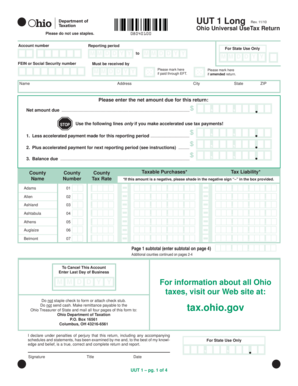

Ohio Universal UseTax Return Tax Ohio 2010-2026

What is the Ohio Universal Use Tax Return?

The Ohio Universal Use Tax Return is a tax form used by residents and businesses to report and pay the use tax owed on purchases made outside of Ohio that are used within the state. This form is particularly relevant for individuals and entities that buy goods or services from out-of-state vendors and do not pay sales tax at the time of purchase. The use tax ensures that local businesses are not disadvantaged by out-of-state purchases and helps maintain fair competition.

Steps to Complete the Ohio Universal Use Tax Return

Completing the Ohio Universal Use Tax Return involves several key steps:

- Gather all relevant purchase documentation, including receipts and invoices.

- Calculate the total amount of purchases subject to use tax.

- Determine the applicable use tax rate for your purchases, which is typically the same as the sales tax rate in your jurisdiction.

- Fill out the Ohio Universal Use Tax Return form, ensuring all sections are completed accurately.

- Submit the completed form along with the payment for the calculated use tax.

Legal Use of the Ohio Universal Use Tax Return

The Ohio Universal Use Tax Return is legally binding when completed and submitted according to state tax regulations. It is essential for taxpayers to understand their obligations under Ohio law, as failure to file or pay the appropriate use tax can result in penalties. The form must be filed annually, and keeping accurate records of purchases is crucial for compliance.

Filing Deadlines / Important Dates

Taxpayers should be aware of specific deadlines for filing the Ohio Universal Use Tax Return. Generally, the form is due annually on the last day of the month following the end of the tax year. For example, if your tax year ends on December 31, the return must be filed by January 31 of the following year. It is advisable to check for any updates or changes to these deadlines each tax year.

Required Documents

To complete the Ohio Universal Use Tax Return, you will need several documents:

- Receipts or invoices for all purchases made outside of Ohio.

- Records of any sales tax paid to out-of-state vendors.

- Previous tax returns, if applicable, for reference.

Examples of Using the Ohio Universal Use Tax Return

Common scenarios for using the Ohio Universal Use Tax Return include:

- A resident purchasing furniture from an online retailer based in another state without paying Ohio sales tax.

- A business acquiring equipment from a vendor outside Ohio and utilizing it within the state.

In both cases, the taxpayer is responsible for reporting the use tax on the Ohio Universal Use Tax Return.

Quick guide on how to complete ohio universal usetax return tax ohio

Fill out Ohio Universal UseTax Return Tax Ohio effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Handle Ohio Universal UseTax Return Tax Ohio on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Ohio Universal UseTax Return Tax Ohio with ease

- Obtain Ohio Universal UseTax Return Tax Ohio and select Get Form to initiate.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that reason.

- Create your signature with the Sign tool, which takes seconds and possesses the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to retain your modifications.

- Select your preferred method for delivering your form—whether by email, SMS, invitation link, or download to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that require reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and eSign Ohio Universal UseTax Return Tax Ohio to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ohio universal usetax return tax ohio

Create this form in 5 minutes!

How to create an eSignature for the ohio universal usetax return tax ohio

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'ohio uut1 printable' document in airSlate SignNow?

The 'ohio uut1 printable' is a customizable document template available in airSlate SignNow that streamlines the process of signing and sending important legal or business documents. It allows users to easily fill out and print forms needed for compliance in Ohio, ensuring a smooth workflow.

-

How can I access the 'ohio uut1 printable' template?

To access the 'ohio uut1 printable' template, sign in to your airSlate SignNow account and navigate to the templates section. You can search for the specific document by typing 'ohio uut1 printable' in the search bar to easily find and utilize it.

-

Is there a cost associated with using the 'ohio uut1 printable' document?

The 'ohio uut1 printable' template is part of airSlate SignNow's comprehensive pricing plans. Depending on your selected plan, you may have free access or need to subscribe to a paid tier that includes this and other powerful features for document management.

-

What are the benefits of using airSlate SignNow for the 'ohio uut1 printable'?

Using airSlate SignNow for the 'ohio uut1 printable' provides numerous benefits, such as faster turnaround times for document signing and enhanced security features. It simplifies the signing process and ensures that you stay compliant with state regulations in Ohio.

-

Can the 'ohio uut1 printable' template be customized?

Yes, the 'ohio uut1 printable' template is fully customizable. You can modify any part of the document to suit your needs, whether that's adding your company's logo, changing text fields, or including additional clauses relevant to your specific situation.

-

Does airSlate SignNow offer integrations that support the 'ohio uut1 printable'?

Absolutely! airSlate SignNow integrates with numerous other applications and platforms, enhancing your ability to use the 'ohio uut1 printable' seamlessly within your existing workflow. This means you can connect it with tools you already use for increased efficiency.

-

How does the signing process work for the 'ohio uut1 printable'?

The signing process for the 'ohio uut1 printable' is straightforward. Once the document is prepared, you can send it to recipients via email, and they can sign it electronically from any device, making the signing process quick and hassle-free.

Get more for Ohio Universal UseTax Return Tax Ohio

- Erie county planning areas zip code overlay www2 erie form

- Dental lifeline network form

- Breaking bad pilot script form

- Demand for compliance or possession form

- Twcc authorization form 153 discovery resource

- Air commercial real estate association standard industrial commercial single tenant lease form

- Blm form 1260

- Dhcs form 6237 department of health care services state of dhcs ca

Find out other Ohio Universal UseTax Return Tax Ohio

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile