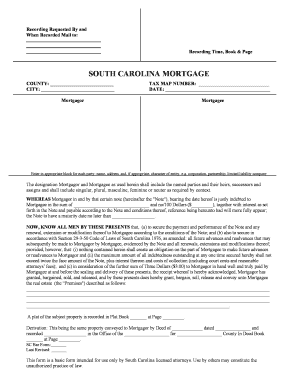

SOUTH CAROLINA MORTGAGE South Carolina Bar Association Scbar Form

Understanding the South Carolina Mortgage

The South Carolina mortgage is a legal document that outlines the terms of a loan secured by real estate. This document is crucial for both lenders and borrowers, as it establishes the rights and obligations of each party involved in the mortgage transaction. It typically includes details such as the loan amount, interest rate, repayment schedule, and the consequences of default. Understanding these elements is essential for anyone looking to navigate the South Carolina mortgage landscape.

Key Elements of the South Carolina Mortgage

Several key elements make up the South Carolina mortgage. These include:

- Loan Amount: The total amount borrowed by the borrower.

- Interest Rate: The cost of borrowing, expressed as a percentage of the loan amount.

- Repayment Terms: The schedule for repayment, including monthly payments and the loan duration.

- Default Clauses: Conditions under which the lender can take action if the borrower fails to meet their obligations.

- Property Description: Details about the property being financed, including its legal description and address.

Steps to Complete the South Carolina Mortgage

Completing a South Carolina mortgage involves several steps to ensure all legal requirements are met. Here is a general outline of the process:

- Gather Necessary Documents: Collect financial statements, identification, and property information.

- Choose a Lender: Research and select a lender that meets your needs.

- Complete the Application: Fill out the mortgage application form accurately.

- Review the Terms: Carefully read the mortgage terms and conditions provided by the lender.

- Sign the Mortgage Document: Execute the mortgage document in the presence of a notary public.

- Submit the Document: Ensure the completed document is submitted to the appropriate county office for recording.

Legal Use of the South Carolina Mortgage

The South Carolina mortgage must comply with state-specific laws and regulations. It is essential for both parties to understand their rights and responsibilities under the mortgage agreement. This includes knowledge of the South Carolina mortgage code, which governs the mortgage process and protects consumers. Legal counsel may be beneficial to navigate complexities and ensure compliance with all applicable laws.

State-Specific Rules for the South Carolina Mortgage

South Carolina has specific rules that govern mortgages, including requirements for disclosure and documentation. Lenders must provide borrowers with clear information about the terms of the loan, including any fees or penalties. Additionally, the South Carolina Bar Association offers resources and guidance to help individuals understand their rights and obligations under state mortgage laws. Familiarity with these rules can help avoid potential legal issues during the mortgage process.

Examples of Using the South Carolina Mortgage

Practical examples of using a South Carolina mortgage can illustrate its application in real-life scenarios. For instance, a first-time homebuyer may secure a mortgage to purchase a home, while a homeowner might refinance their existing mortgage to take advantage of lower interest rates. Each situation may involve different terms and conditions, highlighting the importance of understanding the specific details of the mortgage agreement.

Quick guide on how to complete south carolina mortgage south carolina bar association scbar

Complete SOUTH CAROLINA MORTGAGE South Carolina Bar Association Scbar effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage SOUTH CAROLINA MORTGAGE South Carolina Bar Association Scbar on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to adjust and electronically sign SOUTH CAROLINA MORTGAGE South Carolina Bar Association Scbar with ease

- Find SOUTH CAROLINA MORTGAGE South Carolina Bar Association Scbar and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and is legally equivalent to a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to distribute your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign SOUTH CAROLINA MORTGAGE South Carolina Bar Association Scbar and maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the south carolina mortgage south carolina bar association scbar

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for South Carolina mortgage processes?

airSlate SignNow offers essential features for South Carolina mortgage processes, including secure eSigning, document templates, and customizable workflows. These features streamline the management of mortgage documents, making it easier for businesses to facilitate transactions efficiently. Additionally, the platform allows seamless integration with existing software systems tailored for South Carolina mortgage applications.

-

How does airSlate SignNow ensure security for South Carolina mortgage documents?

Security is a top priority for airSlate SignNow, especially for South Carolina mortgage documents that contain sensitive information. The platform utilizes AES-256 bit encryption and complies with industry standards such as GDPR and HIPAA to protect your data. This ensures that all your South Carolina mortgage documents are securely eSigned and stored.

-

What is the pricing structure for airSlate SignNow for South Carolina mortgage services?

airSlate SignNow offers competitive pricing plans to accommodate businesses involved in South Carolina mortgage services. Our subscription models are designed to be cost-effective, ensuring you only pay for the features you need. Whether you're a small firm or a large mortgage company, there is a pricing plan suitable for your budget.

-

Can airSlate SignNow integrate with mortgage management software used in South Carolina?

Yes, airSlate SignNow easily integrates with popular mortgage management software commonly used in South Carolina. This seamless integration enhances efficiency by reducing the manual data entry burden and speeding up document processing times. You can quickly sync your South Carolina mortgage workflows with existing systems.

-

How can airSlate SignNow benefit my South Carolina mortgage business?

airSlate SignNow can signNowly benefit your South Carolina mortgage business by streamlining the signing process and improving customer experience. With its user-friendly interface, clients can easily eSign documents anytime, reducing turnaround times. This leads to faster closings and higher customer satisfaction, essential for growing your mortgage business.

-

Is there a mobile app for airSlate SignNow that supports South Carolina mortgage transactions?

Yes, airSlate SignNow provides a mobile app that supports seamless South Carolina mortgage transactions. The app allows users to eSign and send documents on-the-go, providing flexibility and convenience for both businesses and clients. This feature is particularly useful in fast-paced environments where timely decisions are critical.

-

How can I get started with airSlate SignNow for my South Carolina mortgage needs?

Getting started with airSlate SignNow for your South Carolina mortgage needs is simple. You can sign up for a free trial to explore the platform’s features and see how they align with your business requirements. Once you're ready, choose a pricing plan that fits your needs, and begin efficiently managing your South Carolina mortgage documents.

Get more for SOUTH CAROLINA MORTGAGE South Carolina Bar Association Scbar

- Impervious area calculation worksheet city of winter garden form

- Commercial load form holy cross energy

- Bill of sale tractor apolloamp39s templates form

- Uniform police traffic accident report

- Answer amp objection to writ of possession form

- Laptop lease agreement template form

- Lease amendment agreement template form

- Lease apartment agreement template form

Find out other SOUTH CAROLINA MORTGAGE South Carolina Bar Association Scbar

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast