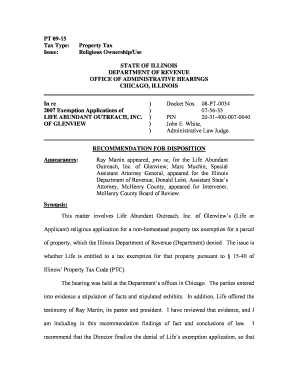

PT 09 15 Religious OwnershipUse Illinois Department of Tax Illinois Form

Understanding the PT 09 15 Religious Ownership Form

The PT 09 15 Religious Ownership form, issued by the Illinois Department of Revenue, is specifically designed for religious organizations to claim property tax exemptions. This form allows qualifying entities to report their religious ownership status and ensure compliance with state tax regulations. It is essential for organizations to accurately complete this form to avoid potential tax liabilities.

Steps to Complete the PT 09 15 Religious Ownership Form

Completing the PT 09 15 form involves several key steps:

- Gather necessary documentation, including proof of religious status, articles of incorporation, and any other relevant paperwork.

- Fill out the form with accurate details regarding the organization’s ownership and use of the property.

- Ensure all signatures are collected from authorized representatives of the religious organization.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the PT 09 15 Religious Ownership Form

To qualify for the PT 09 15 form, an organization must meet specific criteria:

- The organization must be recognized as a religious entity under Illinois law.

- It should own property that is used exclusively for religious purposes.

- The organization must provide evidence of its religious activities and community involvement.

Required Documents for the PT 09 15 Religious Ownership Form

When submitting the PT 09 15 form, organizations must include several supporting documents:

- Proof of religious status, such as a certificate of incorporation or bylaws.

- Documentation showing the property is used for religious purposes, including photographs or usage descriptions.

- Any previous tax exemption certificates or correspondence with the Illinois Department of Revenue.

Form Submission Methods for the PT 09 15 Religious Ownership Form

The PT 09 15 form can be submitted through various methods, ensuring convenience for organizations:

- Online submission via the Illinois Department of Revenue's official website.

- Mailing a completed form to the appropriate address provided by the department.

- In-person submission at designated local offices.

Legal Use of the PT 09 15 Religious Ownership Form

The legal use of the PT 09 15 form is crucial for maintaining compliance with state tax laws. Organizations must ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or loss of tax-exempt status. Understanding the legal implications of filing this form helps organizations protect their interests and uphold their religious mission.

Quick guide on how to complete pt 09 15 religious ownershipuse illinois department of tax illinois

Effortlessly Prepare [SKS] on Any Device

The management of online documents has gained signNow traction among both companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and without issues. Handle [SKS] seamlessly on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The easiest way to edit and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that function.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pt 09 15 religious ownershipuse illinois department of tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois?

PT 09 15 Religious Ownership Use Illinois Department Of Tax Illinois is a form used to claim a property tax exemption for religious organizations in Illinois. This form enables religious institutions to signNow that their property is used exclusively for religious purposes, qualifying them for a reduction in property taxes.

-

How can airSlate SignNow help with PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois?

airSlate SignNow offers a seamless solution for electronically signing and managing the PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois form. Our platform simplifies the process, allowing users to quickly gather signatures, track submissions, and ensure compliance without the hassle of paper forms.

-

What are the pricing options for airSlate SignNow's services related to PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois?

Our pricing plans are designed to be cost-effective, catering to various organizational needs. We offer a free trial, followed by affordable monthly subscriptions that provide access to advanced features for managing documents like the PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois form.

-

What features does airSlate SignNow provide to assist with the completion of PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois?

airSlate SignNow includes features such as customizable templates, bulk sending, and real-time tracking, which streamline the completion of the PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois form. Additionally, our platform ensures secure document storage and compliance with legal standards.

-

Can I integrate airSlate SignNow with other tools for handling PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois?

Yes, airSlate SignNow integrates with a variety of applications, making it easier to handle the PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois process. Our integrations with CRM systems, cloud storage solutions, and other productivity tools enhance your workflow, allowing for better document management.

-

Is airSlate SignNow secure for managing PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois documents?

Absolutely! airSlate SignNow employs industry-standard encryption and security protocols to protect your documents, including the PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois form. Your data privacy and compliance are our top priorities.

-

What benefits can organizations expect from using airSlate SignNow for PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois?

Organizations leveraging airSlate SignNow for PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois will experience increased efficiency, reduced paperwork, and a lower risk of errors. The platform promotes faster processing, which ultimately leads to saving time and resources.

Get more for PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois

Find out other PT 09 15 Religious OwnershipUse Illinois Department Of Tax Illinois

- How To Electronic signature Utah Plumbing Presentation

- How To Electronic signature Utah Plumbing Presentation

- How To Electronic signature Utah Plumbing Presentation

- How Do I Electronic signature Utah Plumbing Presentation

- How Do I Electronic signature Utah Plumbing Presentation

- Help Me With Electronic signature Utah Plumbing Presentation

- How Do I Electronic signature Utah Plumbing Presentation

- How Can I Electronic signature Utah Plumbing Presentation

- Can I Electronic signature Utah Plumbing Presentation

- Help Me With Electronic signature Utah Plumbing Presentation

- Help Me With Electronic signature Utah Plumbing Presentation

- How Can I Electronic signature Utah Plumbing Presentation

- How To Electronic signature Utah Plumbing Presentation

- How Do I Electronic signature Utah Plumbing Presentation

- Can I Electronic signature Utah Plumbing Presentation

- How Can I Electronic signature Utah Plumbing Presentation

- Help Me With Electronic signature Utah Plumbing Presentation

- How Can I Electronic signature Utah Plumbing Presentation

- Can I Electronic signature Utah Plumbing Presentation

- Can I Electronic signature Utah Plumbing Presentation