Fill Fillable Form 00 Goods and Services Tax 2021-2026

What is the Fillable Form 00 Goods And Services Tax?

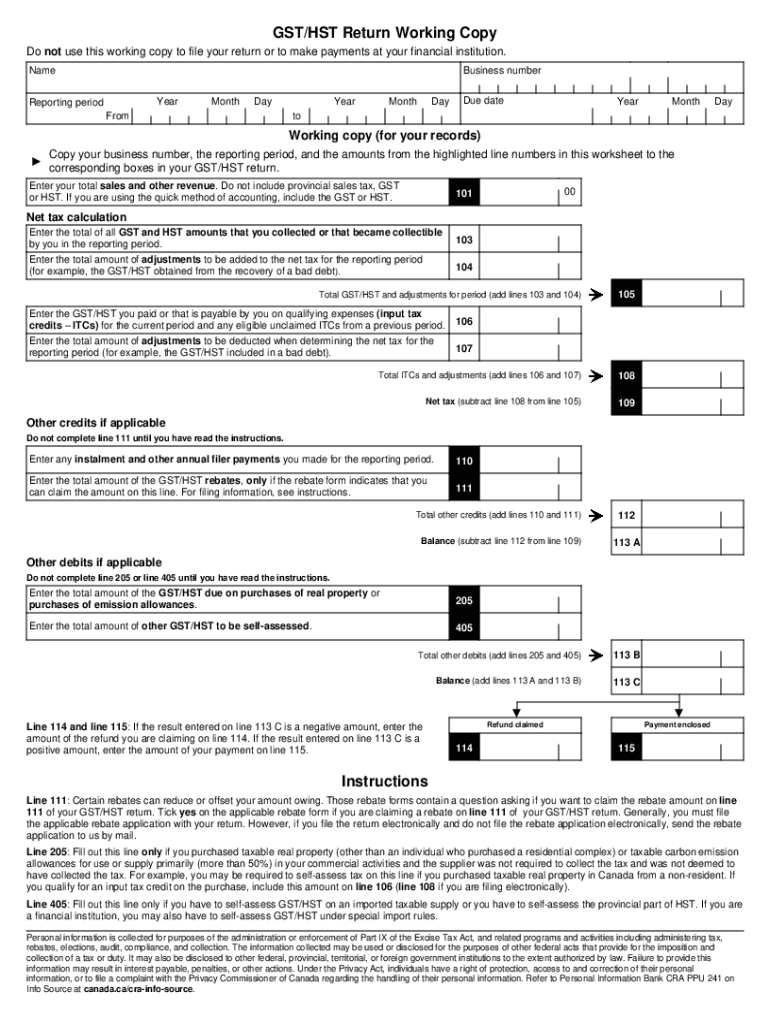

The Fillable Form 00 Goods and Services Tax (GST) is a crucial document for businesses and individuals involved in taxable activities under the Goods and Services Tax framework. This form is used to report the amount of GST collected and the amount of GST that can be claimed back as input tax credits. It is essential for ensuring compliance with tax regulations and maintaining accurate financial records. The form captures various details, including the total sales, total purchases, and applicable tax rates, allowing the taxpayer to calculate their net tax obligation accurately.

Steps to Complete the Fillable Form 00 Goods And Services Tax

Completing the Fillable Form 00 for Goods and Services Tax involves several key steps:

- Gather all necessary documentation, including sales invoices, purchase receipts, and previous tax returns.

- Fill in your business information, including name, address, and tax identification number.

- Report total sales and the corresponding GST collected during the reporting period.

- Detail the total purchases and the GST paid on those purchases, which can be claimed as input tax credits.

- Calculate the net GST payable or refundable by subtracting the total input tax credits from the total GST collected.

- Review the completed form for accuracy before submission.

Legal Use of the Fillable Form 00 Goods And Services Tax

The Fillable Form 00 is legally recognized for reporting GST obligations. For the form to be considered valid, it must be completed accurately and submitted within the stipulated deadlines. Compliance with IRS regulations and state-specific tax laws is essential. The form serves as a legal document that can be used in audits or disputes, ensuring that businesses maintain transparency and accountability in their tax practices.

Form Submission Methods

The Fillable Form 00 can be submitted through various methods to accommodate different preferences:

- Online Submission: Many jurisdictions allow for electronic filing through their official tax websites, providing a quick and efficient way to submit your form.

- Mail: You can print the completed form and send it via postal mail to the designated tax office.

- In-Person: Some taxpayers may prefer to deliver their forms directly to local tax offices, where they can receive immediate confirmation of submission.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for compliance. The due dates for submitting the Fillable Form 00 may vary based on the reporting period, typically occurring quarterly or annually. It is important to check with the IRS or local tax authority for specific deadlines to avoid penalties and interest on late submissions.

Required Documents

To accurately complete the Fillable Form 00, certain documents are necessary:

- Sales invoices that detail the goods or services sold and the GST collected.

- Purchase receipts that outline the costs incurred and the GST paid.

- Previous tax returns for reference and consistency in reporting.

Quick guide on how to complete fill fillable form 00 goods and services tax

Manage Fill Fillable Form 00 Goods And Services Tax easily on any gadget

Digital document administration has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources needed to generate, edit, and eSign your documents swiftly without interruptions. Handle Fill Fillable Form 00 Goods And Services Tax on any gadget with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign Fill Fillable Form 00 Goods And Services Tax with ease

- Find Fill Fillable Form 00 Goods And Services Tax and click on Obtain Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Finished button to save your modifications.

- Choose how you wish to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign Fill Fillable Form 00 Goods And Services Tax and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fill fillable form 00 goods and services tax

Create this form in 5 minutes!

How to create an eSignature for the fill fillable form 00 goods and services tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the gst34 fillable form?

The gst34 fillable form is a document used for GST/HST rebate applications in Canada. It allows businesses to claim refunds on eligible expenses. The fillable format makes it easy to complete, ensuring accuracy and saving time.

-

How can airSlate SignNow help with the gst34 fillable form?

airSlate SignNow simplifies the process of managing the gst34 fillable form by enabling users to fill, sign, and send the document electronically. This eliminates the need for printing and mailing, allowing for a faster submission and reduced turnaround time.

-

Is there a cost associated with using the gst34 fillable form on airSlate SignNow?

While the gst34 fillable form can be created at no cost through airSlate SignNow, there may be subscription fees for premium features and services. Pricing plans vary, offering options for businesses of all sizes to fit their needs.

-

What features does airSlate SignNow offer for the gst34 fillable form?

airSlate SignNow provides various features for the gst34 fillable form, including eSigning, templates, and real-time tracking. Users can easily customize the form, ensuring it meets specific requirements for their GST/HST rebate applications.

-

Can I integrate the gst34 fillable form with other applications using airSlate SignNow?

Yes, airSlate SignNow allows for seamless integration with various applications and software. This means you can connect the gst34 fillable form with accounting software or CRMs, enhancing your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for the gst34 fillable form?

Using airSlate SignNow for the gst34 fillable form offers several benefits, such as reduced processing time, improved accuracy, and enhanced security for sensitive information. This digital solution streamlines your process, facilitating quicker access to funds.

-

How do I get started with the gst34 fillable form on airSlate SignNow?

To get started with the gst34 fillable form on airSlate SignNow, simply create an account and navigate to the document template section. From there, you can easily access, fill out, and manage your gst34 fillable form.

Get more for Fill Fillable Form 00 Goods And Services Tax

- Walk a thon template form

- Comnavreg sw request form newsletter newsletter svncsc

- Leave application form wreuindiain

- Bupa international claim form 41134661

- Bcia 8374 fillable form

- Fundraiser approval form san joaquin delta college deltacollege

- Comfort caredo not resuscitate quotdnrquot order verification form

- Medical practice management agreement template form

Find out other Fill Fillable Form 00 Goods And Services Tax

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy