Tangible Personal ProPerTy Handbook TN Gov 2024-2026

Understanding the Tangible Personal Property Handbook in Tennessee

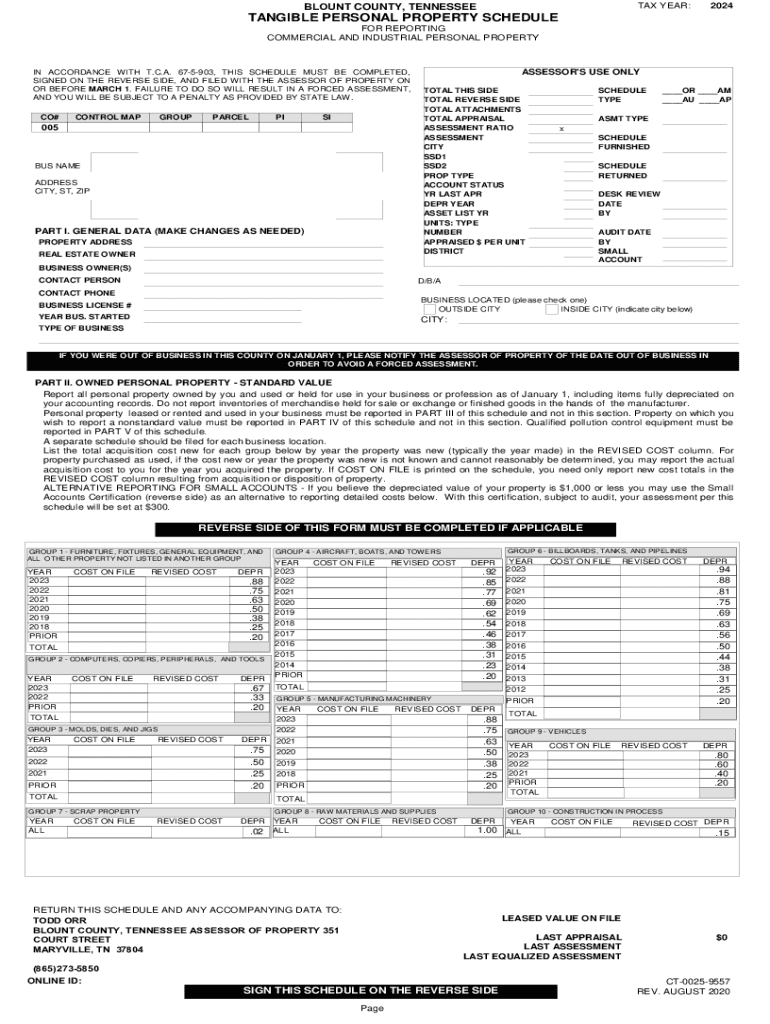

The Tangible Personal Property Handbook is a vital resource provided by the state of Tennessee for individuals and businesses to understand their obligations regarding tangible personal property. This handbook outlines the definitions, classifications, and valuation methods for tangible personal property, which includes items such as machinery, equipment, and furniture. It serves as a guide to help taxpayers accurately report their tangible personal property for tax purposes.

Steps to Complete the Tangible Personal Property Schedule

Completing the tangible personal property schedule involves several key steps. First, gather all necessary documentation regarding your tangible personal property, including purchase receipts and previous tax filings. Next, review the guidelines provided in the Tangible Personal Property Handbook to ensure you understand the classification of your assets. After classifying your property, fill out the schedule accurately, listing each item along with its corresponding value. Finally, double-check your entries for accuracy before submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the tangible personal property schedule. In Tennessee, the deadline for submitting the schedule is typically April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any additional deadlines related to appeals or amendments to ensure compliance with state regulations.

Required Documents for Submission

When submitting the tangible personal property schedule, certain documents are required to support your filing. These may include a detailed list of all tangible personal property owned, purchase invoices, and any previous tax returns that pertain to tangible personal property. Additionally, if you are claiming exemptions or special classifications, documentation supporting these claims should be included to avoid delays in processing.

Legal Use of the Tangible Personal Property Handbook

The Tangible Personal Property Handbook serves a legal function by providing the necessary guidelines for compliance with Tennessee tax laws. It outlines the responsibilities of taxpayers and the legal ramifications of failing to report tangible personal property accurately. Understanding the legal use of this handbook can help individuals and businesses avoid penalties and ensure they meet their tax obligations.

Penalties for Non-Compliance

Failure to comply with the requirements set forth in the tangible personal property schedule can result in penalties. These may include fines, interest on unpaid taxes, and possible legal action. It is essential for taxpayers to be aware of these consequences and to ensure timely and accurate reporting of their tangible personal property to avoid any negative repercussions.

Create this form in 5 minutes or less

Find and fill out the correct tangible personal property handbook tn gov

Create this form in 5 minutes!

How to create an eSignature for the tangible personal property handbook tn gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tangible personal property schedule?

A tangible personal property schedule is a detailed list that outlines all physical assets owned by an individual or business. This schedule is essential for tax purposes and helps in accurately reporting the value of personal property. By using airSlate SignNow, you can easily create and manage your tangible personal property schedule digitally.

-

How can airSlate SignNow help with my tangible personal property schedule?

airSlate SignNow provides a user-friendly platform to create, send, and eSign documents related to your tangible personal property schedule. With its intuitive interface, you can streamline the process of documenting and managing your assets. This ensures that your schedule is always up-to-date and easily accessible.

-

Is there a cost associated with using airSlate SignNow for my tangible personal property schedule?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost is competitive and provides great value considering the features available for managing your tangible personal property schedule. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing a tangible personal property schedule?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to create and manage your tangible personal property schedule efficiently. Additionally, you can collaborate with team members in real-time.

-

Can I integrate airSlate SignNow with other software for my tangible personal property schedule?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to connect your tangible personal property schedule with accounting and management tools. This integration enhances workflow efficiency and ensures that all your data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for my tangible personal property schedule?

Using airSlate SignNow for your tangible personal property schedule provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform simplifies the documentation process, ensuring that your assets are well-organized and compliant with regulations. Additionally, eSigning documents speeds up approvals and reduces paperwork.

-

Is airSlate SignNow secure for managing my tangible personal property schedule?

Yes, airSlate SignNow prioritizes security and employs advanced encryption methods to protect your data. When managing your tangible personal property schedule, you can trust that your information is safe and confidential. Regular security audits and compliance with industry standards further enhance the platform's reliability.

Get more for Tangible Personal ProPerTy Handbook TN gov

- Shrg 117 459closing the tax gap lost revenue from noncompliance form

- Instructions for schedule c form 990 2021internal revenue service

- Form r 1070 ampquotapplication for certification as a manufacturer including

- Instructions for form 2290 rev july 2022 instructions for form 2290 heavy highway vehicle use tax return

- 2022 form w 3ss

- It nrs ohio nonresident statement form

- La lat11 2021 2022 fill out tax template online us legal forms

- About form 8801 credit for prior year minimum taxinstructions for form 8801 2020internal revenue serviceinstructions for form

Find out other Tangible Personal ProPerTy Handbook TN gov

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online