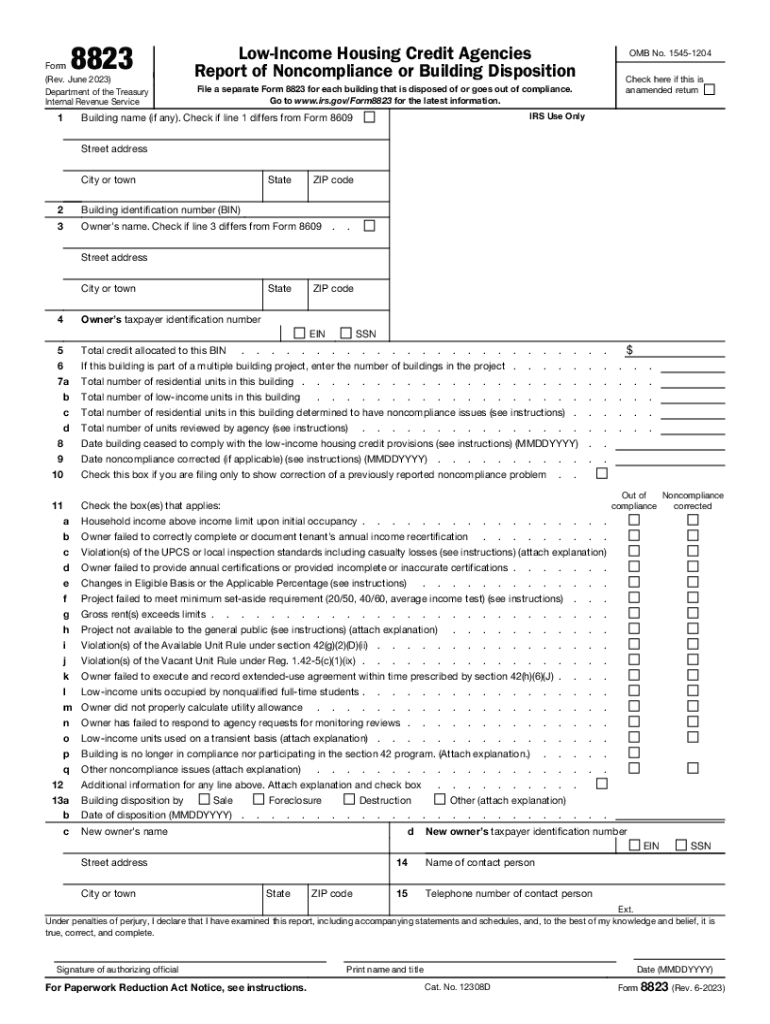

Proposed Collection; Comment Request for Form 8823 2023-2026

IRS Guidelines for Form 14817

The IRS Form 14817, also known as the Form 14817 reply cover sheet, is an essential document for individuals claiming a housing allowance for ministers. This form is specifically designed to ensure that the claims are processed accurately and in compliance with IRS regulations. The IRS provides detailed guidelines on how to complete this form, including the necessary information required for submission. Adhering to these guidelines is crucial for ensuring that the housing allowance is valid and that the claim is accepted without issues.

Steps to Complete Form 14817

Completing the IRS Form 14817 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation that supports your claim for a housing allowance. This may include proof of expenses related to housing, such as rent or mortgage statements. Next, accurately fill out the form, ensuring that all required fields are completed. Pay close attention to the instructions provided by the IRS to avoid common mistakes. Once completed, review the form for any errors before submission to ensure that it meets IRS standards.

Filing Deadlines for Form 14817

It is important to be aware of the filing deadlines associated with the IRS Form 14817. Typically, this form must be submitted alongside your annual tax return. The deadline for filing your tax return is usually April 15 of each year, unless an extension is granted. Failure to submit the form by the deadline may result in delays in processing your claim or potential penalties. Always check the IRS website for any updates on deadlines or changes in filing requirements.

Required Documents for Form 14817

When preparing to submit the IRS Form 14817, certain documents are required to support your claim. These documents may include:

- Proof of housing expenses, such as lease agreements or mortgage statements.

- Documentation of your ministerial duties, which may include letters from your church or organization.

- Any previous tax returns that may provide context for your housing allowance claim.

Having these documents ready will facilitate a smoother filing process and help ensure that your claim is processed efficiently.

Form Submission Methods for Form 14817

The IRS Form 14817 can be submitted through various methods, depending on your preference and the requirements set by the IRS. You may choose to file the form online, which is often the quickest method, or you can submit it via mail. If you opt for the mail submission, ensure that you send it to the correct IRS address specified for your region. Additionally, in-person submissions may be possible at certain IRS offices, but it is advisable to check availability beforehand.

Penalties for Non-Compliance with Form 14817

Failure to comply with the requirements associated with the IRS Form 14817 can lead to significant penalties. If the form is not submitted correctly or on time, you may face delays in receiving your housing allowance or even disqualification from claiming it altogether. Additionally, inaccuracies in the information provided can result in audits or further scrutiny from the IRS, potentially leading to fines. It is essential to ensure that all information is accurate and that the form is submitted in accordance with IRS guidelines to avoid these penalties.

Quick guide on how to complete proposed collection comment request for form 8823

Complete Proposed Collection; Comment Request For Form 8823 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without interruptions. Manage Proposed Collection; Comment Request For Form 8823 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Proposed Collection; Comment Request For Form 8823 effortlessly

- Find Proposed Collection; Comment Request For Form 8823 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Proposed Collection; Comment Request For Form 8823 and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct proposed collection comment request for form 8823

Create this form in 5 minutes!

How to create an eSignature for the proposed collection comment request for form 8823

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 14817, and how can it be used with airSlate SignNow?

Form 14817 is a key document used in various business processes, and airSlate SignNow allows you to send and eSign this form seamlessly. With its user-friendly interface, you can easily customize and manage form 14817, ensuring efficient workflow within your organization.

-

Is there a free trial available for using form 14817 with airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore the features of sending and signing form 14817. This is a great way to understand how our platform can enhance your document-signing processes before committing to a subscription.

-

What are the pricing plans for using form 14817 on airSlate SignNow?

airSlate SignNow provides flexible pricing plans that cater to various business sizes and needs, specifically for processing documents like form 14817. You can choose a plan that aligns with your requirements, whether you need basic features or more advanced capabilities.

-

How does airSlate SignNow ensure the security of form 14817 during signing?

Security is a top priority at airSlate SignNow. When using form 14817, your documents are protected with advanced encryption and robust security measures, ensuring that your sensitive information remains safe throughout the signing process.

-

Can I integrate airSlate SignNow with other applications while using form 14817?

Absolutely! airSlate SignNow offers seamless integrations with various applications and platforms, making it easy to manage form 14817 alongside your existing tools. This flexibility helps streamline your workflow and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for form 14817?

Using airSlate SignNow for form 14817 enhances efficiency, reduces paperwork, and accelerates turnaround times. The platform's intuitive design allows for quick document preparation and easy electronic signature collection, signNowly boosting your business processes.

-

Can I create custom templates for form 14817 in airSlate SignNow?

Yes, airSlate SignNow enables you to create custom templates for form 14817 that can be reused for various transactions. This feature saves time and ensures consistency across all your document processing needs.

Get more for Proposed Collection; Comment Request For Form 8823

- Valdese lions club glenn r yoder form

- Generic sample consent form gocolumbia

- Form ps 014b texas workforce commission twc state tx

- Test correction form 24614904

- Non payment petition to recover possession of real property nycourts form

- Dhs 222 form

- Form of no objection certificate

- Dog daycare contract template form

Find out other Proposed Collection; Comment Request For Form 8823

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template