Form Uut 1 2006

What is the Form Uut 1

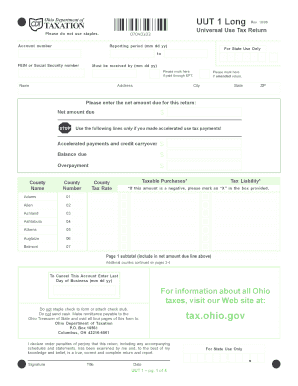

The Form Uut 1 is a specific document used in Ohio for tax-related purposes. It serves as a declaration for various tax obligations and is essential for individuals and businesses to report income accurately. Understanding the purpose of this form is crucial for compliance with state tax laws. It is designed to gather necessary information regarding income sources, deductions, and other relevant data that the Ohio Department of Taxation requires for assessment and processing.

How to use the Form Uut 1

Using the Form Uut 1 involves a straightforward process that requires accurate information entry. First, ensure you have all necessary documents, such as income statements and deduction records. Next, fill out the form by providing your personal details, including your name, address, and Social Security number. Follow the instructions carefully to complete each section, ensuring that all figures are accurate. Once completed, the form can be submitted electronically or through traditional mail, depending on your preference.

Steps to complete the Form Uut 1

Completing the Form Uut 1 involves several key steps:

- Gather all required documentation, including income statements and any relevant tax records.

- Fill in your personal information, ensuring accuracy in your name and address.

- Provide detailed information regarding your income sources and any applicable deductions.

- Review the completed form for any errors or omissions.

- Submit the form electronically via a secure platform or mail it to the designated address.

Legal use of the Form Uut 1

The legal use of the Form Uut 1 is governed by Ohio state tax laws. To ensure that your submission is valid, it is important to comply with all applicable regulations. This includes accurately reporting income and adhering to deadlines for submission. Failure to comply with these legal requirements may result in penalties or additional scrutiny from tax authorities. Utilizing a reliable electronic signature platform can enhance the legal standing of your submission by providing an audit trail and ensuring compliance with eSignature laws.

Key elements of the Form Uut 1

The Form Uut 1 includes several key elements that are essential for accurate tax reporting:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: You must detail all sources of income, including wages, self-employment earnings, and other taxable income.

- Deductions: The form allows for the inclusion of various deductions that may reduce your taxable income.

- Signature: A signature is required to validate the information provided and affirm its accuracy.

Form Submission Methods

The Form Uut 1 can be submitted using multiple methods to accommodate different preferences:

- Online Submission: Many users prefer to submit the form electronically through a secure platform, which often allows for faster processing.

- Mail Submission: Alternatively, you can print the completed form and mail it to the appropriate tax authority address.

- In-Person Submission: Some individuals may choose to deliver the form in person at a local tax office for immediate confirmation of receipt.

Quick guide on how to complete form uut 1

Effortlessly prepare Form Uut 1 on any device

Digital document management has become increasingly popular among organizations and individuals. It offers a fantastic eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Form Uut 1 on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form Uut 1 effortlessly

- Find Form Uut 1 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to share your form, either by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Form Uut 1 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form uut 1

Create this form in 5 minutes!

How to create an eSignature for the form uut 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ohio uut 1 long form pdf and why is it important?

The ohio uut 1 long form pdf is a specific legal document that may be required for certain official processes in Ohio. Understanding and completing this document correctly is crucial for compliance with state regulations. Using airSlate SignNow to eSign the ohio uut 1 long form pdf ensures that you can manage your documents digitally and securely.

-

How does airSlate SignNow help with signing the ohio uut 1 long form pdf?

airSlate SignNow offers an intuitive platform that allows you to easily eSign the ohio uut 1 long form pdf from any device. Our user-friendly interface simplifies the signing process, saving you time. You can also track the status of your document to ensure it's signed promptly.

-

What are the pricing options for using airSlate SignNow to manage the ohio uut 1 long form pdf?

airSlate SignNow provides flexible pricing plans suitable for businesses of all sizes that need to handle documents like the ohio uut 1 long form pdf. Our basic plan offers essential features at an affordable rate, while premium plans provide additional functionality for more complex needs. For detailed pricing, visit our website.

-

Are there any special features for editing the ohio uut 1 long form pdf in airSlate SignNow?

Yes, airSlate SignNow includes robust editing features that allow you to modify the ohio uut 1 long form pdf before signing. You can add text, checkboxes, and other fields to customize the document as per your needs. This flexibility ensures that your forms are complete and compliant with Ohio regulations.

-

Can I integrate airSlate SignNow with other tools for handling the ohio uut 1 long form pdf?

Absolutely! airSlate SignNow supports integration with various business tools like Google Drive, Salesforce, and Dropbox, making it easier to manage your ohio uut 1 long form pdf alongside other documents. These integrations streamlining your workflow and enhance productivity. Visit our integrations page for a complete list of options.

-

What benefits does airSlate SignNow offer for businesses handling the ohio uut 1 long form pdf?

Using airSlate SignNow to handle the ohio uut 1 long form pdf translates to signNow time and cost savings for your business. It eliminates the need for physical signatures, reducing paper waste and allowing you to manage documents remotely. Moreover, our platform enhances security with encryption, ensuring your information is protected.

-

How secure is airSlate SignNow when handling documents like the ohio uut 1 long form pdf?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and security protocols to protect your documents, including the ohio uut 1 long form pdf. We comply with industry standards to ensure that both your data and signatures remain secure during the entire signing process.

Get more for Form Uut 1

Find out other Form Uut 1

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now