California LLC Tax First Year Everything You Need to Know Form

Understanding the California LLC Tax for the First Year

The California LLC tax is a mandatory fee that all limited liability companies must pay to the state. For the first year, this tax is set at a specific amount, which is subject to change. It is essential for new LLCs to understand this obligation to ensure compliance and avoid penalties. The tax is due annually, and the first payment is typically required within a few months of the LLC's formation. This tax is separate from any income tax that the LLC may owe based on its earnings.

Steps to Complete the California LLC Tax for the First Year

To successfully complete the California LLC tax for the first year, follow these steps:

- Determine the amount of the LLC tax based on the current rate set by the state.

- Gather necessary information, including your LLC's formation date and any income details.

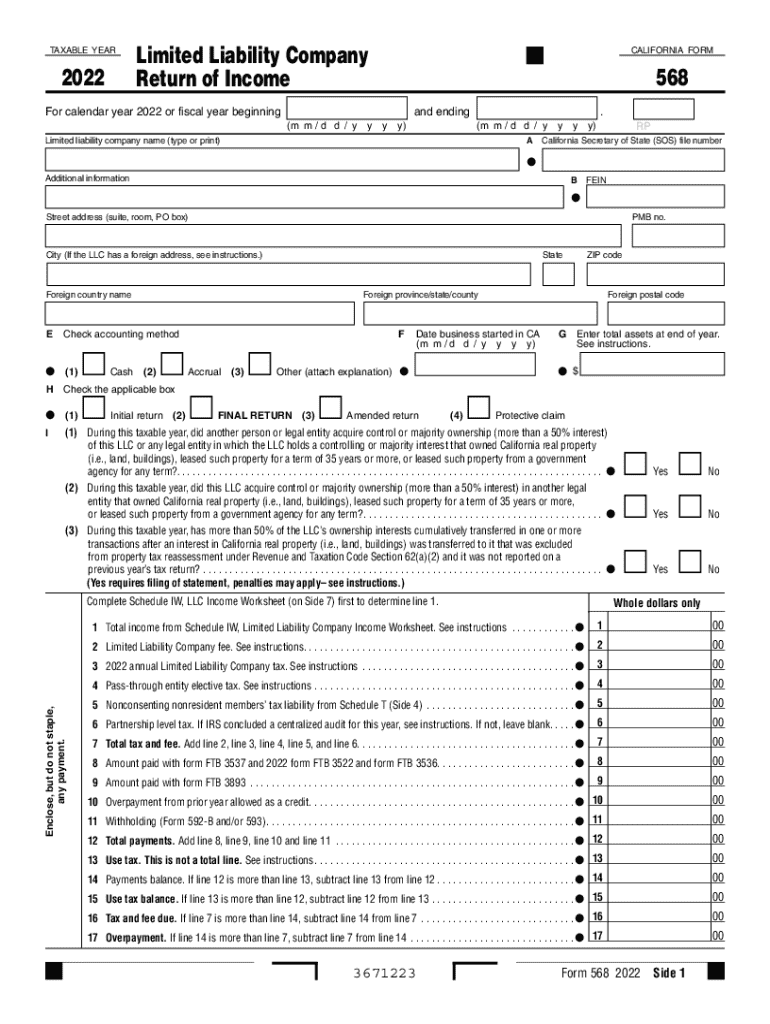

- Complete the required forms, which may include Form 568, used for reporting LLC income and expenses.

- Submit the forms along with payment to the California Franchise Tax Board by the deadline.

Filing Deadlines and Important Dates

Understanding the filing deadlines for the California LLC tax is crucial for compliance. The first-year tax is generally due on the 15th day of the fourth month after the end of the LLC's tax year. For most LLCs operating on a calendar year, this means the tax is due by April 15. Additionally, any forms, such as Form 568, must also be submitted by this date to avoid late fees and penalties.

Required Documents for Filing

When filing the California LLC tax, certain documents are necessary to ensure a smooth process. These typically include:

- Form 568, which reports the LLC's income, deductions, and credits.

- Proof of payment for the LLC tax.

- Any additional schedules or forms that may be required based on the LLC's activities.

Having these documents ready will facilitate timely and accurate filing.

Penalties for Non-Compliance

Failure to comply with the California LLC tax requirements can result in significant penalties. These may include:

- Late fees for overdue tax payments.

