Form or W 4 2024-2026

What is the Oregon W-4 Form?

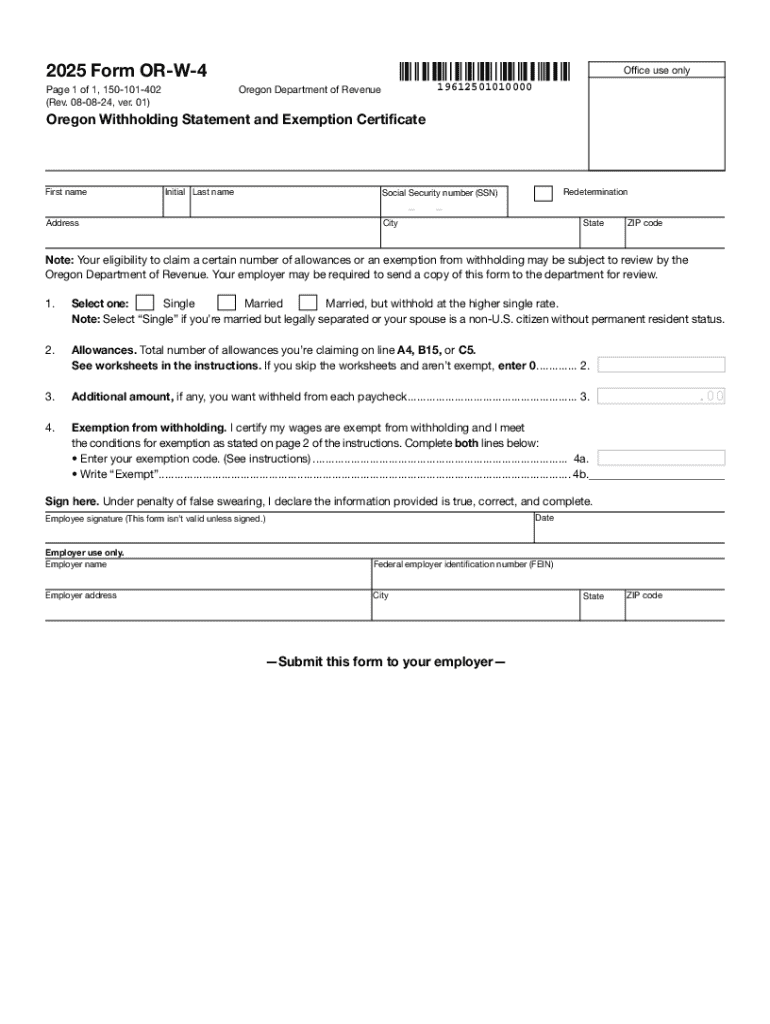

The Oregon W-4 form, also known as the Oregon withholding form, is a crucial document for employees working in Oregon. It is used to determine the amount of state income tax that should be withheld from an employee's paycheck. This form is essential for ensuring that the correct amount of taxes is deducted, helping to avoid underpayment or overpayment of state taxes. Employees must fill out this form accurately to reflect their tax situation, including any allowances they wish to claim.

Steps to Complete the Oregon W-4 Form

Completing the Oregon W-4 form involves several straightforward steps:

- Obtain the Form: Access the Oregon W-4 form from the Oregon Department of Revenue website or through your employer.

- Fill in Personal Information: Provide your name, address, and Social Security number at the top of the form.

- Claim Allowances: Indicate the number of allowances you wish to claim. This affects the amount of tax withheld.

- Additional Withholding: If you want to have extra money withheld from your paycheck, specify the amount in the designated section.

- Sign and Date: Ensure you sign and date the form before submitting it to your employer.

Legal Use of the Oregon W-4 Form

The Oregon W-4 form is legally required for employees in Oregon to ensure proper state tax withholding. Employers must retain this form for their records and must use the information provided to calculate the correct withholding amounts. Failure to submit this form may result in incorrect tax withholding, leading to potential penalties for both the employee and employer. It is important to keep the information updated, especially after significant life changes such as marriage or the birth of a child.

State-Specific Rules for the Oregon W-4 Form

Oregon has specific rules regarding the completion and submission of the W-4 form. Employees must adhere to the following guidelines:

- Employees can only claim allowances based on their personal tax situation.

- Those who are exempt from withholding must indicate this on the form and provide the necessary documentation.

- Employers are required to provide a copy of the completed form to the employee upon request.

How to Obtain the Oregon W-4 Form

The Oregon W-4 form can be easily obtained through various channels:

- Visit the Oregon Department of Revenue website to download a printable version of the form.

- Request a copy from your employer's human resources department.

- Access the form from tax preparation software that includes state tax forms.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Oregon W-4 form is essential for compliance. Here are key dates to remember:

- New employees must submit their W-4 form on or before their first paycheck.

- Existing employees should update their W-4 form whenever there are changes in their tax situation.

- Employers must ensure that the updated forms are processed in a timely manner to reflect changes in withholding.

Create this form in 5 minutes or less

Find and fill out the correct form or w 4

Create this form in 5 minutes!

How to create an eSignature for the form or w 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon W 4 form?

The Oregon W 4 form is a state-specific tax withholding form that allows employees to indicate their tax withholding preferences. By completing the Oregon W 4 form, employees can ensure that the correct amount of state income tax is withheld from their paychecks, helping them avoid underpayment or overpayment of taxes.

-

How can I complete the Oregon W 4 form using airSlate SignNow?

You can easily complete the Oregon W 4 form using airSlate SignNow by uploading the form to our platform. Our user-friendly interface allows you to fill out the necessary fields, sign the document electronically, and send it securely to your employer or payroll department.

-

Is there a cost associated with using airSlate SignNow for the Oregon W 4 form?

airSlate SignNow offers a cost-effective solution for managing documents, including the Oregon W 4 form. We provide various pricing plans to suit different business needs, ensuring that you can access our features without breaking the bank.

-

What features does airSlate SignNow offer for the Oregon W 4 form?

airSlate SignNow provides a range of features for the Oregon W 4 form, including electronic signatures, document templates, and secure storage. These features streamline the process of completing and submitting your form, making it easier for you to manage your tax withholding preferences.

-

Can I integrate airSlate SignNow with other software for managing the Oregon W 4 form?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to manage the Oregon W 4 form seamlessly. Whether you use HR software or payroll systems, our integrations help you maintain a smooth workflow and keep your documents organized.

-

What are the benefits of using airSlate SignNow for the Oregon W 4 form?

Using airSlate SignNow for the Oregon W 4 form provides numerous benefits, including time savings, enhanced security, and ease of use. Our platform ensures that your documents are handled efficiently, allowing you to focus on your work while we take care of the paperwork.

-

How secure is my information when using airSlate SignNow for the Oregon W 4 form?

Your information is highly secure when using airSlate SignNow for the Oregon W 4 form. We implement advanced encryption and security protocols to protect your data, ensuring that your personal and financial information remains confidential and safe from unauthorized access.

Get more for Form Or w 4

- Financial statements only in connection with prenuptial premarital agreement maine form

- Revocation of premarital or prenuptial agreement maine form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children maine form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497310713 form

- Maine business form

- Pre incorporation agreement form

- Maine directors form

- Corporate records maintenance package for existing corporations maine form

Find out other Form Or w 4

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement