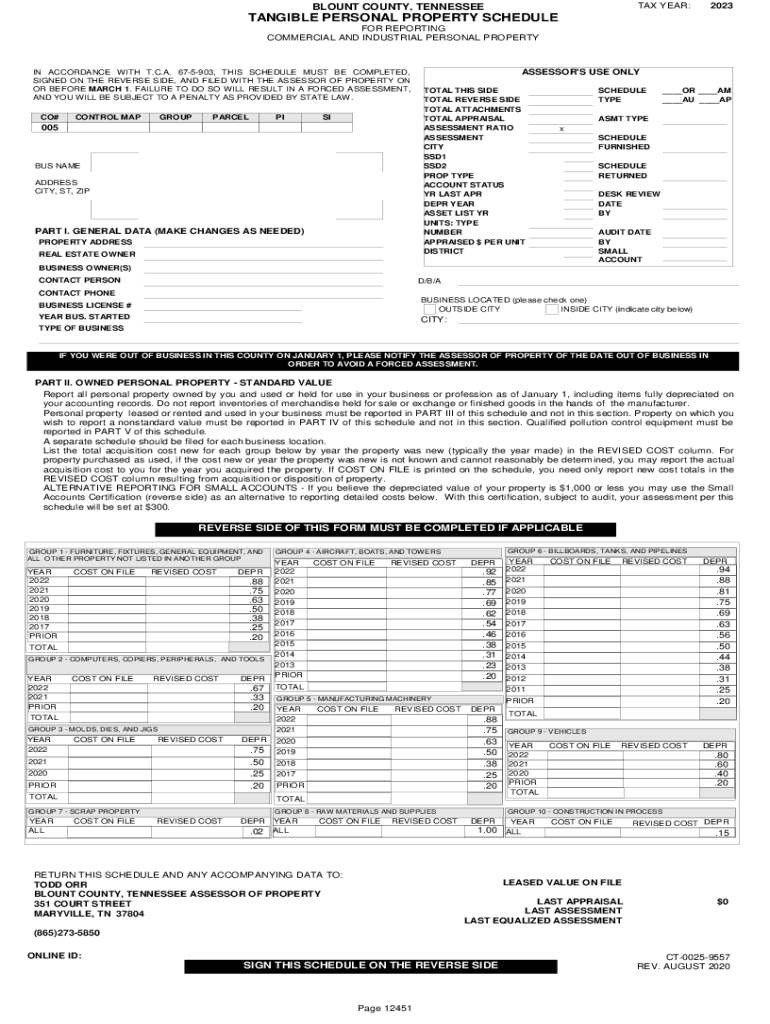

Tangible Personal Property Tax 2023

What is the tangible personal property tax?

The tangible personal property tax is a tax levied on physical items that are movable and not permanently affixed to real estate. This includes items such as machinery, equipment, furniture, and inventory. Each state has its own regulations regarding what qualifies as tangible personal property and how it is assessed. Understanding this tax is essential for businesses and individuals who own such assets, as it directly impacts their financial obligations and tax planning strategies.

Steps to complete the tangible personal property tax

Completing the tangible personal property tax involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your tangible assets, including purchase receipts and inventory lists. Next, determine the assessed value of your property, which may require consulting local guidelines or a tax professional. After calculating the value, fill out the appropriate county tangible personal property tax form, ensuring all information is accurate and complete. Finally, submit the form by the designated deadline, either online, by mail, or in person, depending on your county's regulations.

Required documents for the tangible personal property tax

When filing the tangible personal property tax, specific documents are typically required to support your submission. These may include:

- Purchase invoices for all tangible assets.

- Inventory lists detailing the quantity and value of items.

- Previous tax returns, if applicable.

- Any relevant appraisal documents that establish asset value.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with local tax regulations.

Filing deadlines and important dates

Each state and county may have different deadlines for filing the tangible personal property tax. Generally, forms must be submitted annually by a specific date, often in the spring. It is crucial to check with your local tax authority to confirm the exact deadlines for your area. Missing these deadlines can result in penalties or additional fees, so staying informed about important dates is essential for compliance.

Penalties for non-compliance

Failing to comply with the tangible personal property tax requirements can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Additionally, failure to file can result in the assessment of your property at a higher value, leading to increased tax liabilities. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate filing.

State-specific rules for the tangible personal property tax

Each state has its own set of rules and regulations governing the tangible personal property tax. This can include variations in what is considered taxable property, assessment methods, and filing procedures. For instance, some states may offer exemptions or special rates for certain types of property or businesses. It is essential for taxpayers to familiarize themselves with their state's specific regulations to ensure compliance and optimize their tax obligations.

Quick guide on how to complete tangible personal property tax

Effortlessly prepare Tangible Personal Property Tax on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Handle Tangible Personal Property Tax on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign Tangible Personal Property Tax effortlessly

- Find Tangible Personal Property Tax and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive data using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your adjustments.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Tangible Personal Property Tax to ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tangible personal property tax

Create this form in 5 minutes!

How to create an eSignature for the tangible personal property tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tangible personal property schedule?

A tangible personal property schedule is a detailed list of physical assets owned by an individual or business, integrating items such as furniture, equipment, and other valuable possessions. It is essential for tax purposes, estate planning, and asset management, ensuring that all items are documented accurately to avoid disputes.

-

How can airSlate SignNow help me manage my tangible personal property schedule?

airSlate SignNow provides an easy-to-use platform that allows you to create, send, and eSign your tangible personal property schedule documents seamlessly. With our cloud-based solution, you can organize and update your schedules in real time, ensuring you always have the latest information at your fingertips.

-

What features does airSlate SignNow offer for scheduling tangible personal property?

Our platform includes features like customizable templates, secure e-signatures, and document sharing, all tailored for creating and managing your tangible personal property schedule. Additionally, you can track document statuses and automate reminders, making the process more efficient.

-

Is airSlate SignNow cost-effective for small businesses managing tangible personal property schedules?

Yes, airSlate SignNow offers affordable pricing plans that cater specifically to small businesses, allowing you to manage your tangible personal property schedule without breaking the bank. Our pricing model is designed to offer maximum value with a range of features suitable for all business sizes.

-

Can I integrate airSlate SignNow with other software for managing my tangible personal property schedule?

Absolutely! airSlate SignNow provides integrations with popular business tools, enabling seamless workflows for your tangible personal property schedule management. This flexibility allows you to connect with CRMs, accounting software, and other applications to streamline your processes.

-

What are the benefits of using airSlate SignNow for my tangible personal property schedule?

Using airSlate SignNow for your tangible personal property schedule enhances efficiency and accuracy in asset documentation. The ability to eSign documents quickly reduces delays, while our secure cloud storage ensures your information is accessible and protected.

-

How secure is the data in my tangible personal property schedule with airSlate SignNow?

We prioritize your security at airSlate SignNow, employing advanced encryption and security protocols to protect your tangible personal property schedule data. Your documents are stored securely in the cloud, and access controls ensure that only authorized users can view or edit them.

Get more for Tangible Personal Property Tax

- Special consideration rmit form

- Print the application arkids first form

- Small employer uniform employee application for group health insurance wisconsin

- Attorney or party without attorney name state ba form

- Agreement for direct deposit form uib 1091a

- B2b partnership agreement template form

- Business partnership agreement template form

- Business partnership buyout agreement template form

Find out other Tangible Personal Property Tax

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template