RF 9 Decedent Refund Claim Rev 9 19 Form

What is the RF 9 Decedent Refund Claim Rev 9 19

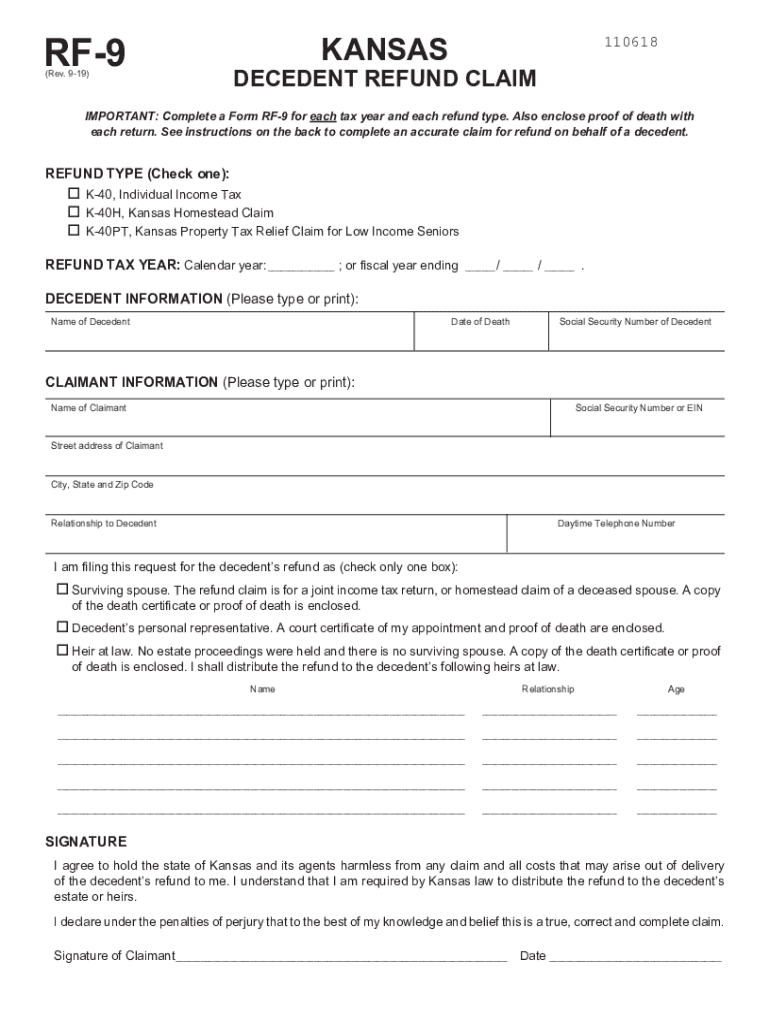

The Kansas Form RF 9, also known as the Decedent Refund Claim Rev 9 19, is a tax form used to claim a refund of taxes paid by a deceased individual. This form is essential for the estate of the decedent to recover any overpaid taxes from the state. It is primarily utilized by the personal representative or executor of the estate to facilitate the refund process on behalf of the deceased. Understanding the purpose of this form is crucial for ensuring that all necessary claims are accurately filed and processed in accordance with state tax laws.

Steps to complete the RF 9 Decedent Refund Claim Rev 9 19

Completing the Kansas Form RF 9 involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including the decedent's personal details, tax identification number, and the tax year for which the refund is being claimed. Next, fill out the form meticulously, ensuring that all required fields are completed. It is essential to include documentation that supports the claim, such as tax returns and proof of payment. Finally, review the completed form for any errors before submitting it to the appropriate state tax authority.

Legal use of the RF 9 Decedent Refund Claim Rev 9 19

The legal use of the RF 9 form is governed by state tax regulations. It is important to understand that this form must be filed within the stipulated time frame following the decedent's passing. The form serves as a formal request for the state to review and process the refund claim. To ensure the claim is legally binding, it must be signed by the personal representative or executor and submitted in accordance with the Kansas Department of Revenue guidelines. Compliance with these legal requirements is necessary for the claim to be honored.

Required Documents

When filing the Kansas Form RF 9, certain documents are required to support the refund claim. These typically include:

- The decedent's tax returns for the relevant tax years.

- Proof of tax payments made by the decedent.

- A copy of the death certificate.

- Documentation proving the relationship of the claimant to the decedent, if applicable.

Having these documents ready will facilitate a smoother filing process and help ensure that the claim is processed without unnecessary delays.

Form Submission Methods (Online / Mail / In-Person)

The RF 9 Decedent Refund Claim can be submitted through various methods, depending on the preferences of the filer and the requirements set by the Kansas Department of Revenue. Typically, the form can be submitted:

- Online through the state’s tax portal, if available.

- By mail, sending the completed form and supporting documents to the designated address.

- In-person at local tax offices, where assistance may be available for completing the form.

Choosing the right submission method can impact the processing time of the refund claim.

Eligibility Criteria

To be eligible to file the Kansas Form RF 9, the claimant must be the personal representative or executor of the decedent's estate. Additionally, the decedent must have been a resident of Kansas and have paid state taxes for the years in question. The claim can only be made for taxes that were overpaid, and it is essential to provide proof of such overpayments to support the claim. Understanding these criteria is vital for ensuring that the refund request is valid and stands a good chance of approval.

Quick guide on how to complete rf 9 decedent refund claim rev 9 19

Complete RF 9 Decedent Refund Claim Rev 9 19 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary template and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents promptly without delays. Manage RF 9 Decedent Refund Claim Rev 9 19 on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-oriented process today.

How to modify and electronically sign RF 9 Decedent Refund Claim Rev 9 19 with ease

- Locate RF 9 Decedent Refund Claim Rev 9 19 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that require reprinting copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign RF 9 Decedent Refund Claim Rev 9 19 and ensure outstanding communication at all stages of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rf 9 decedent refund claim rev 9 19

Create this form in 5 minutes!

How to create an eSignature for the rf 9 decedent refund claim rev 9 19

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kansas Form RF 9 and how can airSlate SignNow assist with it?

The Kansas Form RF 9 is a specific document required for certain legal and financial processes in Kansas. airSlate SignNow streamlines the signing and submission of the Kansas Form RF 9, making it easy for businesses to manage their documents efficiently and securely.

-

How much does it cost to use airSlate SignNow for Kansas Form RF 9?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Users can choose a plan that includes features specifically for handling the Kansas Form RF 9, ensuring that they get the best value for their document management solution.

-

What features does airSlate SignNow provide for Kansas Form RF 9?

Key features of airSlate SignNow for the Kansas Form RF 9 include electronic signatures, document templates, and advanced security protocols. These tools help ensure that your documents are signed quickly and securely, meeting state requirements effortlessly.

-

Can I integrate airSlate SignNow with other applications for managing Kansas Form RF 9?

Yes, airSlate SignNow offers seamless integrations with various applications to enhance your workflow when managing the Kansas Form RF 9. You can easily connect it with CRM systems, cloud storage, and other tools to optimize your document processes.

-

Is airSlate SignNow compliant with Kansas laws regarding the Kansas Form RF 9?

Absolutely! airSlate SignNow adheres to Kansas laws and regulations related to electronic signatures and document management. This compliance ensures that your use of the Kansas Form RF 9 is legally valid and recognized.

-

How does airSlate SignNow improve the efficiency of dealing with Kansas Form RF 9?

By utilizing airSlate SignNow, businesses can signNowly save time and reduce paperwork when dealing with the Kansas Form RF 9. The platform simplifies the entire process, allowing for quick deployment, editing, and signing of documents.

-

What support does airSlate SignNow offer for users of Kansas Form RF 9?

airSlate SignNow provides comprehensive customer support for all users, including those dealing with the Kansas Form RF 9. This support includes tutorials, FAQs, and dedicated assistance to ensure that you fully understand how to manage your documents.

Get more for RF 9 Decedent Refund Claim Rev 9 19

Find out other RF 9 Decedent Refund Claim Rev 9 19

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation