CP 575 a Notice Warm Heart Worldwide Warmheartworldwide Form

What is the CP 575 A Notice?

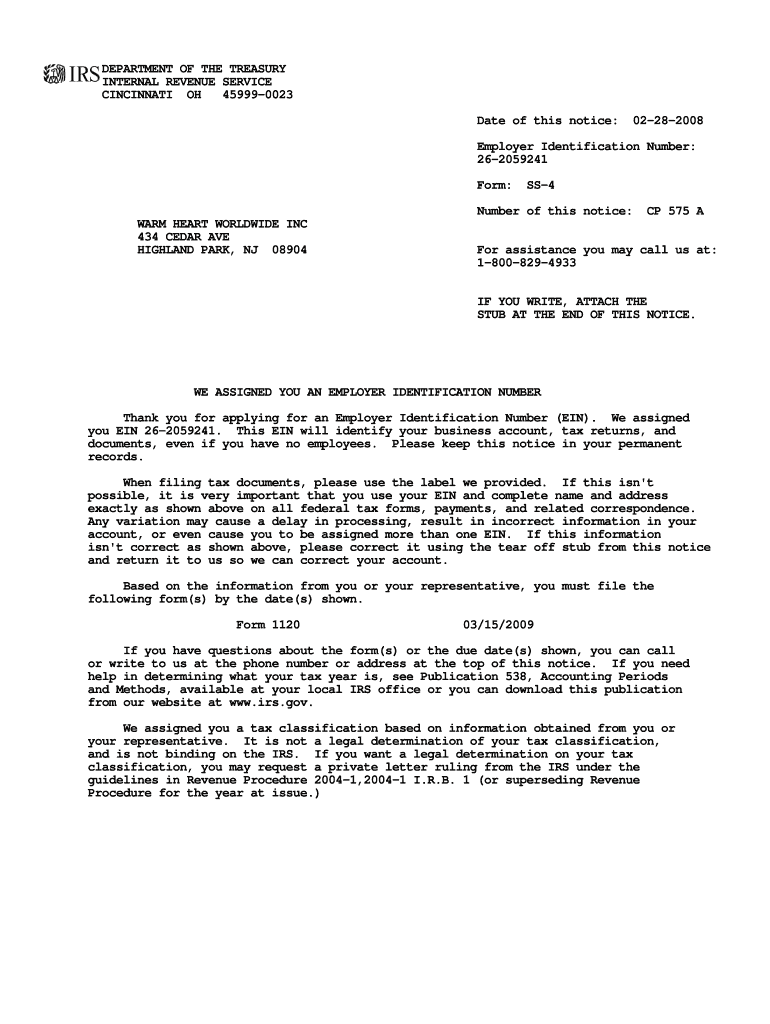

The CP 575 A Notice is an important document issued by the IRS that serves as a confirmation of an entity's Employer Identification Number (EIN). This notice is typically sent to businesses after they successfully apply for an EIN, which is essential for tax reporting and compliance. The CP 575 A contains vital information, including the EIN, the legal name of the entity, and the mailing address. Understanding this notice is crucial for ensuring that businesses remain compliant with federal tax regulations.

How to Obtain the CP 575 A Notice

To obtain the CP 575 A Notice, businesses must first apply for an Employer Identification Number through the IRS. This can be done online, by mail, or by fax. Once the application is processed, the IRS will issue the CP 575 A Notice, which is typically sent to the address provided during the application. If a business does not receive this notice within a few weeks, it is advisable to contact the IRS to confirm the status of the application and request a reissue if necessary.

Steps to Complete the CP 575 A Notice

Completing the CP 575 A Notice involves ensuring that all information is accurate and up-to-date. Here are the steps to follow:

- Review the notice for accuracy, including the EIN, entity name, and address.

- Keep the notice in a secure location, as it is necessary for tax filings and compliance.

- If any information is incorrect, contact the IRS immediately to correct the details.

- Use the CP 575 A Notice when filing taxes or applying for business licenses.

Legal Use of the CP 575 A Notice

The CP 575 A Notice is legally binding and serves as proof of an entity's EIN. It is essential for various legal and financial transactions, including opening business bank accounts, applying for loans, and filing tax returns. Businesses must ensure that they retain this notice as part of their official records to demonstrate compliance with IRS regulations and to facilitate any necessary audits.

IRS Guidelines for the CP 575 A Notice

The IRS provides specific guidelines regarding the use and retention of the CP 575 A Notice. It is recommended that businesses keep this notice indefinitely, as it may be required for future tax filings or inquiries. The IRS also advises that if a business changes its legal structure or name, it should notify the IRS to ensure that the information associated with the EIN remains current.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the CP 575 A Notice is crucial for businesses. Typically, businesses must file their tax returns annually, and the EIN is necessary for this process. The IRS has specific deadlines depending on the type of business entity. For example, corporations must file by March 15, while partnerships have a deadline of April 15. It is important for businesses to be aware of these dates to avoid penalties.

Quick guide on how to complete cp 575 a notice warm heart worldwide warmheartworldwide

Complete CP 575 A Notice Warm Heart Worldwide Warmheartworldwide easily on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly without delays. Manage CP 575 A Notice Warm Heart Worldwide Warmheartworldwide on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign CP 575 A Notice Warm Heart Worldwide Warmheartworldwide effortlessly

- Obtain CP 575 A Notice Warm Heart Worldwide Warmheartworldwide and click on Get Form to initiate.

- Make use of the tools available to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes a few seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your modifications.

- Choose your preferred method to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign CP 575 A Notice Warm Heart Worldwide Warmheartworldwide and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp 575 a notice warm heart worldwide warmheartworldwide

How to generate an electronic signature for your Cp 575 A Notice Warm Heart Worldwide Warmheartworldwide in the online mode

How to create an electronic signature for the Cp 575 A Notice Warm Heart Worldwide Warmheartworldwide in Google Chrome

How to make an electronic signature for signing the Cp 575 A Notice Warm Heart Worldwide Warmheartworldwide in Gmail

How to generate an eSignature for the Cp 575 A Notice Warm Heart Worldwide Warmheartworldwide from your smartphone

How to create an eSignature for the Cp 575 A Notice Warm Heart Worldwide Warmheartworldwide on iOS devices

How to create an eSignature for the Cp 575 A Notice Warm Heart Worldwide Warmheartworldwide on Android OS

People also ask

-

What is a cp575a form?

The cp575a form is a notification sent by the IRS confirming your Employer Identification Number (EIN). Understanding the cp575a is essential for businesses handling tax-related documents. With airSlate SignNow, you can securely eSign and manage your cp575a forms along with other important documentation.

-

How does airSlate SignNow help with cp575a documentation?

airSlate SignNow simplifies the process of managing cp575a forms by allowing you to create, send, and eSign them digitally. This means you can eliminate physical paperwork and streamline your operations. Our user-friendly platform makes it easy to stay organized and compliant with your cp575a-related tasks.

-

Is airSlate SignNow cost-effective for handling cp575a forms?

Yes, airSlate SignNow offers a cost-effective solution for handling cp575a forms and other document-related needs. Our pricing plans cater to different business sizes and requirements, ensuring that you get the best value. With our solutions, you can save time and reduce costs associated with traditional signing methods.

-

What features does airSlate SignNow offer for cp575a management?

airSlate SignNow provides several features to assist in managing cp575a documents, including customizable templates, real-time status tracking, and automated reminders. Additionally, our platform ensures compliance with eSignature laws, making it easy to handle your cp575a forms legally and efficiently. Experience the streamlined process that enhances your productivity.

-

Can I integrate airSlate SignNow with other applications for my cp575a tasks?

Absolutely! airSlate SignNow offers integrations with numerous applications, enabling you to streamline your workflow when dealing with cp575a forms. Whether you need to connect with CRM systems, cloud storage services, or collaboration tools, our platform makes it easy to enhance your productivity. Enjoy the flexibility of working with your favorite tools while managing cp575a documentation.

-

How secure is my cp575a data with airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols to safeguard your cp575a and other sensitive documents. Our compliance with regulations and industry standards means you can confidently manage your cp575a files without worrying about data bsignNowes.

-

What are the benefits of using airSlate SignNow for cp575a eSigning?

Using airSlate SignNow for eSigning cp575a forms brings several benefits, including faster turnaround times and enhanced collaboration. Our intuitive platform allows for quick signature collection and reduces the hassle of physical document exchange. Experience improved efficiency and a smoother signing process for all your cp575a-related needs.

Get more for CP 575 A Notice Warm Heart Worldwide Warmheartworldwide

- Atm placement agreement template form

- Gse algebra 1 answer key form

- Situation report template word form

- Construction loan disbursement schedule form

- This form will be used for new vendors amp updateschanges for any vendor information

- Vendor selection form iit

- St vincent de paul st joseph catholic church form

- Volunteer confidentiality agreement template form

Find out other CP 575 A Notice Warm Heart Worldwide Warmheartworldwide

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word