Delaware Form 200 C Delaware Composite Personal Income Tax 2022-2026

What is the Delaware Form 200 c Delaware Composite Personal Income Tax

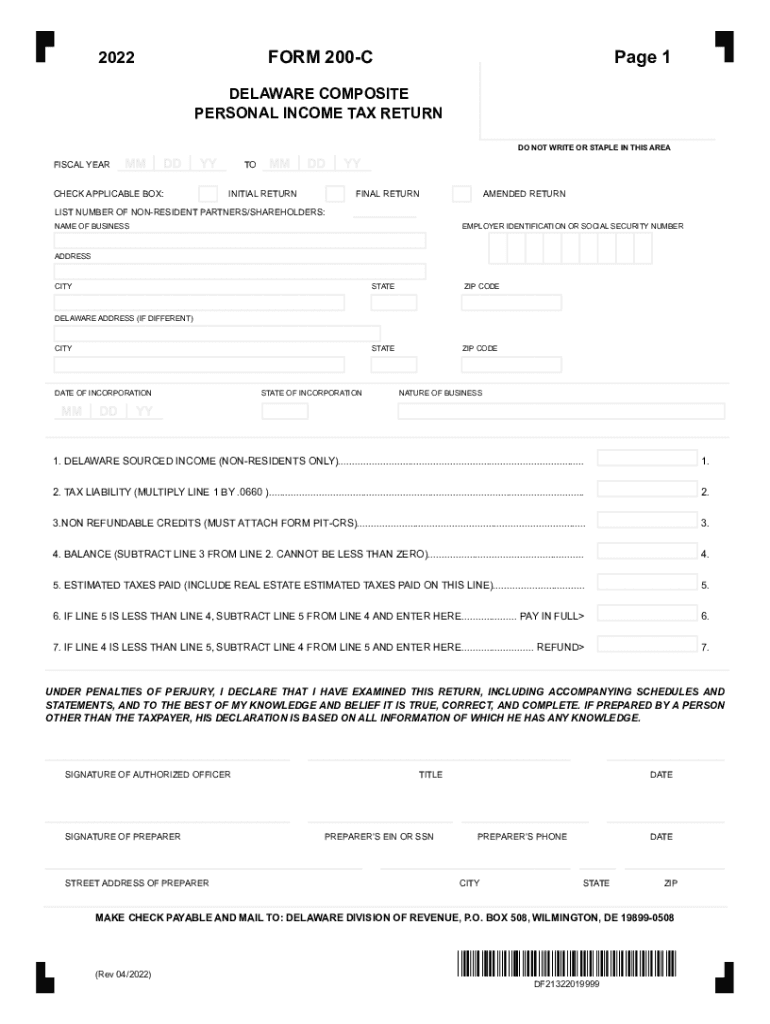

The Delaware Form 200 c is a composite return designed for non-resident individuals who earn income from sources within Delaware. This form allows partnerships and other pass-through entities to file a single tax return on behalf of their non-resident partners, streamlining the tax process for those who may not have a permanent presence in the state. The composite return simplifies compliance by consolidating the tax obligations of multiple individuals into one filing, ensuring that all applicable income is reported and taxed appropriately.

How to use the Delaware Form 200 c Delaware Composite Personal Income Tax

To effectively use the Delaware Form 200 c, individuals or entities must first gather all necessary financial information related to income earned in Delaware. This includes details such as wages, interest, dividends, and other sources of income. Once the information is compiled, the form should be filled out accurately, reflecting the total income and any applicable deductions. It is essential to ensure that all partners or members included in the composite return are listed correctly, as this impacts the overall tax liability. After completing the form, it should be submitted to the Delaware Division of Revenue by the designated deadline.

Steps to complete the Delaware Form 200 c Delaware Composite Personal Income Tax

Completing the Delaware Form 200 c involves several key steps:

- Gather all relevant income documentation for non-resident partners.

- Fill out the form with accurate income figures and applicable deductions.

- Ensure that all partners are listed on the form, including their respective income shares.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the Delaware Division of Revenue by the due date.

Required Documents

When filing the Delaware Form 200 c, certain documents are required to substantiate the income reported. These may include:

- W-2 forms for wages earned in Delaware.

- 1099 forms for other income sources, such as interest or dividends.

- Partnership agreements that outline the distribution of income among partners.

- Any supporting documentation for deductions claimed on the return.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Delaware Form 200 c. Typically, the composite return must be filed by April 30 of the year following the tax year in question. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Timely filing is essential to avoid penalties and interest on any taxes owed.

Penalties for Non-Compliance

Failure to file the Delaware Form 200 c on time or accurately can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid tax balances.

- Potential audits or additional scrutiny from the Delaware Division of Revenue.

It is advisable to ensure compliance to avoid these financial repercussions.

Quick guide on how to complete delaware form 200 c delaware composite personal income tax

Complete Delaware Form 200 c Delaware Composite Personal Income Tax effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Delaware Form 200 c Delaware Composite Personal Income Tax on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Delaware Form 200 c Delaware Composite Personal Income Tax with ease

- Obtain Delaware Form 200 c Delaware Composite Personal Income Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Delaware Form 200 c Delaware Composite Personal Income Tax and ensure excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delaware form 200 c delaware composite personal income tax

Create this form in 5 minutes!

How to create an eSignature for the delaware form 200 c delaware composite personal income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 200c and how does it work?

Form 200c is a specific type of document that can be easily created, edited, and sent using airSlate SignNow. This platform allows users to streamline their workflow by simplifying the signing process. With airSlate SignNow, businesses can efficiently manage form 200c through an intuitive interface designed for ease of use.

-

How much does it cost to use airSlate SignNow for form 200c?

The pricing for using airSlate SignNow to manage form 200c varies based on your business needs and the number of users. It offers flexible pricing plans, ensuring both affordability and access to essential features. You can choose a plan that aligns with your budget and effectively supports your document signing requirements.

-

What are the key features of airSlate SignNow for handling form 200c?

airSlate SignNow offers a range of features specifically designed to enhance your experience with form 200c. This includes customizable templates, eSignature capabilities, document tracking, and collaboration tools. These features make it easy to manage your forms while ensuring security and compliance.

-

Can I integrate airSlate SignNow with other applications for form 200c?

Yes, airSlate SignNow provides integrations with numerous applications to facilitate the handling of form 200c. This allows you to connect with tools such as Google Drive, Salesforce, and more for a seamless workflow. These integrations ensure that you can manage your documents efficiently without disrupting your existing processes.

-

What are the benefits of using airSlate SignNow for form 200c?

Using airSlate SignNow for form 200c brings multiple benefits, including increased efficiency and reduced turnaround time for document signing. The platform’s user-friendly interface ensures that both senders and signers have a straightforward experience. Additionally, it enhances document security, keeping sensitive information protected.

-

Is there customer support available for queries related to form 200c?

airSlate SignNow provides robust customer support for any inquiries related to form 200c. Users can access help via multiple channels such as live chat, email, or phone. This ensures that you have the assistance you need to effectively manage your document signing process.

-

How can I create a form 200c using airSlate SignNow?

Creating a form 200c in airSlate SignNow is a straightforward process. Simply log into your account, select the document creation option, and customize your form as needed. The platform also offers various templates which can expedite the setup and ensure compliance.

Get more for Delaware Form 200 c Delaware Composite Personal Income Tax

- Louisiana code of civil procedure article 3945 b1 form

- Heart of america belly dance competition form

- Cardiac diagnostics requisition wdmh on ca wdmh on form

- City of cleveland ems medical authorization form

- Nysca parents code of ethics form

- Clayton veterinary form

- Form it 360 1 change of city resident status tax year 772088717

- General business contract template form

Find out other Delaware Form 200 c Delaware Composite Personal Income Tax

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later