- Interest on unpaid taxes, which can accumulate over time.

- Potential legal action from the state if the tax remains unpaid.

It is essential for LLC owners to stay informed about their tax obligations to avoid these consequences.

Digital vs. Paper Version of Forms

When filing the California LLC tax, businesses have the option to submit forms either digitally or via paper. Digital submissions can often be processed more quickly and may reduce the risk of errors. However, some may prefer paper forms for record-keeping purposes. Regardless of the method chosen, ensuring that all information is accurate and submitted on time is essential for compliance.

Quick guide on how to complete california llc tax first year everything you need to know

Complete California LLC Tax First Year Everything You Need To Know effortlessly on any device

Digital document management has gained signNow traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without holdups. Manage California LLC Tax First Year Everything You Need To Know on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The easiest method to modify and eSign California LLC Tax First Year Everything You Need To Know seamlessly

- Obtain California LLC Tax First Year Everything You Need To Know and then select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal authority as a traditional wet signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Edit and eSign California LLC Tax First Year Everything You Need To Know and facilitate exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california llc tax first year everything you need to know

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an LLC limited company and how does it differ from other business structures?

An LLC limited company, or limited liability company, combines the benefits of both a corporation and a partnership. It offers limited liability protection for owners, shielding personal assets from business debts, while allowing for flexible management structures. This makes it an ideal choice for many entrepreneurs looking to maximize their protection and tax benefits.

-

What features does airSlate SignNow offer for managing documents in an LLC limited company?

airSlate SignNow provides a robust set of features designed for LLC limited companies, including easy document creation, electronic signatures, and secure storage. You can streamline your workflow with templates and customizable forms, making it simpler to manage agreements and contracts for your business. The platform also supports real-time collaboration, allowing team members to work together efficiently.

-

Is airSlate SignNow affordable for small LLC limited companies?

Yes, airSlate SignNow offers competitive pricing plans that cater to small LLC limited companies as well as larger enterprises. With options for monthly or annual billing, businesses can choose a plan that fits their budget. Additionally, the cost-effectiveness of the platform helps small companies save time and resources while managing their document workflows.

-

How can airSlate SignNow integrations benefit my LLC limited company?

Integrating airSlate SignNow with other applications can signNowly enhance the efficiency of your LLC limited company. The platform supports various integrations with popular tools like CRM systems, accounting software, and project management apps. This allows for seamless data transfer, minimizing manual input, and ensuring that your team can work smarter and more cohesively.

-

What is the benefit of using eSignatures for my LLC limited company?

Using eSignatures offers numerous benefits for an LLC limited company, including increased speed and convenience in signing documents. This digital solution reduces paperwork and the time it takes to obtain signatures, allowing your business to finalize contracts more quickly. Moreover, eSignatures provide a level of security and verification that traditional signatures cannot match.

-

Can airSlate SignNow help with compliance for my LLC limited company?

Absolutely! airSlate SignNow is designed with compliance in mind, helping your LLC limited company adhere to industry regulations and standards. The platform ensures that all eSignatures are legally binding and provides an audit trail for document transactions, which can be invaluable for maintaining compliance in audits and legal matters.

-

How does airSlate SignNow support remote teams in LLC limited companies?

airSlate SignNow is perfect for supporting remote teams in LLC limited companies by enabling easy access to documents from anywhere. Team members can collaborate in real time and sign documents electronically, eliminating the need for in-person meetings or courier services. This enhances productivity and ensures your business operations continue smoothly, regardless of location.

Get more for California LLC Tax First Year Everything You Need To Know

- Podiatry progress note template form

- Aml independent review template form

- Ncic initial entry report txdps state tx form

- Structural observation report form beverly hills

- Affidavit to claim small business tax exemption form

- Eagle county student ski pass form

- Vload authorization form 101995574

- Non exclusive beat license agreement template form

Find out other California LLC Tax First Year Everything You Need To Know

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile

- How To Electronic signature Kansas lease agreement

- Electronic signature Michigan Landlord tenant lease agreement Now

- How Can I Electronic signature North Carolina Landlord tenant lease agreement

- Can I Electronic signature Vermont lease agreement

- Can I Electronic signature Michigan Lease agreement for house

- How To Electronic signature Wisconsin Landlord tenant lease agreement

- Can I Electronic signature Nebraska Lease agreement for house

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now