SEP IRA and SIMPLE IRA Distribution 2023-2026

What is the SEP IRA and SIMPLE IRA Distribution?

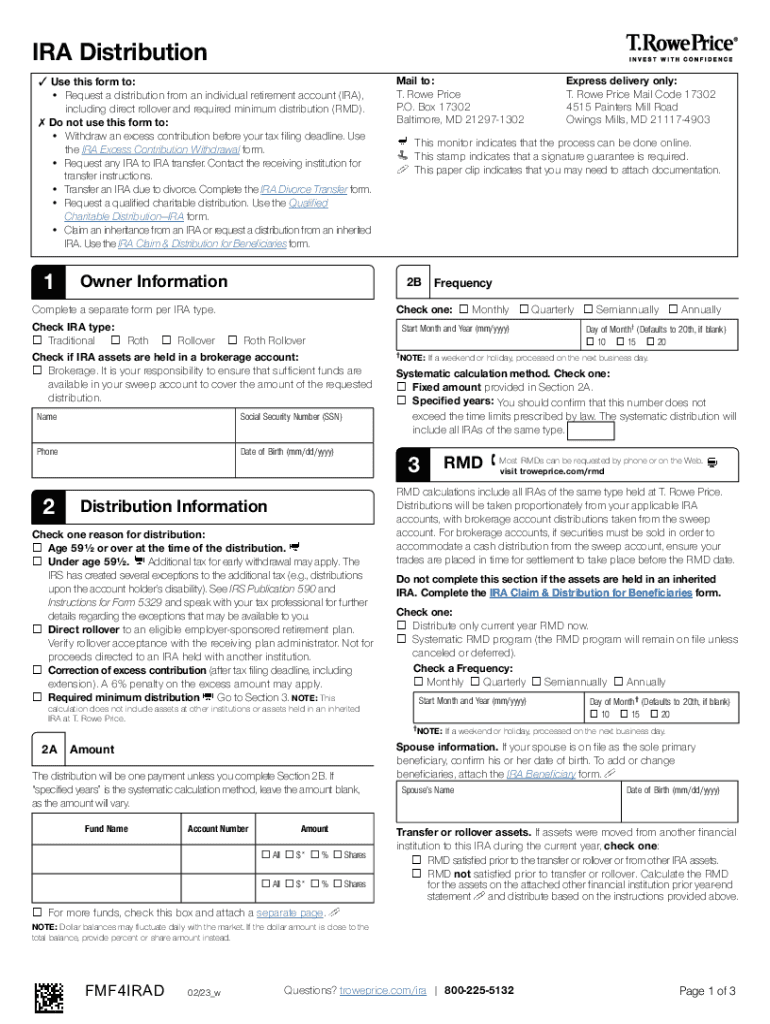

The SEP IRA and SIMPLE IRA distribution refers to the process by which account holders can withdraw funds from their retirement accounts. These distributions are subject to specific rules and regulations set forth by the Internal Revenue Service (IRS). A SEP IRA, or Simplified Employee Pension Individual Retirement Account, is designed for self-employed individuals and small business owners, allowing them to contribute to their own and their employees' retirement savings. The SIMPLE IRA, or Savings Incentive Match Plan for Employees, is intended for small businesses that want to offer retirement benefits to their employees. Understanding the nature of these distributions is crucial for account holders to avoid penalties and ensure compliance with federal regulations.

How to Use the SEP IRA and SIMPLE IRA Distribution

Using the SEP IRA and SIMPLE IRA distribution involves several steps to ensure that the process is compliant with IRS guidelines. First, account holders should determine their eligibility for distributions, which typically requires reaching a certain age or meeting specific hardship criteria. Next, they must complete the necessary paperwork, which may include forms provided by their financial institution. It is important to note that distributions can be taken as a lump sum or in periodic payments, depending on the account holder's preference and financial needs. Consulting with a tax advisor can help clarify the implications of taking a distribution, including any tax liabilities that may arise.

Steps to Complete the SEP IRA and SIMPLE IRA Distribution

Completing a distribution from a SEP IRA or SIMPLE IRA involves a series of clear steps:

- Verify eligibility for distribution based on age or hardship.

- Gather necessary documentation, including account details and identification.

- Fill out the distribution request form provided by your financial institution.

- Choose the method of distribution, whether as a lump sum or in installments.

- Submit the completed form to your financial institution for processing.

Each of these steps is essential to ensure a smooth and compliant distribution process.

Legal Use of the SEP IRA and SIMPLE IRA Distribution

The legal use of SEP IRA and SIMPLE IRA distributions is governed by IRS regulations. Withdrawals must comply with specific guidelines to avoid penalties. For instance, early withdrawals made before the age of fifty-nine and a half may incur a ten percent additional tax. Furthermore, distributions must be reported on tax returns, and any taxable amounts will be subject to ordinary income tax. It is vital for account holders to understand these legal implications to avoid unintended financial consequences.

IRS Guidelines

The IRS provides detailed guidelines regarding SEP IRA and SIMPLE IRA distributions. These guidelines outline the tax implications, eligibility criteria, and the necessary forms required for distributions. Account holders should familiarize themselves with these regulations to ensure compliance. The IRS stipulates that distributions can be made without penalty under certain circumstances, such as disability or significant medical expenses. Staying informed about these guidelines aids in making informed decisions regarding retirement funds.

Eligibility Criteria

Eligibility for taking distributions from a SEP IRA or SIMPLE IRA is determined by several factors, including age and account type. Generally, account holders must be at least fifty-nine and a half years old to avoid early withdrawal penalties. However, there are exceptions for certain hardship situations. Additionally, employees must have participated in the plan for a minimum period to qualify for distributions. Understanding these eligibility criteria is essential for proper planning and compliance.

Quick guide on how to complete sep ira and simple ira distribution

Prepare SEP IRA And SIMPLE IRA Distribution effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents promptly without any delays. Manage SEP IRA And SIMPLE IRA Distribution on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign SEP IRA And SIMPLE IRA Distribution with minimal effort

- Obtain SEP IRA And SIMPLE IRA Distribution and then click Get Form to begin.

- Employ the tools we provide to complete your form.

- Emphasize essential sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign SEP IRA And SIMPLE IRA Distribution and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sep ira and simple ira distribution

Create this form in 5 minutes!

How to create an eSignature for the sep ira and simple ira distribution

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are qualifying transactions in airSlate SignNow?

Qualifying transactions in airSlate SignNow refer to the specific types of e-signature and document management activities that meet the criteria for our specialized pricing plans. These transactions include sending, signing, and storing documents securely within our platform. Understanding qualifying transactions helps businesses optimize their usage and save costs.

-

How does airSlate SignNow price its qualifying transactions?

airSlate SignNow employs a transparent pricing model that includes various tiers based on the number of qualifying transactions. The pricing is designed to be budget-friendly for businesses of all sizes, allowing you to choose a plan that perfectly fits your estimated transaction volume. Exploring our pricing tiers can help you find the best value for your qualifying transactions.

-

What features are included for qualifying transactions?

When you engage in qualifying transactions with airSlate SignNow, you gain access to an array of features such as customizable templates, real-time tracking, and secure cloud storage. Our platform ensures that all qualifying transactions are legally compliant and secure, enhancing your document management processes. The robust features streamline your workflows, making them more efficient.

-

How can airSlate SignNow benefit my business in managing qualifying transactions?

airSlate SignNow can substantially benefit your business by simplifying the process of managing qualifying transactions. With our intuitive interface, your team can execute e-signatures quickly and efficiently, reducing turnaround times. This leads to increased productivity and ultimately enhances customer satisfaction as transactions are completed seamlessly.

-

Can I integrate airSlate SignNow with other tools for my qualifying transactions?

Yes, airSlate SignNow offers integrations with numerous popular tools and applications, streamlining your processes for qualifying transactions. This allows for an enhanced workflow where documents can be sent directly from your existing systems. Integrating with platforms like CRM systems, project management tools, and more can signNowly elevate your efficiency.

-

What types of businesses can benefit from qualifying transactions with airSlate SignNow?

Businesses across various sectors can benefit from qualifying transactions with airSlate SignNow, from small startups to large enterprises. Industries such as real estate, healthcare, and finance find particular value in our document management capabilities. No matter your industry, optimizing qualifying transactions can effectively streamline your operations.

-

Is there a limit to the number of qualifying transactions in airSlate SignNow?

The limit on qualifying transactions depends on the pricing plan you choose with airSlate SignNow. Each plan offers a different threshold of transactions per month, designed to accommodate a range of business needs. You can easily upgrade your plan as your business grows and your transaction volume increases.

Get more for SEP IRA And SIMPLE IRA Distribution

Find out other SEP IRA And SIMPLE IRA Distribution

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement