Wyoming Department of Revenue Cheyenne , WY Business Page Form

Understanding the Wyoming Department of Revenue

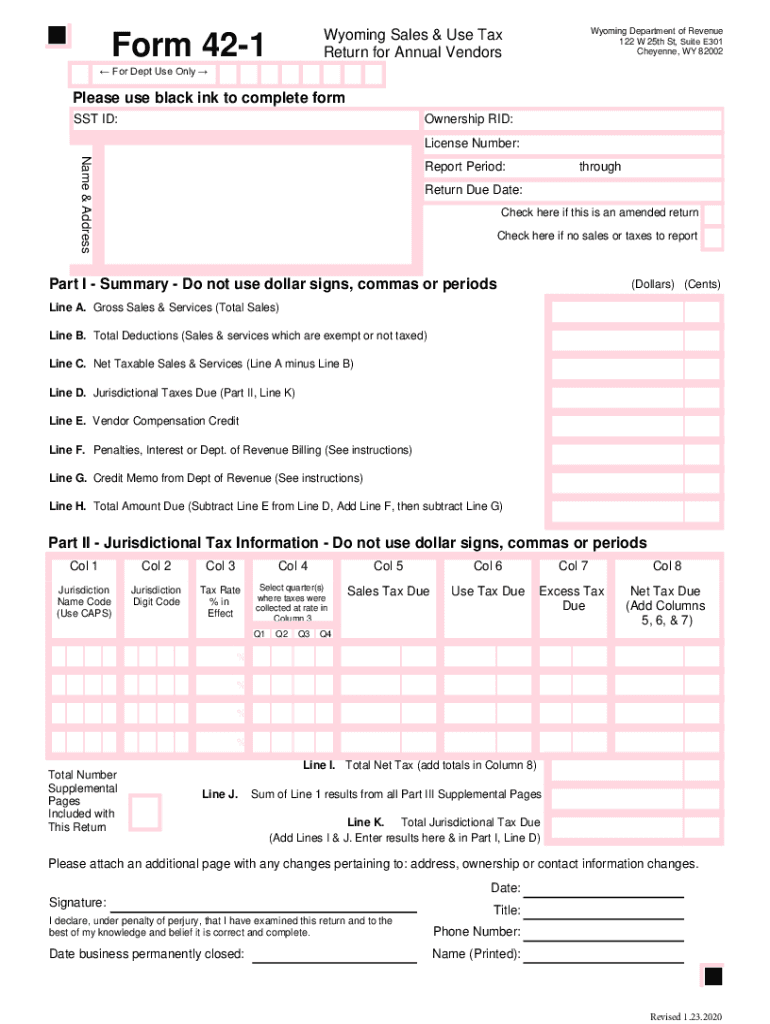

The Wyoming Department of Revenue (DOR) is responsible for administering tax laws and collecting revenue for the state. This includes overseeing the Wyoming 421 tax, which is essential for businesses operating within the state. The DOR provides resources and guidance to help taxpayers understand their obligations and ensure compliance with state tax regulations.

Steps to Complete the Wyoming 421 Tax Form

Completing the Wyoming 421 tax form involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Access the form through the Wyoming Department of Revenue website or obtain a physical copy.

- Fill out the form accurately, ensuring all required information is included.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online or by mail.

Required Documents for Wyoming 421 Tax Submission

When filing the Wyoming 421 tax, certain documents are necessary to support your submission. These typically include:

- Proof of income, such as W-2s or 1099 forms.

- Records of business expenses to substantiate deductions.

- Any prior tax returns that may be relevant to the current filing.

- Identification documents, if required by the DOR.

Filing Deadlines for Wyoming 421 Tax

It is crucial to be aware of the filing deadlines for the Wyoming 421 tax. Typically, the deadline aligns with the federal tax filing date, which is April fifteenth for most taxpayers. However, businesses may have different deadlines based on their fiscal year. Always check the Wyoming DOR website for the most current information regarding specific due dates.

Penalties for Non-Compliance with Wyoming 421 Tax

Failure to comply with Wyoming 421 tax regulations can result in penalties. These may include:

- Late filing fees, which accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential legal action for severe non-compliance, including audits.

Digital vs. Paper Version of the Wyoming 421 Tax Form

Taxpayers have the option to file the Wyoming 421 tax form either digitally or on paper. The digital version is often more efficient, allowing for quicker processing times and immediate confirmation of submission. Conversely, paper submissions may take longer to process and require additional time for delivery. Consider your preferences and capabilities when choosing the method of submission.

Quick guide on how to complete wyoming department of revenue cheyenne wy business page

Manage Wyoming Department Of Revenue Cheyenne , WY Business Page seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without interruptions. Manage Wyoming Department Of Revenue Cheyenne , WY Business Page on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to edit and eSign Wyoming Department Of Revenue Cheyenne , WY Business Page with ease

- Obtain Wyoming Department Of Revenue Cheyenne , WY Business Page and select Get Form to begin.

- Utilize the features we provide to complete your form.

- Highlight essential sections of your documents or obscure confidential details with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Modify and eSign Wyoming Department Of Revenue Cheyenne , WY Business Page and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wyoming department of revenue cheyenne wy business page

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wyoming 421 tax and how does it work?

The Wyoming 421 tax refers to a specific tax structure in Wyoming that offers businesses various benefits, including incentivized growth opportunities. Understanding the Wyoming 421 tax can help you navigate the financial landscape of your business in Wyoming, ensuring compliance and maximizing your tax advantages.

-

How can airSlate SignNow help with documents related to the Wyoming 421 tax?

airSlate SignNow simplifies the process of sending and eSigning documents that pertain to the Wyoming 421 tax. With our user-friendly platform, you can securely manage your tax documentation, ensuring that all necessary forms are completed and submitted on time, streamlining your tax-related processes.

-

What features does airSlate SignNow offer that are beneficial for managing Wyoming 421 tax documents?

Our platform offers features such as customizable templates, secure storage, and real-time tracking for documents related to the Wyoming 421 tax. These tools help ensure that your tax documents are easily accessible and manageable, reducing the administrative burden on your team.

-

Is airSlate SignNow cost-effective for small businesses dealing with Wyoming 421 tax?

Yes, airSlate SignNow provides a cost-effective solution for small businesses managing Wyoming 421 tax documents. Our competitive pricing plans are designed to accommodate various business sizes, allowing you to efficiently handle your tax responsibilities without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for managing Wyoming 421 tax?

Absolutely! airSlate SignNow offers seamless integrations with various business applications that help manage Wyoming 421 tax processes. This interoperability allows for enhanced workflows and collaboration, ensuring that all aspects of your tax documentation are efficiently handled.

-

What benefits does eSigning offer for Wyoming 421 tax documents?

eSigning Wyoming 421 tax documents with airSlate SignNow expedites the approval process, making it faster and more efficient. The legal validity of eSignatures ensures that your documents are recognized by regulatory authorities, saving you time and hassle during tax season.

-

How secure is airSlate SignNow when dealing with Wyoming 421 tax information?

airSlate SignNow prioritizes security for all user data, including information related to the Wyoming 421 tax. Our platform utilizes advanced encryption technologies and compliance with industry standards to ensure that your sensitive tax documents are always protected.

Get more for Wyoming Department Of Revenue Cheyenne , WY Business Page

- California massage therapy council form

- 2d kinematics worksheet answers form

- Application form prime care

- Employment application for heritage inn charlottesville va form

- Claim form vpi pet insurance

- Agreement bond form for candidates admitted for mbbs

- Nixie label form

- Pip1 personal independence payment claim form

Find out other Wyoming Department Of Revenue Cheyenne , WY Business Page

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile