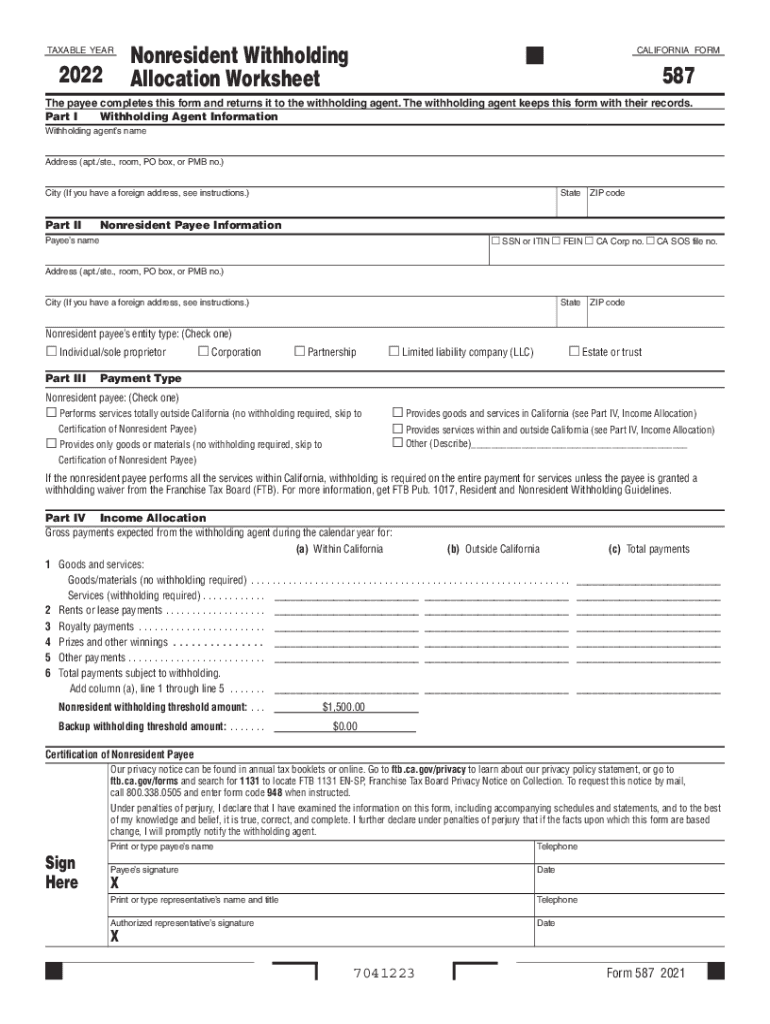

Form 587 Nonresident Withholding Allocation Worksheet , Form 587, Nonresident Withholding Allocation Worksheet 2022

Understanding the CA 587 Form 2024

The CA 587 form, also known as the Nonresident Withholding Allocation Worksheet, is essential for nonresident individuals and entities engaged in business or receiving income in California. This form helps determine the amount of withholding tax that must be deducted from payments made to nonresidents. It is particularly relevant for individuals who earn income from California sources but do not reside in the state. Understanding this form is crucial for compliance with California tax regulations.

Steps to Complete the CA 587 Form 2024

Completing the CA 587 form involves several key steps to ensure accurate reporting and withholding calculations:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Identify the type of income you are receiving and provide details about the source of that income.

- Calculate the total amount of income subject to withholding and apply the appropriate withholding rates as specified by California tax guidelines.

- Complete the allocation section to indicate how the income is distributed among various sources, if applicable.

- Review the completed form for accuracy before submission.

Obtaining the CA 587 Form 2024

The CA 587 form can be obtained through the California Franchise Tax Board's official website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many tax preparation software programs include the CA 587 form, allowing users to complete it digitally. Ensure that you are using the 2024 version of the form to comply with the latest tax regulations.

Key Elements of the CA 587 Form 2024

Several key elements are crucial when filling out the CA 587 form:

- Personal Information: Accurate identification details are necessary to ensure proper processing.

- Income Details: Clear documentation of the income sources helps determine the correct withholding amounts.

- Withholding Calculation: Understanding the applicable withholding rates is essential for compliance.

- Signature and Date: The form must be signed and dated to validate the information provided.

