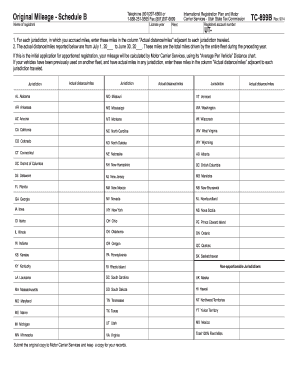

TC 899B, Original Mileage Schedule B Utah State Tax Commission Tax Utah Form

What is the TC 899B, Original Mileage Schedule B Utah State Tax Commission Tax Utah

The TC 899B, Original Mileage Schedule B, is a specific form utilized by taxpayers in Utah to report mileage for tax purposes. This form is essential for individuals who need to document their vehicle usage for business-related activities, allowing them to claim deductions on their state tax returns. The Utah State Tax Commission requires accurate reporting of mileage to ensure compliance with state tax laws. Understanding the purpose of this form is crucial for taxpayers who wish to maximize their deductions and maintain proper records.

Steps to complete the TC 899B, Original Mileage Schedule B Utah State Tax Commission Tax Utah

Completing the TC 899B requires careful attention to detail to ensure all necessary information is accurately reported. Follow these steps for successful completion:

- Gather all relevant documentation, including odometer readings, receipts, and any other records of vehicle use.

- Fill out the personal information section, including your name, address, and Social Security number.

- Document the total miles driven for business purposes, separating them from personal use.

- Calculate the total deduction based on the mileage driven and the applicable rate set by the state.

- Review the completed form for accuracy before submission.

Legal use of the TC 899B, Original Mileage Schedule B Utah State Tax Commission Tax Utah

The TC 899B must be used in accordance with Utah state tax laws to ensure its legal validity. This includes adhering to guidelines for mileage reporting and maintaining accurate records. The form serves as a legal document that can be requested during audits or reviews by the Utah State Tax Commission. Therefore, it is essential to complete the form truthfully and retain supporting documents that validate the reported mileage.

How to obtain the TC 899B, Original Mileage Schedule B Utah State Tax Commission Tax Utah

Taxpayers can obtain the TC 899B from the Utah State Tax Commission's official website or by visiting their local tax office. The form is typically available in a downloadable PDF format, allowing for easy access and printing. Additionally, tax preparation software may also include this form, making it convenient for users to complete their tax filings electronically.

State-specific rules for the TC 899B, Original Mileage Schedule B Utah State Tax Commission Tax Utah

Utah has specific rules governing the use of the TC 899B, which include guidelines on what qualifies as business mileage and the documentation required to substantiate claims. Taxpayers must familiarize themselves with these rules to ensure compliance and avoid potential penalties. It is important to note that personal commuting miles are generally not deductible, and only miles driven for business purposes can be reported on this form.

Filing Deadlines / Important Dates

Filing deadlines for the TC 899B align with the general tax filing deadlines in Utah. Taxpayers should ensure they submit the form by the designated date to avoid late fees or penalties. Typically, the deadline for filing individual tax returns is April 15, unless extended. It is advisable to check for any updates or changes to these deadlines each tax year to remain compliant.

Quick guide on how to complete tc 899b original mileage schedule b utah state tax commission tax utah

Complete TC 899B, Original Mileage Schedule B Utah State Tax Commission Tax Utah seamlessly on any device

Digital document management has become favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed materials, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage TC 899B, Original Mileage Schedule B Utah State Tax Commission Tax Utah on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign TC 899B, Original Mileage Schedule B Utah State Tax Commission Tax Utah effortlessly

- Obtain TC 899B, Original Mileage Schedule B Utah State Tax Commission Tax Utah and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign TC 899B, Original Mileage Schedule B Utah State Tax Commission Tax Utah and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 899b original mileage schedule b utah state tax commission tax utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TC 899B, Original Mileage Schedule B for Utah State Tax Commission?

The TC 899B, Original Mileage Schedule B is a form used by the Utah State Tax Commission to report vehicle mileage for tax purposes. It enables taxpayers to provide detailed information about business-related travel and claim deductions. Accurate reporting on this form can help maximize your tax efficiency in Utah.

-

How can airSlate SignNow assist with filing the TC 899B, Original Mileage Schedule B?

airSlate SignNow offers an easy-to-use platform to eSign and manage documents, including the TC 899B, Original Mileage Schedule B. Our solution allows users to fill out, sign, and store the form securely without the hassle of printing. Streamlining your filing process with our platform ensures accuracy and compliance with Utah State Tax Commission requirements.

-

Is there a cost associated with using airSlate SignNow for the TC 899B, Original Mileage Schedule B?

Yes, airSlate SignNow provides a variety of pricing plans tailored to your business needs, making it a cost-effective solution for filing the TC 899B, Original Mileage Schedule B. We offer flexible pricing options based on the number of documents you sign and send. You can choose a plan that suits your volume of document preparation and signing.

-

What features does airSlate SignNow offer for completing the TC 899B, Original Mileage Schedule B?

airSlate SignNow includes a range of features to assist with the TC 899B, Original Mileage Schedule B, including customizable templates, secure cloud storage, and real-time tracking. Our user-friendly interface lets you easily upload your document, fill in the required fields, and obtain signatures seamlessly. Additionally, our platform is mobile-friendly, allowing you to complete your forms on the go.

-

Can I integrate airSlate SignNow with other applications for my tax documentation needs?

Yes, airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and Dropbox, making it convenient to manage documents related to the TC 899B, Original Mileage Schedule B. These integrations enhance your workflow by allowing seamless document access and storage. This way, you can centralize your tax documentation and streamline your processes.

-

What are the benefits of using airSlate SignNow for the TC 899B, Original Mileage Schedule B?

Using airSlate SignNow for the TC 899B, Original Mileage Schedule B simplifies the signing process and reduces paperwork. With our digital solution, you save time and enhance accuracy when preparing your tax forms for the Utah State Tax Commission. Plus, our secure platform ensures that your sensitive information is protected throughout the filing process.

-

Is airSlate SignNow compliant with Utah State Tax Commission regulations?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations, including those set by the Utah State Tax Commission. This means that when you use our platform for the TC 899B, Original Mileage Schedule B, you can be assured that you are meeting the state’s requirements for eSignature and document handling.

Get more for TC 899B, Original Mileage Schedule B Utah State Tax Commission Tax Utah

- How to change your name in virginia findlaw state laws form

- Rvcc 1098 t form

- Registration registry form

- Consent form consent form instructions for the xcel energy

- Self declaration letter format for medical insurance

- Action plan for anaphylaxis dc public schools dcps dc form

- Form 4684 1649331

- Key man insurance agreement template form

Find out other TC 899B, Original Mileage Schedule B Utah State Tax Commission Tax Utah

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online