Amount of Overpayment to Be Applied to Estimated Tax Form

What is the amount of overpayment to be applied to estimated tax?

The amount of overpayment to be applied to the 2018 estimated tax form refers to any excess payment made towards your tax obligations that can be credited towards future estimated tax payments. Taxpayers may find themselves in a situation where they have overpaid their taxes due to various reasons, such as changes in income or deductions. This overpayment can be beneficial as it reduces the amount owed in subsequent tax periods, effectively acting as a prepayment of future taxes.

How to use the amount of overpayment to be applied to estimated tax

To utilize the overpayment on your 2018 estimated tax form, you must first determine the total amount of overpayment from your previous tax filings. This figure can be found on your prior year's tax return. Once identified, you can apply this amount to your current estimated tax payments by indicating it on the appropriate line of the 2018 estimated tax form. This will help lower the overall tax burden for the current year, allowing for more accurate budgeting and financial planning.

Steps to complete the amount of overpayment to be applied to estimated tax

Completing the section for overpayment on the 2018 estimated tax form involves several key steps:

- Review your previous year’s tax return to identify the total overpayment amount.

- Locate the section on the 2018 estimated tax form where you can apply this overpayment.

- Enter the identified overpayment amount in the designated field.

- Double-check your entries for accuracy to ensure proper application of the overpayment.

IRS guidelines

The IRS provides specific guidelines regarding the application of overpayments to estimated taxes. According to IRS regulations, taxpayers can apply any overpayment from the previous year to their current estimated tax payments. It is important to ensure that all calculations are accurate and that the overpayment is properly documented. Taxpayers should also keep records of their overpayments for future reference and potential audits.

Filing deadlines / important dates

Filing deadlines for the 2018 estimated tax form are crucial for compliance. Generally, estimated tax payments are due quarterly, with specific deadlines falling on April 15, June 15, September 15, and January 15 of the following year. It is essential to adhere to these deadlines to avoid penalties and interest on unpaid taxes. Taxpayers should mark these dates on their calendars to ensure timely submissions.

Required documents

When filling out the 2018 estimated tax form, certain documents may be required to support your calculations and claims. These may include:

- Your previous year’s tax return, which provides the basis for your estimated payments.

- Documentation of any income changes, such as pay stubs or 1099 forms.

- Records of deductions and credits that may affect your taxable income.

Penalties for non-compliance

Failure to accurately apply the overpayment or to meet estimated tax payment deadlines can result in penalties imposed by the IRS. These penalties may include interest on unpaid amounts and additional fines for late payments. Understanding the importance of compliance and ensuring timely and accurate filings can help mitigate these risks, allowing taxpayers to maintain good standing with the IRS.

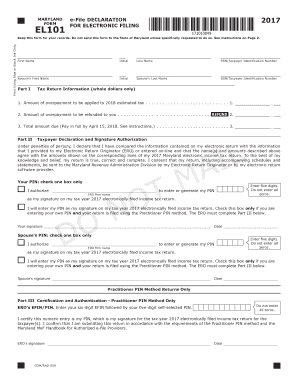

Quick guide on how to complete amount of overpayment to be applied to 2018 estimated tax

Effortlessly Prepare Amount Of Overpayment To Be Applied To Estimated Tax on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Manage Amount Of Overpayment To Be Applied To Estimated Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to Edit and Electronically Sign Amount Of Overpayment To Be Applied To Estimated Tax with Ease

- Locate Amount Of Overpayment To Be Applied To Estimated Tax and click Get Form to begin.

- Utilize the available tools to fill out your form.

- Select relevant sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how to send your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or mislaid files, tedious form searches, or errors that require new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Amount Of Overpayment To Be Applied To Estimated Tax to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What does "Line 75: 75 Amount of line 73 you want applied to your 2012 estimated tax" mean?

If you have a refund, it will appear on line 73 of your Form 1040. You can choose not to have all or part of that refund returned to you, but to use it instead to pay a portion of the following year's tax bill. If you choose to do that, you put the amount you want to use to pay next year's tax bill on line 75 and put the balance of the refund to be returned to you (if any) on line 74a.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

What percent of people don't have the intelligence to fill out tax forms?

Recent statistics that I've seen indicate that about 66% of electronically filed returns are filed by paid preparers. This doesn't necessarily mean that these filers don't have the intelligence but it does indicate that they have a level of discomfort and anxiety and prefer the solace of having a paid preparer fill out and transmit the forms. It all depends on the level of complexity of the form. For the young wage earner living at home with his or her parents, who is able to operate a computer and can operate simple tax return software, I would think that 80% should be intelligent enough to fill out tax forms. Especially because the software is designed to prompt and assist (and check the arithmetic).One of America's most respected jurists, Judge Learned Hand, offers a more thoughtful observation on the law of taxation: ‘In my own case the words of such an act as the Income Tax ... merely dance before my eyes in a meaningless procession; cross-reference to cross-reference, exception upon exception—couched in abstract terms that offer no handle to seize hold of—leave in my mind only a confused sense of some vitally important, but successfully concealed, purport, which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time. I know that these monsters are the result of fabulous industry and ingenuity, plugging up this hole and casting out that net, against all possible evasion; yet at times I cannot help recalling a saying of William James about certain passages of Hegal [sic]: that they were no doubt written with a passion of rationality; but that one cannot help wondering whether to the reader they have any significance save that the words are strung together with syntactical correctness.’ Ruth Realty Co. v. Horn, 222 Or. 290, 353 P.2d 524, 526 n. 2 (Or. 1960) (citing 57 Yale L.J. 167, 169 (1947)), overruled on other grounds by Parr v. DOR, 276 Or. 113, 553 P.2d 1051 (Or. 1976). The Humorist Dave Barry had this observation "The IRS is working hard to develop a tax form so scary that merely reading it will cause the ordinary taxpayer's brain to explode.” His candidate for the best effort so far is Schedule J Form 1118 "Separate Limitation Loss Allocations and Other Adjustments Necessary to Determine Numerators of Limitations fraction, Year end Recharacterization Balance and Overall Foreign Loss Account Balances"And don’t forget this observation from Albert Einstein “The hardest thing to understand in the world is the income tax. “ So if Al had trouble understanding taxes, I don't see how a mere mortal has any chance.

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

Why is the alternative minimum tax form of 6251 so onerous to fill out?

To make things simpler, ironically.The purpose of the AMT is to ensure that the uber rich pay at least a minimum amount of taxes, but has since morphed into something that hits the upper middle classes*. It does that by having fewer tax brackets, fewer allowed deductions and a higher standard deduction. What you owe is whatever causes you to pay more taxes.However, this needs to be done in addition to the traditional tax calculation. So you need to take your calculations of your various income measures, and put back in various deductions that are disallowed under AMT rules. Or have to be recalculated. It’s a pain.Either someone decided that this was easier than having a completely separate tax form to calculate your AMt tax or someone lobbied to have mor complicated taxes so you’d go to one of the tax places or download tax software.*With the Trump tax changes, AMT affects fewer people.

Create this form in 5 minutes!

How to create an eSignature for the amount of overpayment to be applied to 2018 estimated tax

How to create an electronic signature for the Amount Of Overpayment To Be Applied To 2018 Estimated Tax in the online mode

How to make an eSignature for your Amount Of Overpayment To Be Applied To 2018 Estimated Tax in Google Chrome

How to generate an electronic signature for signing the Amount Of Overpayment To Be Applied To 2018 Estimated Tax in Gmail

How to generate an electronic signature for the Amount Of Overpayment To Be Applied To 2018 Estimated Tax straight from your smartphone

How to make an electronic signature for the Amount Of Overpayment To Be Applied To 2018 Estimated Tax on iOS devices

How to generate an electronic signature for the Amount Of Overpayment To Be Applied To 2018 Estimated Tax on Android

People also ask

-

What is the 'Amount Of Overpayment To Be Applied To Estimated Tax'?

The 'Amount Of Overpayment To Be Applied To Estimated Tax' refers to any excess payment that a taxpayer can apply towards their upcoming estimated tax payments. This amount can help reduce future tax liabilities and improve cash flow management. Understanding how to apply this overpayment effectively can optimize your tax strategy.

-

How can airSlate SignNow help with managing estimated tax payments?

airSlate SignNow offers features that streamline the process of preparing and signing tax-related documents, making it easier to manage the 'Amount Of Overpayment To Be Applied To Estimated Tax.' With our eSigning capabilities, you can ensure timely submissions and keep track of your overpayments securely. This efficiency can lead to better financial planning.

-

Is there a cost associated with using airSlate SignNow for tax document management?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs, making it a cost-effective solution for managing tax documents. By utilizing our platform, you can save time and reduce the hassle associated with handling the 'Amount Of Overpayment To Be Applied To Estimated Tax.' Check our pricing page for more details.

-

What features does airSlate SignNow offer for tax document signing?

airSlate SignNow offers a range of features including customizable templates, bulk sending, and advanced tracking, all of which enhance the signing experience for tax documents. These features ensure that you can easily manage the 'Amount Of Overpayment To Be Applied To Estimated Tax' with organized documentation. This helps maintain compliance and accuracy.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow integrates seamlessly with many popular accounting software solutions, allowing you to streamline the management of the 'Amount Of Overpayment To Be Applied To Estimated Tax.' This integration enhances your workflow, enabling easy access to tax-related documents while ensuring accuracy.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly improve your business’s efficiency by automating the document signing process, including those related to the 'Amount Of Overpayment To Be Applied To Estimated Tax.' You’ll benefit from faster turnaround times, enhanced security, and reduced administrative burdens, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive tax documents, including those related to the 'Amount Of Overpayment To Be Applied To Estimated Tax,' are protected. With advanced encryption and secure cloud storage, you can have peace of mind knowing your information is safe.

Get more for Amount Of Overpayment To Be Applied To Estimated Tax

- Vt act 250 disclosure statement 2008 form

- Fill in co 411 2010 form

- Vermont emergency examination form mh 11

- Final construction valuation form division of fire safety firesafety vermont

- Vt dcf doe csp forms

- Vermont substitute w 9 form 2011

- Vermont domicile statement form

- Arizona form 301 tax fill out ampamp sign online

Find out other Amount Of Overpayment To Be Applied To Estimated Tax

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free