LIMITED LIABILITY COMPANY AUTHORIZATION RESOLUTION Form

Understanding the LLC Authorization Resolution

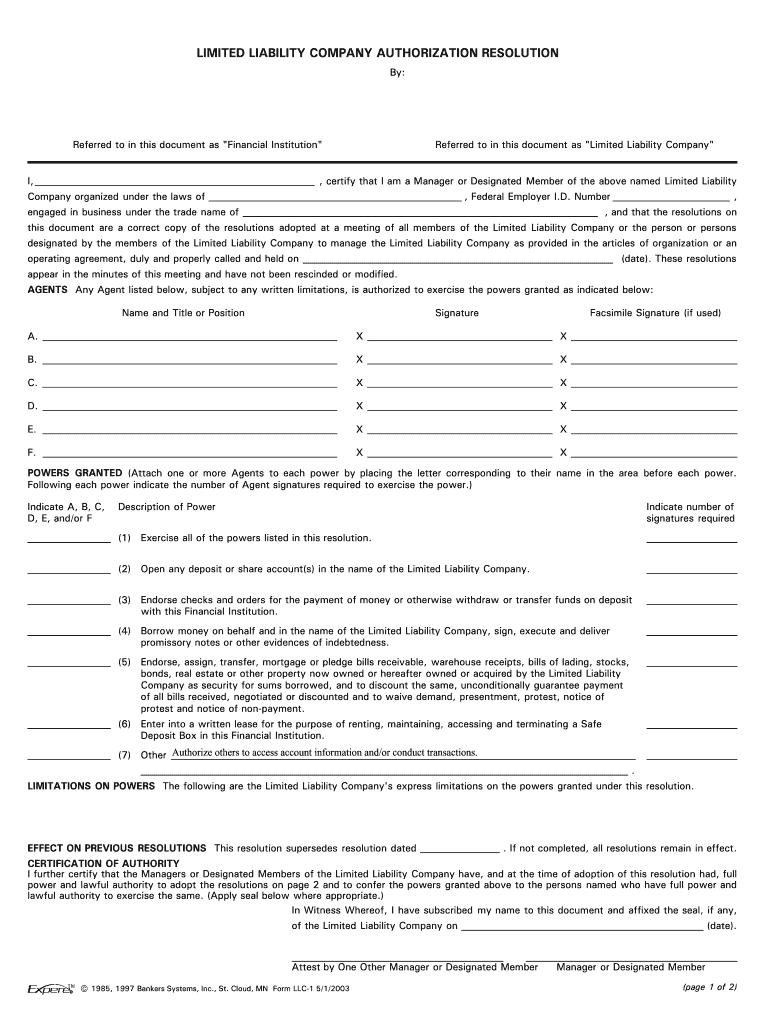

The limited liability company authorization resolution is a formal document that grants specific individuals the authority to act on behalf of the LLC. This resolution is essential for defining who can sign contracts, agreements, and other legal documents for the company. It serves to protect the interests of the LLC by ensuring that only authorized individuals can make binding decisions. Typically, this document is created during meetings of the members or managers of the LLC and must be documented properly to be legally effective.

Key Elements of the LLC Authorization Resolution

When drafting an LLC signing authority template, several key elements should be included to ensure its validity:

- Name of the LLC: Clearly state the full legal name of the limited liability company.

- Date of Resolution: Include the date when the resolution is adopted.

- Authorized Signers: List the names and titles of individuals who are granted signing authority.

- Scope of Authority: Specify the extent of the authority granted, including what types of documents the signers can execute.

- Signatures: Provide spaces for the signatures of the authorized individuals and possibly the members or managers who approve the resolution.

Steps to Complete the LLC Authorization Resolution

Completing an LLC authorization resolution involves several straightforward steps:

- Gather Information: Collect the necessary details about the LLC, including its name, the authorized signers, and the scope of their authority.

- Draft the Resolution: Use a template to create the resolution, ensuring all key elements are included.

- Review and Approve: Present the resolution to members or managers for review and approval during a formal meeting.

- Sign the Document: Ensure that all required parties sign the resolution to validate it.

- Store the Document: Keep the signed resolution in a secure location, as it may be needed for future reference or legal purposes.

Legal Use of the LLC Authorization Resolution

The LLC authorization resolution is legally binding once properly executed. It is crucial for compliance with state laws governing limited liability companies. This document can be required by banks, vendors, and other entities when verifying the authority of individuals to act on behalf of the LLC. Ensuring that the resolution is in place helps mitigate risks associated with unauthorized actions, protecting the LLC from potential legal disputes.

Examples of Using the LLC Authorization Resolution

There are various scenarios in which an LLC authorization resolution may be utilized:

- Opening a Bank Account: Banks often require a resolution to confirm who is authorized to open and manage accounts for the LLC.

- Signing Contracts: When entering into contracts with suppliers or clients, the resolution verifies that the signatory has the authority to bind the LLC.

- Real Estate Transactions: If the LLC is involved in buying or selling property, an authorization resolution may be necessary to validate the transaction.

Quick guide on how to complete limited liability company authorization resolution

Complete LIMITED LIABILITY COMPANY AUTHORIZATION RESOLUTION effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the resources you require to draft, adjust, and electronically sign your documents swiftly without hindrance. Handle LIMITED LIABILITY COMPANY AUTHORIZATION RESOLUTION on any device using airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to modify and electronically sign LIMITED LIABILITY COMPANY AUTHORIZATION RESOLUTION with ease

- Obtain LIMITED LIABILITY COMPANY AUTHORIZATION RESOLUTION and then click Get Form to initiate.

- Use the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign LIMITED LIABILITY COMPANY AUTHORIZATION RESOLUTION and ensure seamless communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can a foreigner (a non-citizen living outside the U.S.) form a limited liability company (LLC) in the United States?

Yes, anyone in the world can create an LLC in the United States. You never need the visit the United States to do so, it can be done by fax in many states, by mail in the rest, and by lawyer in all of them.Merely holding an ownership interest in an LLC (a passive member) is unlikely the violate the terms of any visa, despite generating self-employment income; but you'll want to consult an immigration attorney. Being an active member while present in the United States can, as you would require work authorization.The tax implications of owning an LLC depends upon the nature of the income. Unless the only income is from passive investments and/or personal services performed outside of the United States; it would otherwise likely give rise to income effectively connected to a trade or business in the United States, and thus be taxable even for a non-resident alien.

-

How can I fill out the authorization form in Wipro's synergy?

By authorisation form I assume that you mean LOA. Just download the pdf and sign it with stylus or get a printout,sign it and scan the copy.Now upload it!If I my assumption is wrong please provide little clear picture!Thank you!Allah maalik!

-

What are some reasons that a health insurance company would ask for a pre-authorization form to be filled out by a Dr. before filling a prescription?

One common reason would be that there is a cheaper, therapeutically equivalent drug that they would like you to try first before they approve a claim for the prescribed drug. Another reason is that they want to make sure the prescribed drug is medically necessary.Remember that nothing is stopping you from filling the prescribed drug. It just won't be covered by insurance until the pre-authorization process is complete.

-

What does the authorization form in Wipro’s Synergy need to be filled out?

I don't exactly remember how the form was looking like in synergy portal. But I hope it is Authorizing Wipro to do background verification on all the details provided by candidate. It needs your name and signature with date.

-

What are the technicalities in merging two sole-proprietorships to form a limited liability company?

Hi,Who can form a LLP in India?Limited Liability Partnership Act, 2008 specifies that an Individual and/or a Body Corporate can become partners in a LLP.Can we consider Sole Proprietorship as Body Corporate?The act in section 2 defines the term Body Corporate as follows:“body corporate" means a company as defined in section 3 of the Companies Act, 1956 (1 of 1956) and includes-(i) a limited liability partnership registered under this Act;(ii) a limited liability partnership incorporated outside India; and(iii) a company incorporated outside India, but does not include-(i) a corporation sole;(ii) a co-operative society registered under any law for the time being in force; and(iii) any other body corporate (not being a company as defined in section 3 of the Companies Act, 1956 (1 of 1956) or a limited liability partnership as defined in this Act), which the Central Government may, by notification in the Official Gazette, specify in this behalf;Since the definition of Body Corporate do not include Sole Proprietorship, one can opine that Sole Proprietorship can not become partners in a LLP.SO HOW CAN 2 SOLE PROPRIETORSHIP BE MERGED TO FORM A LLP?The owners of the Sole proprietorships can come together to form a LLP and become Designated Partners.Once the LLP is formed, a takeover of business agreements can be executed between the LLP and the respective sole proprietorships.The most popular mode of takeover is via “slump sale” under which all the assets and liabilities of a business concern are transferred with lump sum valuation instead of valuing each and every asset and liability individually.It is imperative to identify and analyse the tax implications, stamp duty and related government expenses that shall incur after the merger of businesses.Stamp duty on transfer of assets shall be dependent on the state in which the entities are located.Tax implecations like capital gain tax, GST etc also need to be considered.Also important aspect is ascertaining the valuation of transaction. I.e what shall be the total valuation of both sole proprietorships and whether newly formed LLP is capable of bearing the same.To sum up, many factors are required to take into consideration when business of multiple organisations is merged into a single organization.The answer above provides general gist of the technicalities of merger which is my personal opinion. You are requested to approach a professional who can advise you based on your specific transaction.Hope this was helpful!Thanks!CS Priyal PathakHome - Priyal Pathak

-

I am forming a Limited Liability Company. Do I need to file taxes separate for my company and how frequent should I file?