Filing Deadlines for the CA 587 Form 2024

It is important to be aware of the filing deadlines associated with the CA 587 form. Typically, the form must be submitted by the due date of the income payment. For most taxpayers, this aligns with the annual tax return deadline. However, specific deadlines may vary based on the type of income and the payer's reporting requirements. Always check the California Franchise Tax Board's website for the most current deadlines to avoid penalties.

Legal Use of the CA 587 Form 2024

The CA 587 form serves a legal purpose in ensuring compliance with California's tax regulations regarding nonresident withholding. Proper completion and timely submission of this form help avoid potential penalties for both the payer and the nonresident recipient. Understanding the legal implications of the information reported on the CA 587 form is essential for all parties involved in transactions subject to California withholding tax.

Quick guide on how to complete form 587 nonresident withholding allocation worksheet form 587 nonresident withholding allocation worksheet

Complete Form 587 Nonresident Withholding Allocation Worksheet , Form 587, Nonresident Withholding Allocation Worksheet seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Form 587 Nonresident Withholding Allocation Worksheet , Form 587, Nonresident Withholding Allocation Worksheet on any device using airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Form 587 Nonresident Withholding Allocation Worksheet , Form 587, Nonresident Withholding Allocation Worksheet effortlessly

- Locate Form 587 Nonresident Withholding Allocation Worksheet , Form 587, Nonresident Withholding Allocation Worksheet and click Get Form to begin.

- Utilize the tools provided to finalize your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 587 Nonresident Withholding Allocation Worksheet , Form 587, Nonresident Withholding Allocation Worksheet while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 587 nonresident withholding allocation worksheet form 587 nonresident withholding allocation worksheet

Create this form in 5 minutes!

How to create an eSignature for the form 587 nonresident withholding allocation worksheet form 587 nonresident withholding allocation worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA 587 form 2024?

The CA 587 form 2024 is an important document used for requesting an Individual Income Tax Return extension for California. It allows taxpayers to easily file for an extension to avoid penalties. By utilizing airSlate SignNow, you can eSign your CA 587 form 2024 securely and efficiently.

-

How can airSlate SignNow help with the CA 587 form 2024?

airSlate SignNow simplifies the process of completing the CA 587 form 2024 by enabling users to fill out and eSign documents online. This not only saves time but also ensures that your forms are submitted accurately and on time. With intuitive features, airSlate SignNow makes tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the CA 587 form 2024?

Yes, airSlate SignNow offers a range of pricing plans tailored to fit different business needs. You can choose a subscription that best fits your requirements for managing documents like the CA 587 form 2024. The platform provides a cost-effective solution for eSigning and managing your forms.

-

Can I integrate airSlate SignNow with other software while using the CA 587 form 2024?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including CRM systems and cloud storage services. This flexibility allows you to manage your CA 587 form 2024 alongside other business processes, enhancing efficiency and organization.

-

What are the key benefits of using airSlate SignNow for the CA 587 form 2024?

Using airSlate SignNow for the CA 587 form 2024 provides numerous advantages, such as improved efficiency and reduced paperwork. The platform ensures that documents are completed faster, cuts down on physical storage needs, and allows for easy tracking of signed documents. Additionally, it enhances security for your sensitive tax information.

-

Can multiple users eSign the CA 587 form 2024 with airSlate SignNow?

Yes, airSlate SignNow supports multiple users, allowing teams to collaborate on the CA 587 form 2024 efficiently. You can easily invite colleagues to eSign or review the document, which streamlines the process and fosters better teamwork. Everyone can be involved in completing necessary paperwork without the hassle of traditional methods.

-

Is airSlate SignNow compliant with legal standards for the CA 587 form 2024?

Yes, airSlate SignNow is designed to meet industry standards for electronic signatures, ensuring that your CA 587 form 2024 is legally compliant. The service adheres to regulations such as eSign and UETA, guaranteeing that your eSigned documents hold up in legal situations. You can trust airSlate SignNow to maintain the integrity of your signed forms.

Get more for Form 587 Nonresident Withholding Allocation Worksheet , Form 587, Nonresident Withholding Allocation Worksheet

- Dart paratransit application 36333486 form

- Asset disposition list form

- University student reporting an incident form

- Validator application form citb

- Insurance information form 43326573

- Jetform80001102 library ifd dor ms

- Rpd 41329 sustainable building tax credit claim form

- Lease for trucking agreement template form

Find out other Form 587 Nonresident Withholding Allocation Worksheet , Form 587, Nonresident Withholding Allocation Worksheet

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF