Form OW 8 P SUP I Annualized Income Installment Method for Individuals

Overview of the OW 8 P SUP I Annualized Income Installment Method

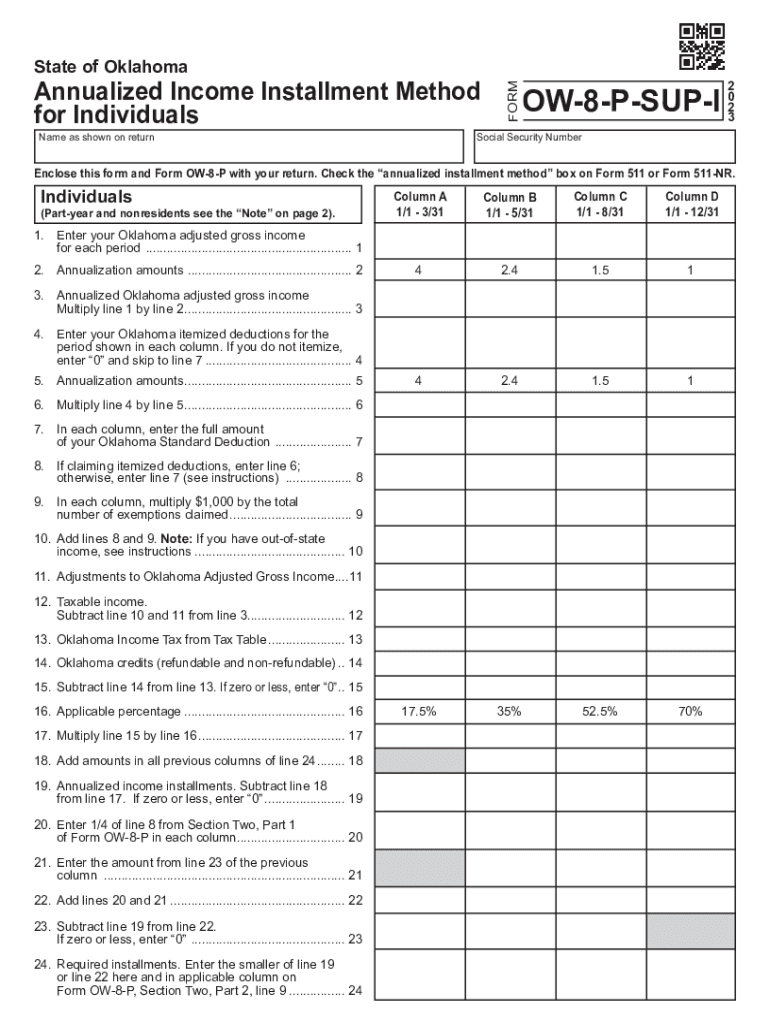

The OW 8 P SUP I form is designed for individuals who need to calculate their annualized income for installment payments. This method allows taxpayers to avoid penalties by aligning their estimated tax payments with their actual income throughout the year. It is particularly useful for those with fluctuating income, such as self-employed individuals or those with seasonal work. Understanding the purpose of this form is essential for accurate tax reporting and compliance.

Steps to Complete the OW 8 P SUP I Form

Completing the OW 8 P SUP I form involves several key steps:

- Gather all necessary income documentation, including pay stubs, invoices, and other income records.

- Calculate your annualized income based on the income received in each period.

- Fill out the form by entering your personal information and the calculated income amounts.

- Review the completed form for accuracy before submission.

Following these steps will help ensure that your form is filled out correctly, minimizing the risk of errors that could lead to penalties.

Obtaining the OW 8 P SUP I Form

The OW 8 P SUP I form can be obtained through various channels. It is available on the official state tax department website, where you can download a PDF version. Additionally, you may request a physical copy by contacting your local tax office. Ensure you have the most recent version of the form to comply with current tax regulations.

Legal Use of the OW 8 P SUP I Form

The OW 8 P SUP I form is legally recognized for tax purposes in the United States. It is essential for individuals who wish to report their income accurately and avoid underpayment penalties. Using this form correctly helps taxpayers stay compliant with federal and state tax laws, ensuring that all income is reported and taxed appropriately.

Filing Deadlines for the OW 8 P SUP I Form

Timely filing of the OW 8 P SUP I form is crucial to avoid penalties. The deadlines typically align with the annual tax filing dates. For most individuals, this means submitting the form by April 15 of the following year. However, if you are self-employed or have other specific circumstances, it is advisable to check for any applicable extensions or specific deadlines that may apply to your situation.

Examples of Using the OW 8 P SUP I Form

Consider a freelance graphic designer who experiences varying income levels throughout the year. By using the OW 8 P SUP I form, they can calculate their estimated tax payments based on the income they have received during specific periods, rather than estimating their annual income. This method can lead to more accurate tax payments and potentially reduce the risk of underpayment penalties.

Quick guide on how to complete form ow 8 p sup i annualized income installment method for individuals

Complete Form OW 8 P SUP I Annualized Income Installment Method For Individuals effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form OW 8 P SUP I Annualized Income Installment Method For Individuals on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and eSign Form OW 8 P SUP I Annualized Income Installment Method For Individuals without any hassle

- Find Form OW 8 P SUP I Annualized Income Installment Method For Individuals and click Get Form to begin.

- Use the tools provided to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign feature, which takes just moments and holds the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form OW 8 P SUP I Annualized Income Installment Method For Individuals and guarantee outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ow 8 p sup i annualized income installment method for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's pricing structure for using the ow 8 i features?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including the essential features of ow 8 i. You can choose from monthly and annual subscriptions, each designed to make eSigning and document management affordable. Our pricing ensures you get maximum value for the capabilities that ow 8 i brings to your workflow.

-

How does airSlate SignNow enhance document security for ow 8 i transactions?

airSlate SignNow prioritizes document security by implementing industry-standard encryption protocols, safeguarding your ow 8 i transactions. Each document is stored securely and is accessible only to authorized users, ensuring that your sensitive information remains protected. With features like user authentication and audit trails, you can trust that your documents are in safe hands.

-

What are the key features of airSlate SignNow that utilize the ow 8 i capabilities?

The ow 8 i capabilities of airSlate SignNow include seamless eSigning, customizable templates, and advanced document editing features. With these tools, businesses can streamline their document workflows, reduce turnaround times, and enhance collaboration among team members. The user-friendly interface makes it easy for anyone to leverage the full potential of ow 8 i.

-

Can airSlate SignNow integrate with other tools I currently use alongside ow 8 i?

Yes, airSlate SignNow offers a variety of integrations with popular applications that you may already be using, enhancing the functionality of ow 8 i. Tools like Google Drive, Salesforce, and Microsoft Office can effortlessly connect with airSlate SignNow, allowing for a smooth transition of documents and data. This integration capability maximizes your efficiency and productivity.

-

What are the benefits of using airSlate SignNow for ow 8 i eSigning?

Using airSlate SignNow for your ow 8 i eSigning needs brings numerous benefits including increased efficiency, cost savings, and improved document management. With its intuitive design, you can easily send and receive signed documents in real-time, speeding up your business processes. Plus, the automation features help eliminate human error, making your workflow more reliable.

-

How does airSlate SignNow support mobile users for ow 8 i functions?

airSlate SignNow is fully optimized for mobile devices, enabling users to access the ow 8 i features anytime, anywhere. Whether you are using a smartphone or tablet, you can easily send and sign documents on the go. This mobile usability ensures that you stay productive and engaged, even when you are away from your desk.

-

What customer support options are available for airSlate SignNow users focusing on ow 8 i?

Customers using airSlate SignNow to leverage ow 8 i can take advantage of various support options, including live chat, email assistance, and a comprehensive knowledge base. Our dedicated support team is available to help you troubleshoot any issues and ensure that you maximize the use of ow 8 i. With these resources, you'll have guidance whenever you need it.

Get more for Form OW 8 P SUP I Annualized Income Installment Method For Individuals

- Application for diplomatic official visa to indonesia 100422166 form

- Child immunization questionnaire form

- Change of contractor form

- Patient summary form bconsciouschirobbcomb

- Mpac request for occupancy form

- Educatoramp39s statement ramsey county minnesota co ramsey mn form

- Millionaire party qualification form educational organization

- Gardener contract template form

Find out other Form OW 8 P SUP I Annualized Income Installment Method For Individuals

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now