FORM 587 Nonresident Withholding Allocation Worksheet 2024-2026

What is the FORM 587 Nonresident Withholding Allocation Worksheet

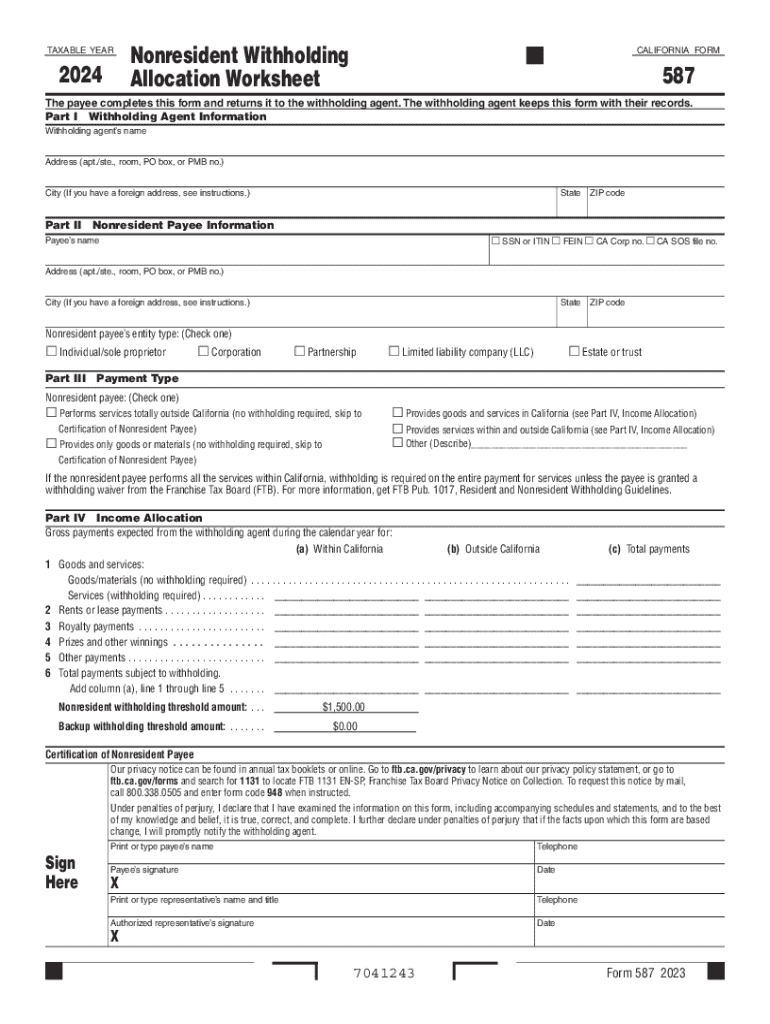

The FORM 587, also known as the Nonresident Withholding Allocation Worksheet, is a document used primarily in California for tax purposes. It is designed for nonresidents who receive income from California sources. This form helps determine the appropriate amount of state income tax that should be withheld from payments made to nonresidents. By accurately completing this form, nonresidents can ensure compliance with California tax laws while potentially reducing their overall tax liability.

How to use the FORM 587 Nonresident Withholding Allocation Worksheet

Using the FORM 587 involves several straightforward steps. First, gather all relevant income information, including the type of income received and the source of that income. Next, fill out the form by providing details such as your name, address, and the specific amounts of income. It is crucial to follow the instructions carefully to ensure accuracy. Once completed, the form should be submitted to the payer, who will use it to determine the withholding amount. This process helps both the payer and the nonresident fulfill their tax obligations efficiently.

Steps to complete the FORM 587 Nonresident Withholding Allocation Worksheet

Completing the FORM 587 requires careful attention to detail. Start by entering your personal information, including your name and address. Next, indicate the type of income you are receiving and the amount. Be sure to provide any necessary supporting documentation that may be required by the payer. After filling out all sections of the form, review it for accuracy. Finally, submit the completed form to the appropriate payer, ensuring they have the information needed to withhold the correct amount of taxes from your payments.

Key elements of the FORM 587 Nonresident Withholding Allocation Worksheet

Several key elements are essential to the FORM 587. These include the nonresident's personal information, the type of income being reported, and the specific amounts that apply. Additionally, the form requires details about the withholding rates applicable to the income type. Understanding these elements is vital for accurate completion and compliance with California tax laws. Each section of the form plays a crucial role in determining the correct withholding amount, making attention to detail imperative.

Legal use of the FORM 587 Nonresident Withholding Allocation Worksheet

The legal use of the FORM 587 is primarily to ensure compliance with California tax regulations for nonresidents earning income from California sources. By accurately completing and submitting this form, nonresidents can avoid potential penalties associated with under-withholding or non-compliance. It is important to understand that this form serves as a legal document that supports the withholding process, protecting both the payer and the recipient under California law.

Filing Deadlines / Important Dates

Filing deadlines for the FORM 587 are crucial for nonresidents to observe. Typically, the form should be submitted to the payer before any payments are made to ensure proper withholding. It is advisable to check the specific deadlines for the tax year in question, as these can vary. Staying informed about important dates helps nonresidents avoid penalties and ensures compliance with tax regulations.

Create this form in 5 minutes or less

Find and fill out the correct form 587 nonresident withholding allocation worksheet

Create this form in 5 minutes!

How to create an eSignature for the form 587 nonresident withholding allocation worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 587 form and how can airSlate SignNow help?

The form 587 form is a crucial document used for various tax-related purposes. airSlate SignNow simplifies the process of filling out and signing the form 587 form electronically, ensuring that you can complete it quickly and securely.

-

Is there a cost associated with using airSlate SignNow for the form 587 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the completion and signing of the form 587 form, making it a cost-effective solution for your document management.

-

What features does airSlate SignNow offer for the form 587 form?

airSlate SignNow provides features such as customizable templates, electronic signatures, and real-time tracking for the form 587 form. These tools enhance efficiency and ensure that your documents are processed smoothly and securely.

-

Can I integrate airSlate SignNow with other applications for the form 587 form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage the form 587 form alongside your existing tools. This seamless integration enhances your workflow and saves time.

-

How does airSlate SignNow ensure the security of the form 587 form?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption and secure cloud storage to protect your form 587 form and other documents, ensuring that your sensitive information remains confidential.

-

Can I access the form 587 form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage the form 587 form on the go. This flexibility ensures that you can complete your documents anytime, anywhere.

-

What are the benefits of using airSlate SignNow for the form 587 form?

Using airSlate SignNow for the form 587 form offers numerous benefits, including increased efficiency, reduced paper usage, and faster turnaround times. These advantages help streamline your document processes and improve overall productivity.

Get more for FORM 587 Nonresident Withholding Allocation Worksheet

Find out other FORM 587 Nonresident Withholding Allocation Worksheet

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online