Form 948

What is the Form 948

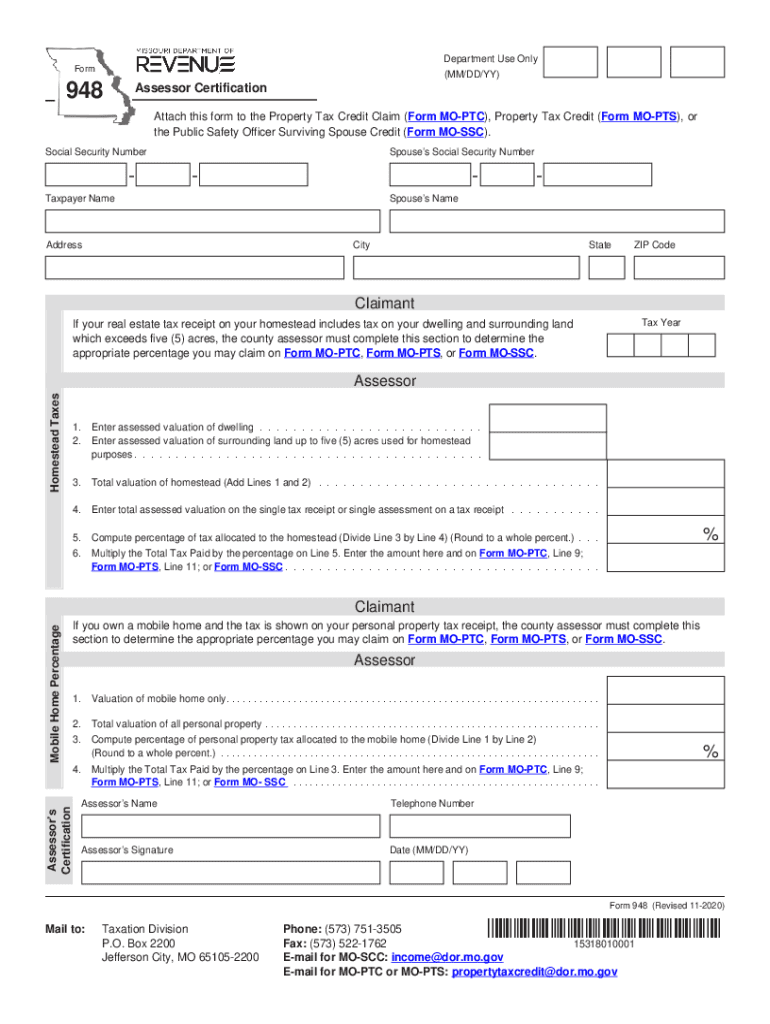

The Form 948 is a document used primarily for assessor certification in Missouri. This form is essential for individuals seeking to certify their qualifications as assessors within the state. It collects vital information about the applicant's background, training, and experience in property assessment. Understanding the purpose and requirements of the Form 948 is crucial for those looking to pursue a career in this field.

How to use the Form 948

Using the Form 948 involves several steps to ensure that all required information is accurately provided. Applicants must first download the form from an official source. After obtaining the form, it is important to fill out all sections completely, including personal details, educational background, and relevant work experience. Once completed, the form should be submitted to the appropriate state authority for review and processing.

Steps to complete the Form 948

Completing the Form 948 requires careful attention to detail. Here are the steps to follow:

- Download the Form 948 from the official Missouri state website.

- Read the instructions thoroughly to understand what information is required.

- Fill in your personal information, including your name, address, and contact details.

- Provide details about your educational qualifications and any relevant training.

- List your work experience related to property assessment.

- Review the completed form for accuracy and completeness.

- Submit the form to the designated state office, either online or by mail.

Legal use of the Form 948

The legal use of the Form 948 is governed by state regulations regarding assessor certification. To be considered valid, the form must be completed in accordance with the guidelines set forth by the Missouri state authorities. This includes ensuring that all information is truthful and accurate, as any discrepancies could lead to penalties or denial of certification. Utilizing a reliable eSignature solution can enhance the legal validity of the form when submitting it electronically.

Key elements of the Form 948

Several key elements must be included in the Form 948 to ensure its acceptance. These elements include:

- Personal identification information of the applicant.

- Educational credentials, including degrees and certifications.

- Detailed work history relevant to assessment practices.

- Signature of the applicant, affirming the accuracy of the information provided.

- Date of submission, indicating when the form was completed.

Who Issues the Form

The Form 948 is issued by the Missouri state government, specifically the department responsible for property assessment and taxation. This department oversees the certification process for assessors and ensures that all applicants meet the necessary qualifications. It is important for applicants to submit their forms to the correct office to avoid delays in processing.

Quick guide on how to complete form 948

Complete Form 948 with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 948 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Form 948 effortlessly

- Retrieve Form 948 and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow accommodates all your document management requirements in just a few clicks from any chosen device. Modify and eSign Form 948 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 948

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 948 and how is it used?

Form 948 is a document used for various administrative and legal purposes. With airSlate SignNow, you can easily fill out, sign, and send Form 948 digitally, streamlining your workflow and enhancing efficiency.

-

How much does it cost to use airSlate SignNow for form 948?

airSlate SignNow offers competitive pricing plans tailored to meet different business needs. You can manage and eSign documents like form 948 without incurring high costs, making it a budget-friendly solution.

-

What features does airSlate SignNow offer for managing form 948?

airSlate SignNow includes several features to assist with form 948, such as customizable templates, automated workflows, and secure eSigning capabilities. These features enhance your document management process, saving you time.

-

Can I integrate form 948 with other software using airSlate SignNow?

Yes, airSlate SignNow allows for seamless integration with various applications and software platforms. This functionality makes it easy to incorporate form 948 into your existing systems, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for form 948?

Using airSlate SignNow for form 948 provides numerous benefits, such as reduced turnaround times, enhanced security with encrypted signings, and increased accessibility. These advantages help your business operate more efficiently.

-

Is it easy to get started with form 948 on airSlate SignNow?

Absolutely! airSlate SignNow offers an intuitive interface that makes it easy to start using form 948. With minimal training required, you can quickly set up and send your documents for eSignature.

-

How secure is my data when using form 948 with airSlate SignNow?

AirSlate SignNow prioritizes security with advanced encryption protocols to protect your data when using form 948. You can trust that your documents are safe throughout the signing process.

Get more for Form 948

Find out other Form 948

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free