If you are the only owner of the LLC, the default tax classification as "sole proprietor," which means that the LLC itself is disregarded for tax purposes (i.e. it does not exist for tax purposes). In that case, you would include all of the company's business income and loss on your personal income tax return (Form 1040, filed annually), in a Schedule C attachment.If the LLC has more than one owner, the default tax classification is partnership, which means you would have to file a partnership tax return annually (Form 1065). The LLC would report any profit or loss to you via a Schedule K-1, and then you would include that income on your personal income tax return.

-

What amount of work (filling in forms, meeting minutes, etc.) is needed to form a limited company in the UK?

I started a limited company when I was 16, not having any idea about the technicalities of setting one up, such as the financial figures and tax etc.I went through the Companies House, which is the official government website for setting a ltd company up (it takes 48 hours for the paperwork to be processed)So the actual filling in of the paperwork and the application details was extremely straightforward. All you need to know are the following:Company name and addressOfficer details - this is you (if you're the founding director) and your company secretaryShare capital and shareholder detailsThis took me around 45 minutes to fully complete, with the majority of this time being spent on trying to get other shareholder information (which you need in place of a signature.)Setting up for tax is a slightly different matter, but is also very straight forward through the relevant government website.So in summary.It takes between 45 - 60 minutesThe paperwork is easyIt costs £15 as opposed to the extortionate price that a company would charge to 'help' you set it upHope this helps!

Create this form in 5 minutes!

How to create an eSignature for the limited liability company authorization resolution

How to create an electronic signature for the Limited Liability Company Authorization Resolution in the online mode

How to create an eSignature for your Limited Liability Company Authorization Resolution in Chrome

How to make an electronic signature for putting it on the Limited Liability Company Authorization Resolution in Gmail

How to make an electronic signature for the Limited Liability Company Authorization Resolution straight from your smart phone

How to make an electronic signature for the Limited Liability Company Authorization Resolution on iOS devices

How to make an electronic signature for the Limited Liability Company Authorization Resolution on Android OS

People also ask

-

What is an LLC signing authority template?

An LLC signing authority template is a customizable document that outlines who has the authority to sign on behalf of a limited liability company. This template is essential for establishing clear roles and responsibilities in business transactions. Using an LLC signing authority template ensures compliance and streamlines the signing process.

-

How can I create an LLC signing authority template with airSlate SignNow?

Creating an LLC signing authority template with airSlate SignNow is straightforward. Simply log in to your account, select the template feature, and customize fields according to your organization’s needs. This ensures that your signing authority is clearly defined and easily accessible.

-

What are the benefits of using an LLC signing authority template?

Using an LLC signing authority template provides clarity and legal protection by specifying who can authorize documents for your LLC. It also facilitates quicker approval processes, as all parties understand their signing capabilities. This reduces the risk of unauthorized signatures and enhances overall efficiency.

-

Are there any costs associated with obtaining an LLC signing authority template?

airSlate SignNow offers various pricing plans that include access to customizable LLC signing authority templates. Depending on your subscription level, you can utilize a range of features to enhance your document signing experience. Be sure to check the pricing page for specific details.

-

Can I customize the LLC signing authority template to fit my company's needs?

Absolutely! airSlate SignNow allows you to fully customize your LLC signing authority template. You can modify sections, add necessary details, and tailor the content to suit your company’s specific requirements, ensuring that it meets all legal and operational needs.

-

Is the LLC signing authority template legally binding?

Yes, an LLC signing authority template created with airSlate SignNow is legally binding when executed properly. It provides the necessary documentation that verifies the signer's authority, which is important in legal contexts. Always ensure that all signers are authorized according to your template guidelines.

-

Does airSlate SignNow integrate with other software for managing LLC signing authority templates?

Yes, airSlate SignNow offers integrations with a variety of software solutions, making it easier to manage your LLC signing authority templates alongside your other business tools. This includes popular platforms for document management and workflow automation, enhancing overall productivity.

Get more for LIMITED LIABILITY COMPANY AUTHORIZATION RESOLUTION

- Annotation bookmark d103 form

- Special condition 3 february edition lawsociety form

- Verified petition sample form

- Keeping a running balance 222087160 form

- Sustainable building and construction form

- Rent to own with option agreement template form

- Rent to rent agreement template form

- Rent to own purchase agreement template form

Find out other LIMITED LIABILITY COMPANY AUTHORIZATION RESOLUTION

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure