CKYC & KRA KYC Form Know Your Client Application F 2022-2026

Understanding the CKYC & KRA KYC Form

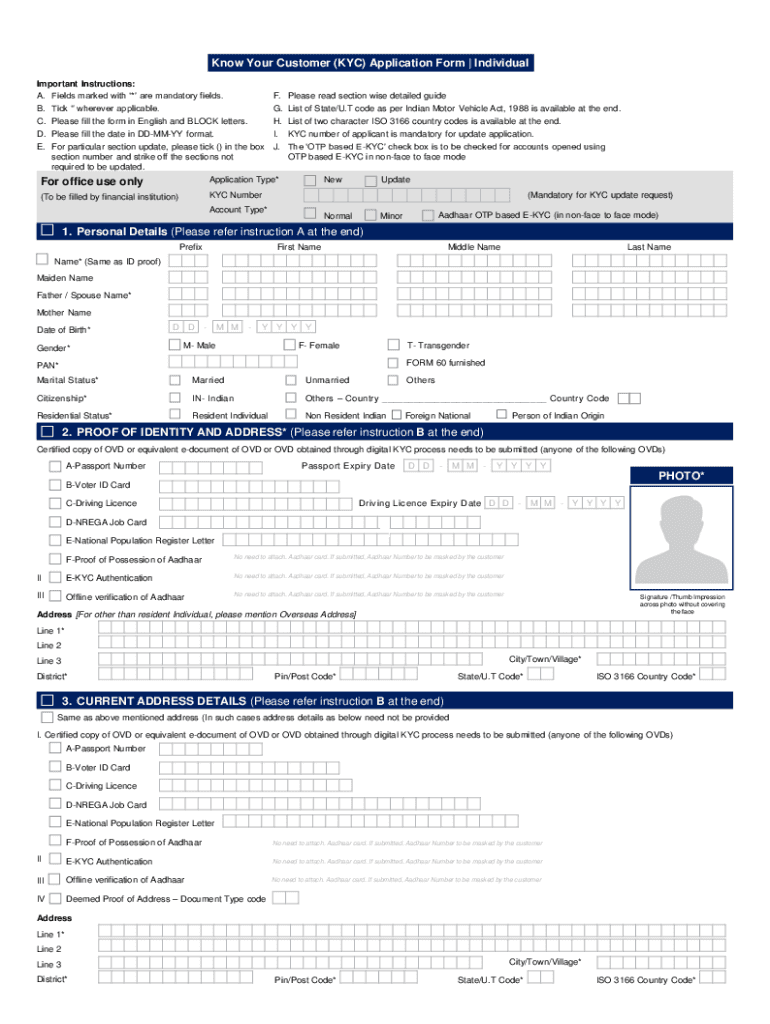

The CKYC (Central Know Your Customer) and KRA (KYC Registration Agency) KYC form is essential for individuals and businesses to establish their identity and comply with regulatory requirements. This form collects personal information, including name, address, date of birth, and identification documents. It is crucial for financial institutions to verify the identity of their clients to prevent fraud and money laundering. By completing this form, clients can ensure they meet the necessary compliance standards set by regulatory bodies in the United States.

Steps to Complete the CKYC & KRA KYC Form

Completing the CKYC & KRA KYC form involves several straightforward steps:

- Gather required documents, such as a government-issued ID, proof of address, and any additional identification as specified by the institution.

- Fill out the form with accurate personal information, ensuring all details match the provided documents.

- Review the completed form for any errors or omissions.

- Submit the form electronically or in person, depending on the institution's requirements.

Following these steps can help streamline the process and reduce the likelihood of delays in verification.

Legal Use of the CKYC & KRA KYC Form

The CKYC & KRA KYC form serves a critical legal function in the financial sector. It is designed to comply with the regulations set forth by the Financial Crimes Enforcement Network (FinCEN) and other relevant authorities. By ensuring that financial institutions have verified their clients' identities, this form helps mitigate risks associated with money laundering and terrorist financing. The legal framework surrounding this form mandates that institutions maintain accurate records and conduct due diligence on their clients.

Required Documents for the CKYC & KRA KYC Form

To successfully complete the CKYC & KRA KYC form, clients need to provide several key documents:

- A valid government-issued photo ID, such as a driver's license or passport.

- Proof of address, which can be a utility bill, bank statement, or lease agreement.

- Social Security Number (SSN) or Employer Identification Number (EIN) for businesses.

Having these documents ready can facilitate a smoother application process and ensure compliance with regulatory requirements.

Form Submission Methods

The CKYC & KRA KYC form can typically be submitted through various methods, depending on the institution's policies:

- Online Submission: Many institutions offer secure online portals for electronic submission of the form.

- Mail Submission: Clients may also opt to print the form and send it via postal mail to the designated address.

- In-Person Submission: Some institutions allow clients to submit the form in person at their branches.

Choosing the appropriate submission method can help ensure timely processing of the application.

Eligibility Criteria for the CKYC & KRA KYC Form

Eligibility to complete the CKYC & KRA KYC form generally includes:

- Individuals over the age of eighteen with valid identification.

- Businesses and organizations that require verification for banking and financial services.

- Non-resident individuals who wish to engage with U.S. financial institutions may also need to complete this form.

Understanding eligibility can help clients determine their need for this form and the associated requirements.

Quick guide on how to complete ckyc kra kyc form know your client application f

Effortlessly prepare CKYC & KRA KYC Form Know Your Client Application F on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle CKYC & KRA KYC Form Know Your Client Application F on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign CKYC & KRA KYC Form Know Your Client Application F with ease

- Obtain CKYC & KRA KYC Form Know Your Client Application F and click on Get Form to begin.

- Utilize our tools to complete your form.

- Emphasize important sections of the documents or redact private information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or inaccuracies that require new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Alter and eSign CKYC & KRA KYC Form Know Your Client Application F while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ckyc kra kyc form know your client application f

Create this form in 5 minutes!

How to create an eSignature for the ckyc kra kyc form know your client application f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a know your client application form?

A know your client application form is an essential document that businesses utilize to verify the identity of their clients. It helps in compliance with regulations and enhances customer trust. By using airSlate SignNow, you can easily create and manage these forms electronically.

-

Why should I use the airSlate SignNow for my know your client application form?

airSlate SignNow provides a user-friendly platform that simplifies the creation and signing of your know your client application form. Its eSignature capabilities ensure faster processing and enhanced security. Additionally, it offers a cost-effective solution that reduces paperwork and streamlines your workflow.

-

Are there any specific features for know your client application forms in airSlate SignNow?

Yes, airSlate SignNow offers customizable templates and automation features specifically for your know your client application form. These features enable you to tailor the forms according to your business needs while ensuring compliance. The platform also supports real-time tracking and notifications, making management easier.

-

How much does it cost to use airSlate SignNow for know your client application forms?

Pricing for airSlate SignNow varies based on the features you need. It is designed to be cost-effective, helping businesses save on administrative costs associated with traditional paperwork for know your client application forms. You can choose from several plans that fit different levels of business requirements.

-

Can I integrate airSlate SignNow with other applications for my know your client application form?

Yes, airSlate SignNow offers seamless integrations with various applications, including CRM systems and document management software. This means you can efficiently manage your know your client application form alongside your other business processes. Integrating these tools can enhance your overall workflow.

-

What are the benefits of using a digital know your client application form?

Digital know your client application forms signNowly reduce processing time and environmental impact by eliminating paper use. Using airSlate SignNow enhances data security and allows easy access and tracking. This digital approach ensures compliance while providing a better experience for both the business and clients.

-

Is the know your client application form compliant with regulations?

Yes, when you create a know your client application form using airSlate SignNow, you can ensure that your forms are compliant with industry regulations. The platform is designed to meet legal standards, which helps protect your business from potential liabilities. Compliance is key to maintaining trust with your clients.

Get more for CKYC & KRA KYC Form Know Your Client Application F

- Boise cooperative preschool form

- Kasingkahulugan ng mababaw form

- Cottonwood palo verde form

- Onesys form

- Massachusetts 1 es form

- Permit to employ and work work experience ca dept of education the permit to employ and work form must be completed and signed

- Self employment income worksheet form

- Registrationwaiver form individualparticipant last pit

Find out other CKYC & KRA KYC Form Know Your Client Application F

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement