11288B Request under Section 88B of the Inland Revenue Ordinance Cap 112 for a Notice of No Objection to a Company Being Deregis Form

Understanding the 11288B Request Under Section 88B

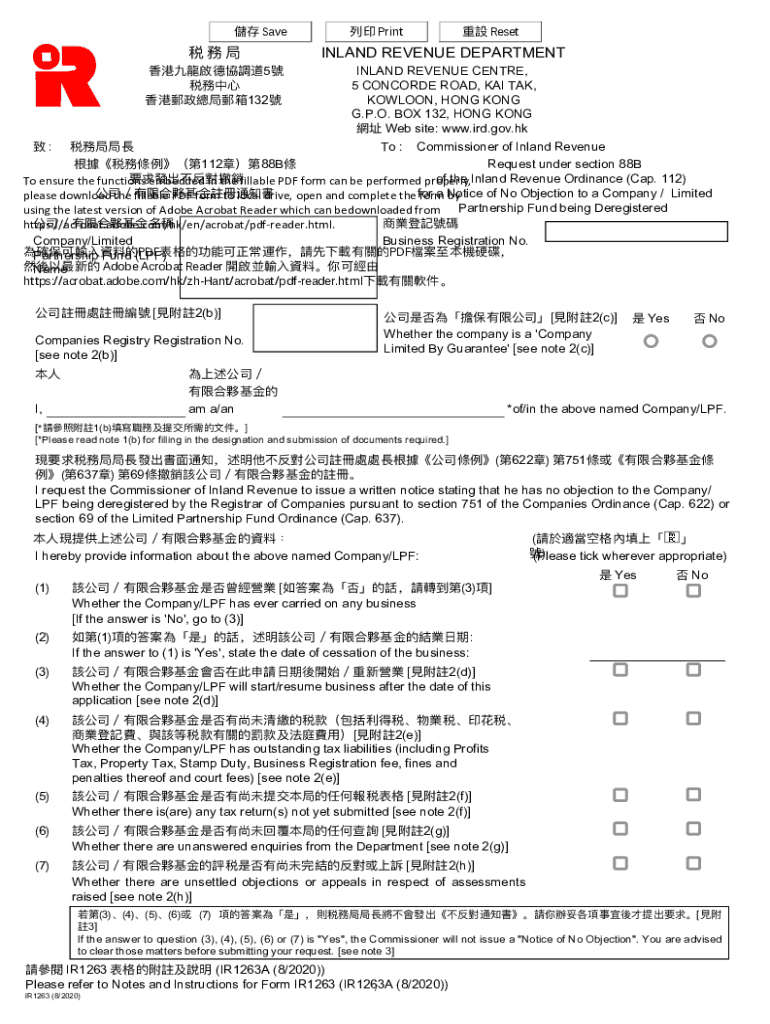

The 11288B Request Under Section 88B of the Inland Revenue Ordinance Cap 112 is a formal document used to seek a Notice of No Objection to a company being deregistered. This request is essential for businesses that wish to cease operations and remove their company from the official register. The form serves as a declaration that there are no outstanding tax obligations or liabilities associated with the company, ensuring compliance with local regulations.

Steps to Complete the 11288B Request

Completing the 11288B form involves several key steps:

- Gather necessary information about the company, including its registration details and tax identification number.

- Ensure that all outstanding tax returns have been filed and that there are no pending tax liabilities.

- Fill out the form accurately, providing all required details as specified in the instructions.

- Review the completed form for any errors or omissions before submission.

Obtaining the 11288B Request Form

The 11288B Request form can typically be obtained from the official government revenue agency's website or office. It is important to ensure that you are using the most current version of the form to avoid any compliance issues. If assistance is needed, consulting with a tax professional can also be beneficial.

Key Elements of the 11288B Request

When filling out the 11288B Request, certain key elements must be included:

- Company name and registration number.

- Details of the authorized signatory.

- Confirmation that all tax obligations have been met.

- Signature and date of submission.

Legal Use of the 11288B Request

The 11288B Request is legally significant as it ensures that a company is compliant with tax laws before deregistration. Submitting this form protects the business owners from future liabilities and confirms that the company has fulfilled all legal requirements. Failure to submit this request properly can lead to penalties or complications in the deregistration process.

Examples of Using the 11288B Request

Common scenarios for using the 11288B Request include:

- A company that has ceased operations and wishes to formally deregister.

- Businesses that have completed their final tax obligations and are ready to close.

- Companies undergoing restructuring that require deregistration of certain entities.

Quick guide on how to complete 11288b request under section 88b of the inland revenue ordinance cap 112 for a notice of no objection to a company being

Effortlessly prepare 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112 For A Notice Of No Objection To A Company Being Deregis on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent environmentally friendly option to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112 For A Notice Of No Objection To A Company Being Deregis on any device through the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112 For A Notice Of No Objection To A Company Being Deregis with ease

- Find 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112 For A Notice Of No Objection To A Company Being Deregis and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you'd like to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112 For A Notice Of No Objection To A Company Being Deregis to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 11288b request under section 88b of the inland revenue ordinance cap 112 for a notice of no objection to a company being

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112?

The 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112 is a formal application submitted to obtain a Notice of No Objection to a company's deregistration. This document is essential for businesses looking to dissolve their operations legally without any pending tax issues.

-

How does airSlate SignNow facilitate the completion of the 11288B Request?

airSlate SignNow provides an intuitive platform for users to fill out the 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112. With easy document editing, eSigning capabilities, and secure storage, businesses can streamline the submission process effectively.

-

What are the costs associated with using airSlate SignNow for the 11288B Request?

airSlate SignNow offers a cost-effective solution for managing your documents, including the 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112. Pricing plans are designed to accommodate businesses of all sizes, ensuring you get the best value for your document handling needs.

-

What features does airSlate SignNow provide for eSigning the 11288B Request?

With airSlate SignNow, users benefit from features such as electronic signatures, document templates, real-time tracking, and cloud storage. These functionalities enhance the process of completing the 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112, making document management efficient and secure.

-

How can I ensure the security of my documents while using airSlate SignNow?

airSlate SignNow prioritizes document security with industry-standard encryption, secure access controls, and audit trails. When handling sensitive forms like the 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112, you can be confident that your data is protected.

-

Does airSlate SignNow integrate with other platforms for document management?

Yes, airSlate SignNow easily integrates with various applications and platforms, enhancing your workflow. This means you can streamline your process for the 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112 while maintaining your existing systems.

-

Can airSlate SignNow assist with tracking the status of my 11288B Request?

Absolutely! airSlate SignNow equips you with real-time tracking capabilities, allowing you to monitor the progress of your 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112 until it’s completed. This feature keeps you informed and helps you manage deadlines effectively.

Get more for 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112 For A Notice Of No Objection To A Company Being Deregis

Find out other 11288B Request Under Section 88B Of The Inland Revenue Ordinance Cap 112 For A Notice Of No Objection To A Company Being Deregis

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe