Application for Educational Course Instructor Window Texas Form

What is the Application For Educational Course Instructor Window Texas

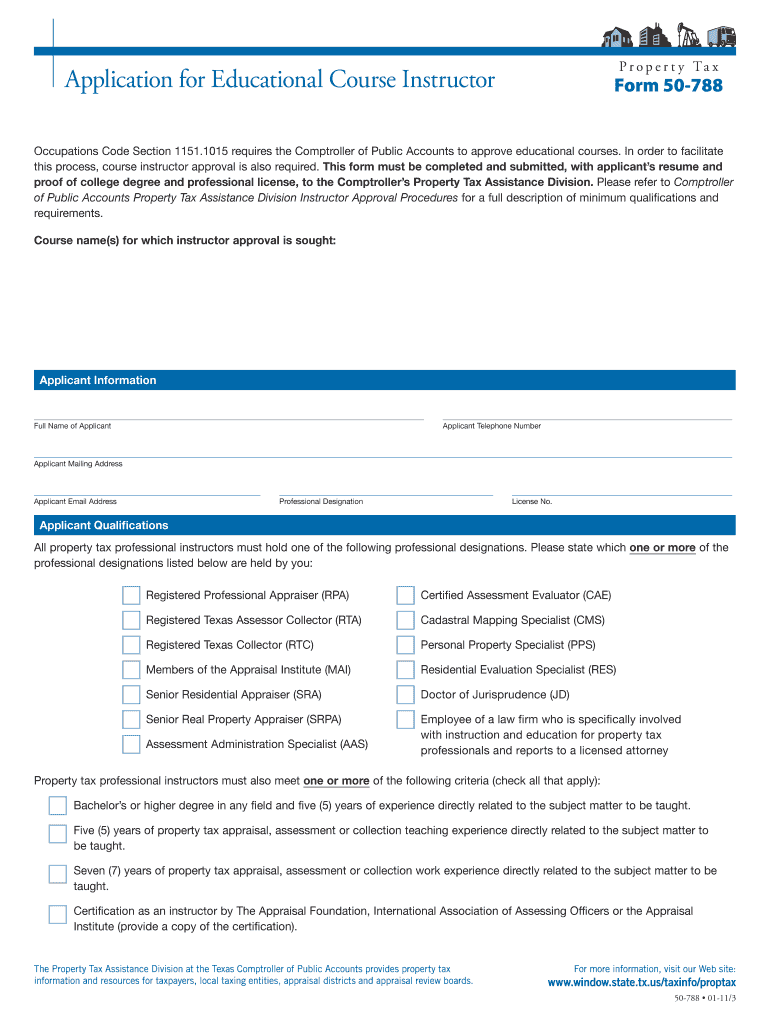

The Application For Educational Course Instructor Window Texas is a formal document used by individuals seeking to become certified instructors for educational courses in the state of Texas. This application is essential for those who wish to teach various subjects within educational institutions or training programs. It outlines the qualifications and requirements necessary to obtain instructor certification, ensuring that applicants meet the state's educational standards and regulations.

How to Obtain the Application For Educational Course Instructor Window Texas

To obtain the Application For Educational Course Instructor Window Texas, applicants can visit the official website of the Texas Education Agency (TEA). The application is typically available for download in a PDF format, allowing individuals to fill it out digitally or print it for manual completion. Additionally, applicants may contact local educational institutions or training organizations for guidance on accessing the application and understanding the specific requirements for submission.

Steps to Complete the Application For Educational Course Instructor Window Texas

Completing the Application For Educational Course Instructor Window Texas involves several key steps:

- Review the eligibility criteria to ensure you qualify for the instructor position.

- Gather all required documents, such as proof of education, teaching experience, and any relevant certifications.

- Fill out the application form accurately, providing all requested information in the designated sections.

- Attach any necessary supporting documents, ensuring they are organized and clearly labeled.

- Submit the completed application either online, by mail, or in person, following the specific submission guidelines provided by the TEA.

Key Elements of the Application For Educational Course Instructor Window Texas

The key elements of the Application For Educational Course Instructor Window Texas include personal information, educational background, teaching experience, and references. Applicants must provide detailed information about their qualifications, including degrees obtained, institutions attended, and any relevant coursework. Additionally, the application may require a statement of purpose or teaching philosophy, which allows candidates to express their approach to education and instructional methods.

Eligibility Criteria

Eligibility for the Application For Educational Course Instructor Window Texas typically includes having a minimum level of education, such as a bachelor's degree in a relevant field. Applicants may also need to demonstrate teaching experience or complete specific training programs. Furthermore, background checks and references from previous employers or educational institutions may be required to ensure the applicant's suitability for the instructor role.

Form Submission Methods

The Application For Educational Course Instructor Window Texas can be submitted through various methods, depending on the specific requirements set by the Texas Education Agency. Common submission methods include:

- Online submission through the TEA's official portal.

- Mailing the completed application to the designated address provided in the application guidelines.

- In-person submission at local educational offices or designated locations.

Quick guide on how to complete application for educational course instructor window texas

Execute [SKS] effortlessly on any device

Digital document management has become increasingly popular among companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the proper form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any holdups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to edit and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight key sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only a moment and carries the same legal validity as a conventional wet ink signature.

- Verify all information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application For Educational Course Instructor Window Texas

Create this form in 5 minutes!

How to create an eSignature for the application for educational course instructor window texas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Educational Course Instructor Window Texas?

The Application For Educational Course Instructor Window Texas is a streamlined process designed for individuals looking to become certified instructors for educational courses in Texas. This application allows you to submit your qualifications, ensuring compliance with Texas educational standards.

-

How can I apply for the Application For Educational Course Instructor Window Texas?

To apply for the Application For Educational Course Instructor Window Texas, you can visit our official website and complete the online form. Alternatively, you may contact the appropriate educational authority in Texas to obtain further guidance on the application process.

-

What are the costs associated with the Application For Educational Course Instructor Window Texas?

The costs associated with the Application For Educational Course Instructor Window Texas may vary based on the type of course and institution. It's recommended to check the official fee schedule provided on the Texas education board website or our site for the most accurate information.

-

What features does the Application For Educational Course Instructor Window Texas offer?

The Application For Educational Course Instructor Window Texas includes features such as digital submission for convenience, compliance tracking, and clear guidelines for documentation requirements. Additionally, it offers a user-friendly interface for instructors to navigate the application process easily.

-

What benefits are associated with the Application For Educational Course Instructor Window Texas?

The Application For Educational Course Instructor Window Texas provides several benefits, including quicker processing times and reduced paperwork. This efficiency allows prospective instructors to focus more on teaching and less on administrative duties, enhancing their overall educational effectiveness.

-

Are there any integrations available for the Application For Educational Course Instructor Window Texas?

Yes, the Application For Educational Course Instructor Window Texas can integrate with various educational platforms and systems. These integrations allow for seamless data transfer and management, making it easier to keep track of your application status and relevant documentation.

-

How long does the approval process for the Application For Educational Course Instructor Window Texas typically take?

The approval process for the Application For Educational Course Instructor Window Texas generally takes a few weeks, depending on the completeness of your application and the time of year. To expedite the process, ensure that you submit all required documents promptly.

Get more for Application For Educational Course Instructor Window Texas

Find out other Application For Educational Course Instructor Window Texas

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure