Form W9 Request for Taxpayer Identification and Certification 2009

What is the Form W-9 Request for Taxpayer Identification and Certification

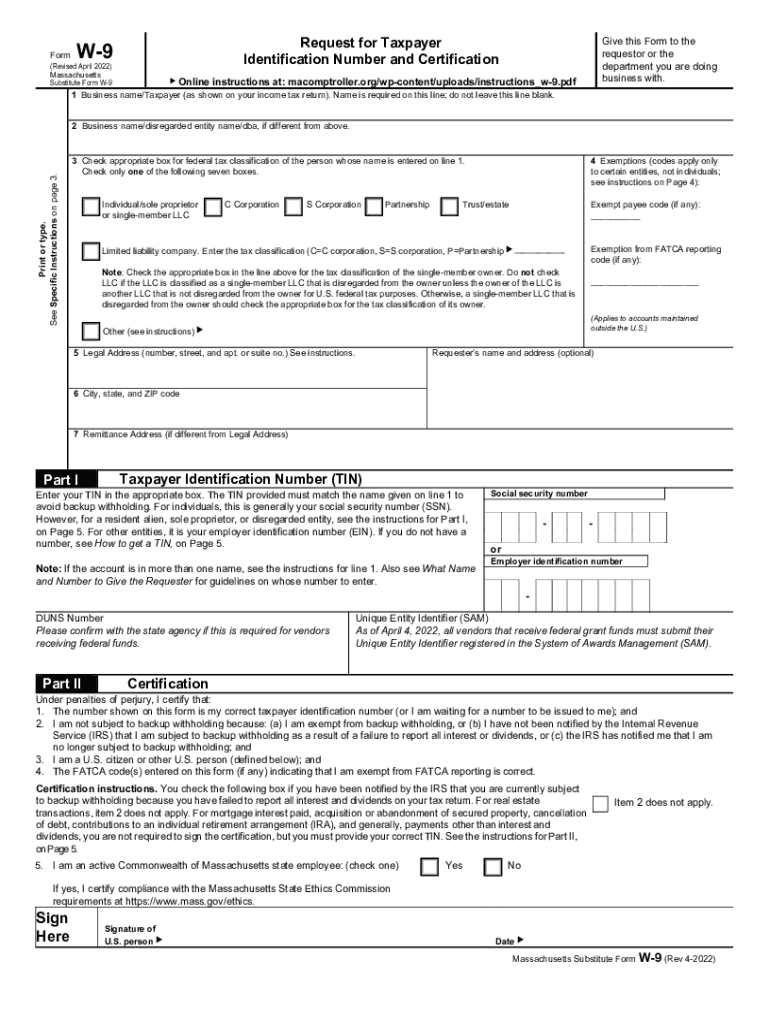

The Form W-9 is a request for taxpayer identification and certification used primarily in the United States. It is essential for individuals and entities that are required to provide their taxpayer identification number (TIN) to another party. The form is commonly used by freelancers, independent contractors, and businesses to report income paid to them to the Internal Revenue Service (IRS). By completing the W-9, individuals certify their TIN and confirm their tax status, which is crucial for accurate tax reporting.

Steps to Complete the Form W-9

Filling out the W-9 form involves several straightforward steps:

- Provide your name as it appears on your tax return.

- Enter your business name, if applicable.

- Select your federal tax classification, such as individual, corporation, or partnership.

- Fill in your address, including city, state, and ZIP code.

- Input your taxpayer identification number, which may be your Social Security number (SSN) or Employer Identification Number (EIN).

- Sign and date the form to certify that the information provided is accurate.

Once completed, the form should be submitted to the requesting party, not the IRS.

Legal Use of the Form W-9

The W-9 form is legally binding, and its primary purpose is to ensure accurate reporting of income to the IRS. It is important for both the requester and the individual providing the W-9 to understand its implications. The requester uses the information to prepare Form 1099, which reports payments made to the individual or entity. Failure to provide accurate information can lead to penalties for both parties, including backup withholding on payments made to the individual.

IRS Guidelines for the Form W-9

The IRS provides specific guidelines for completing and submitting the W-9 form. It is crucial to ensure that the information is current and accurate to avoid complications during tax filing. The IRS recommends that individuals review the form periodically, especially if there are changes in their tax status or personal information. Additionally, the IRS does not require the W-9 to be submitted with tax returns; it is only necessary when requested by a payer.

Form Submission Methods

The completed W-9 form can be submitted in various ways, depending on the requester's preferences:

- Online: Many businesses allow for electronic submission through secure portals.

- Email: The form can be scanned and emailed directly to the requester.

- Mail: A physical copy can be mailed to the requesting party at their designated address.

It is essential to choose a submission method that ensures the security of your personal information.

Examples of Using the Form W-9

Common scenarios where the W-9 form is utilized include:

- Freelancers providing services to clients who need to report payments made.

- Independent contractors working with businesses that require tax documentation.

- Landlords collecting rent from tenants who may need to report rental income.

In each case, the W-9 helps ensure that the correct taxpayer information is reported to the IRS, facilitating compliance with tax laws.

Quick guide on how to complete form w9 request for taxpayer identification and certification

Prepare Form W9 Request For Taxpayer Identification And Certification effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage Form W9 Request For Taxpayer Identification And Certification on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related operation today.

How to edit and eSign Form W9 Request For Taxpayer Identification And Certification with ease

- Locate Form W9 Request For Taxpayer Identification And Certification and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form W9 Request For Taxpayer Identification And Certification and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w9 request for taxpayer identification and certification

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W9 form in Massachusetts?

A W9 form in Massachusetts is a tax form used by the IRS for individuals and entities to provide their taxpayer identification information. Completing the W9 allows businesses to report payments they have made to you to the IRS. It’s essential for ensuring proper tax reporting and compliance when working with independent contractors or freelancers in Massachusetts.

-

How can airSlate SignNow help me complete a W9 in Massachusetts?

airSlate SignNow simplifies the process of completing a W9 in Massachusetts by enabling users to fill out the form electronically and eSign it securely. With our platform, you can easily share the completed W9 with stakeholders and keep track of submissions. This efficiency eliminates paper clutter and ensures that you remain compliant with Massachusetts tax requirements.

-

Is airSlate SignNow compliant with Massachusetts eSignature laws?

Yes, airSlate SignNow is fully compliant with Massachusetts eSignature laws, ensuring that your signed W9 forms are legally binding. Our platform uses advanced encryption and security measures to protect your sensitive information. Trust in airSlate SignNow for a secure and compliant solution for handling W9 forms in Massachusetts.

-

What are the costs associated with using airSlate SignNow for W9 forms?

Pricing for airSlate SignNow varies depending on the plan you choose, which includes features for creating, sending, and managing electronic documents like W9 forms. We provide different tiered pricing options to fit businesses of all sizes, so you can find one that suits your needs while ensuring your W9 processes in Massachusetts are cost-effective.

-

Can I integrate airSlate SignNow with other software to manage W9 forms in Massachusetts?

Yes, airSlate SignNow offers various integrations with popular business applications that allow you to streamline the management of W9 forms in Massachusetts. Whether you use CRMs, accounting software, or other platforms, our integrations enhance your workflow by making it easy to receive, manage, and store your W9 documents.

-

What advantages does airSlate SignNow provide for managing W9 forms in Massachusetts?

Using airSlate SignNow for W9 forms in Massachusetts allows you to save time, reduce paperwork, and enhance security through electronic signings. The platform is user-friendly, enabling businesses to complete and manage W9 forms faster than traditional paper methods. Additionally, our tracking features help you monitor the status of your forms and ensure compliance.

-

How secure is my information when using airSlate SignNow for a W9 in Massachusetts?

Your information is extremely secure when using airSlate SignNow for a W9 in Massachusetts. Our platform utilizes state-of-the-art encryption and security protocols to safeguard your sensitive data. We take your privacy seriously, ensuring that your W9 forms and other personal information remain protected against unauthorized access.

Get more for Form W9 Request For Taxpayer Identification And Certification

- Usapa da form 31

- 11 4 fertilization and the formation of the embryo answer key

- City of detroit pf hra claim formvmt comment

- Mri safety screening form

- South dakota driver evaluation request form

- Paid family leave form sample

- Selling agent commission verification first integrity title firstintegritytitle form

- Illinois1call form

Find out other Form W9 Request For Taxpayer Identification And Certification

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy