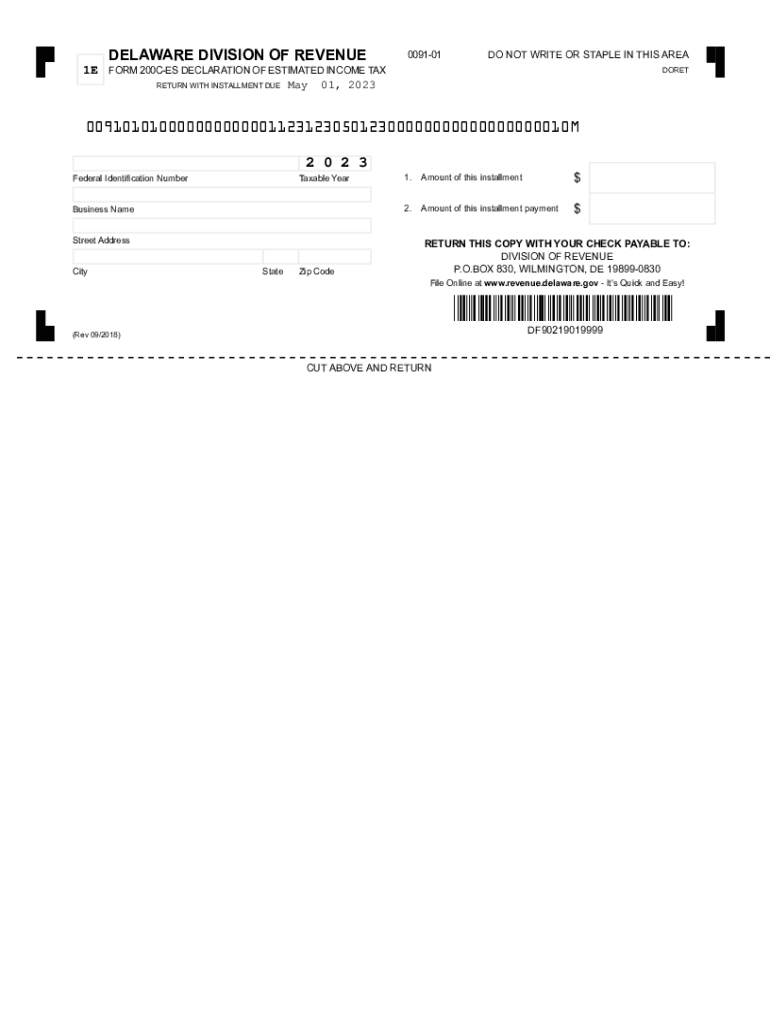

Delaware Form 200 ES Declaration of Estimated Tax for 2023-2026

What is the Delaware Form 200 ES Declaration Of Estimated Tax For

The Delaware Form 200 ES Declaration Of Estimated Tax For is a tax form used by individuals and businesses in Delaware to report and pay estimated income taxes. This form is essential for taxpayers who expect to owe tax of one thousand dollars or more when filing their annual tax return. The form helps ensure that taxpayers meet their tax obligations throughout the year by allowing them to make quarterly estimated payments based on their expected income.

How to use the Delaware Form 200 ES Declaration Of Estimated Tax For

Using the Delaware Form 200 ES involves several steps. First, taxpayers must calculate their expected annual income and the corresponding tax liability. This estimate will help determine the amount to be paid in each quarterly installment. After calculating the estimated tax, taxpayers fill out the form with their personal information, including name, address, and Social Security number. Once completed, the form must be submitted along with the payment for the estimated tax due.

Steps to complete the Delaware Form 200 ES Declaration Of Estimated Tax For

Completing the Delaware Form 200 ES requires careful attention to detail. Here are the steps involved:

- Gather necessary financial information, including income sources and deductions.

- Calculate the estimated annual income and tax liability.

- Determine the quarterly payment amounts based on the total estimated tax.

- Fill out the form with accurate personal and financial details.

- Review the form for accuracy before submission.

- Submit the form along with the payment by the specified deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Delaware Form 200 ES are crucial for compliance. Estimated tax payments are typically due on the fifteenth day of April, June, September, and January of the following year. Taxpayers should be aware of these dates to avoid penalties and interest for late payments. It is advisable to mark these deadlines on a calendar to ensure timely submissions.

Penalties for Non-Compliance

Failure to file the Delaware Form 200 ES or to make the required estimated tax payments can result in significant penalties. The state may impose a penalty for underpayment of estimated tax, which can accumulate over time. Additionally, interest may accrue on any unpaid tax amounts. To avoid these consequences, taxpayers should ensure they meet their estimated tax obligations promptly.

Eligibility Criteria

To be eligible to file the Delaware Form 200 ES, taxpayers must expect to owe one thousand dollars or more in tax for the current tax year. This applies to both individuals and businesses. Furthermore, taxpayers should have a valid Social Security number or Employer Identification Number (EIN) when submitting the form. Understanding these criteria helps ensure that the correct individuals and entities file the form appropriately.

Quick guide on how to complete delaware form 200 es declaration of estimated tax for

Effortlessly Prepare Delaware Form 200 ES Declaration Of Estimated Tax For on Any Device

Digital document management has become increasingly favored by both organizations and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without any holdups. Manage Delaware Form 200 ES Declaration Of Estimated Tax For on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Modify and eSign Delaware Form 200 ES Declaration Of Estimated Tax For with Ease

- Obtain Delaware Form 200 ES Declaration Of Estimated Tax For and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal authority as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Delaware Form 200 ES Declaration Of Estimated Tax For and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delaware form 200 es declaration of estimated tax for

Create this form in 5 minutes!

How to create an eSignature for the delaware form 200 es declaration of estimated tax for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Delaware Form 200 ES Declaration Of Estimated Tax For?

The Delaware Form 200 ES Declaration Of Estimated Tax For is a required document for businesses in Delaware to declare their estimated tax liabilities. This form helps ensure that taxpayers make timely payments throughout the year to avoid penalties. Understanding this form is crucial for compliance and financial planning.

-

How can airSlate SignNow help with the Delaware Form 200 ES Declaration Of Estimated Tax For?

airSlate SignNow streamlines the process of completing the Delaware Form 200 ES Declaration Of Estimated Tax For by providing easy-to-use eSigning features. You can fill out the form electronically, sign it, and send it without the hassle of printing or scanning. This saves time and reduces errors in your tax filings.

-

Is there a cost associated with using airSlate SignNow for the Delaware Form 200 ES Declaration Of Estimated Tax For?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for handling the Delaware Form 200 ES Declaration Of Estimated Tax For. We provide a clear breakdown of costs, ensuring that you can choose the plan that best fits your budget and usage. Check our website for the latest pricing information.

-

What features does airSlate SignNow offer for tax documents like the Delaware Form 200 ES Declaration Of Estimated Tax For?

airSlate SignNow offers a range of features tailored for handling tax documents, such as customizable templates, real-time collaboration, and secure cloud storage. With our platform, you can easily manage multiple revisions and ensure all stakeholders have access to the latest versions of the Delaware Form 200 ES Declaration Of Estimated Tax For. These features enhance efficiency and accuracy.

-

Is it easy to integrate airSlate SignNow with other software for handling the Delaware Form 200 ES Declaration Of Estimated Tax For?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, making it easier to manage your tax documents, including the Delaware Form 200 ES Declaration Of Estimated Tax For. This allows you to streamline your workflow and maintain a centralized document repository, ensuring that all essential documents are in one place.

-

Can I store previous versions of the Delaware Form 200 ES Declaration Of Estimated Tax For on airSlate SignNow?

Yes, airSlate SignNow provides a secure environment where you can store all versions of the Delaware Form 200 ES Declaration Of Estimated Tax For. This feature allows you to easily reference past submissions for review or compliance purposes. It also helps in tracking changes and ensuring accuracy in your filings.

-

How does airSlate SignNow ensure the security of my Delaware Form 200 ES Declaration Of Estimated Tax For?

Security is a top priority for airSlate SignNow. We utilize advanced encryption protocols and secure data storage to protect all your documents, including the Delaware Form 200 ES Declaration Of Estimated Tax For. Our platform also complies with industry standards to ensure that your sensitive information remains confidential and secure during the signing process.

Get more for Delaware Form 200 ES Declaration Of Estimated Tax For

Find out other Delaware Form 200 ES Declaration Of Estimated Tax For

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed