Employer S Quarterly Report for Employees Contract Form

Understanding the Employer’s Quarterly Report For Employees Contract

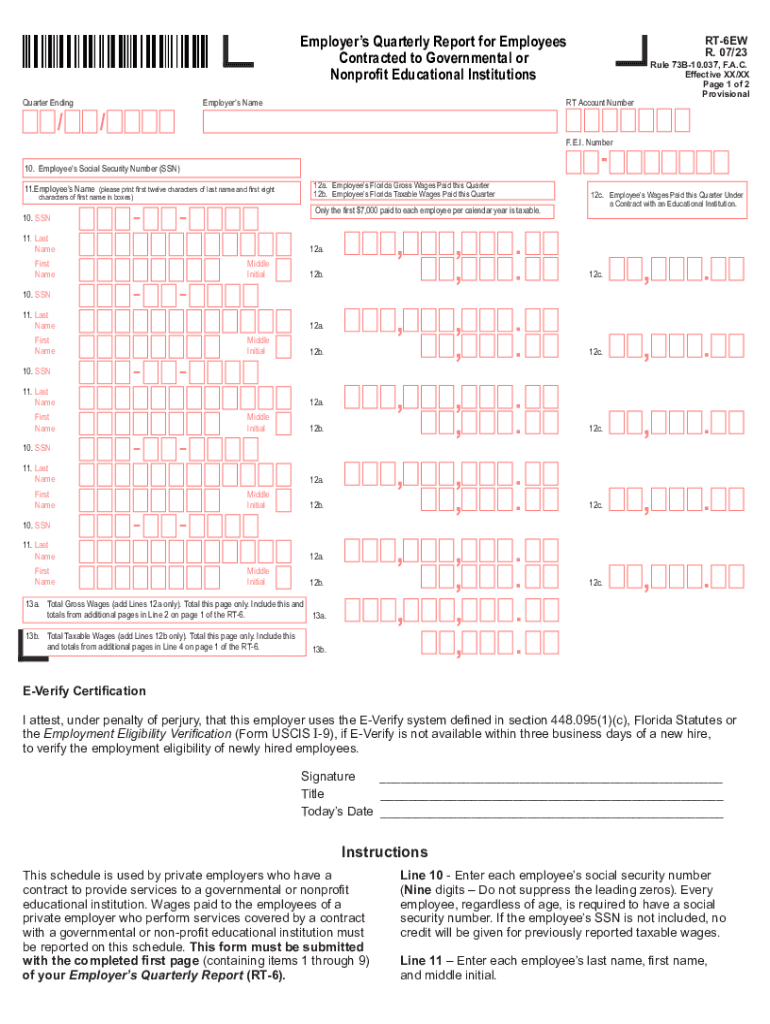

The Employer’s Quarterly Report For Employees Contract is a crucial document that employers in the United States must complete to report wages, taxes withheld, and other relevant employee information to the government. This report is typically submitted to the Internal Revenue Service (IRS) and state tax agencies. It helps ensure compliance with tax laws and provides necessary data for social security and unemployment benefits. Understanding this report is essential for maintaining accurate payroll records and fulfilling legal obligations.

Steps to Complete the Employer’s Quarterly Report For Employees Contract

Completing the Employer’s Quarterly Report involves several key steps:

- Gather employee information, including names, addresses, and Social Security numbers.

- Compile wage data for each employee, detailing earnings for the quarter.

- Calculate the total taxes withheld from employee wages, including federal and state taxes.

- Fill out the report accurately, ensuring all required fields are completed.

- Review the report for accuracy before submission to avoid penalties.

Filing Deadlines and Important Dates

Timely submission of the Employer’s Quarterly Report is essential to avoid penalties. Generally, employers must file this report within a month following the end of each quarter. The specific deadlines are:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Legal Use of the Employer’s Quarterly Report For Employees Contract

The Employer’s Quarterly Report serves a legal purpose by ensuring compliance with federal and state employment laws. It is used to report employee earnings and tax withholdings, which are critical for determining eligibility for benefits such as unemployment insurance and social security. Failure to file this report can result in legal repercussions, including fines and penalties.

Required Documents for Filing

To complete the Employer’s Quarterly Report, several documents are necessary:

- Employee payroll records, including wage and tax information.

- Previous quarter reports for reference and consistency.

- Employer identification number (EIN) for accurate reporting.

- Any state-specific forms or requirements that may apply.

Who Issues the Employer’s Quarterly Report

The Employer’s Quarterly Report is typically issued by the IRS and may also involve state tax agencies. Employers must ensure they are using the correct version of the report, as requirements can vary by state. It is important to stay updated on any changes to reporting requirements or forms to ensure compliance.

Quick guide on how to complete employers quarterly report for employees contract

Complete Employer s Quarterly Report For Employees Contract seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any hold-ups. Manage Employer s Quarterly Report For Employees Contract on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

How to alter and eSign Employer s Quarterly Report For Employees Contract effortlessly

- Locate Employer s Quarterly Report For Employees Contract and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Employer s Quarterly Report For Employees Contract to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employers quarterly report for employees contract

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Employer’s Quarterly Report For Employees Contract?

The Employer’s Quarterly Report For Employees Contract is a vital document that employers must submit, detailing employee earnings and tax contributions every quarter. This report helps ensure compliance with tax laws and provides enrolled employees with important data regarding their earnings and withholdings.

-

How can airSlate SignNow help with the Employer’s Quarterly Report For Employees Contract?

airSlate SignNow streamlines the process of preparing and submitting the Employer’s Quarterly Report For Employees Contract by allowing users to easily eSign and manage documents. Our user-friendly platform simplifies collaboration, ensuring that all necessary signatures are obtained efficiently.

-

What are the pricing options for using airSlate SignNow for the Employer’s Quarterly Report For Employees Contract?

airSlate SignNow offers several pricing plans to accommodate businesses of all sizes, allowing you to choose the best option for preparing your Employer’s Quarterly Report For Employees Contract. Each plan comes with various features, ensuring you can find a cost-effective solution that meets your needs.

-

What features does airSlate SignNow provide for the Employer’s Quarterly Report For Employees Contract?

airSlate SignNow includes features like customizable templates, eSigning capabilities, and secure storage to simplify the completion of the Employer’s Quarterly Report For Employees Contract. Additionally, our platform offers integration with other tools, enhancing productivity and collaboration.

-

How does airSlate SignNow ensure the security of the Employer’s Quarterly Report For Employees Contract?

Security is a top priority for airSlate SignNow. We use advanced encryption technologies and secure cloud storage to protect the integrity of the Employer’s Quarterly Report For Employees Contract, ensuring that sensitive employee data remains confidential and safe from unauthorized access.

-

Can I integrate airSlate SignNow with my existing systems for managing the Employer’s Quarterly Report For Employees Contract?

Yes, airSlate SignNow offers seamless integrations with various business tools and software, enabling you to efficiently manage the Employer’s Quarterly Report For Employees Contract within your existing workflows. This connectivity enhances productivity and provides a smoother experience when handling important documents.

-

What are the benefits of using airSlate SignNow for the Employer’s Quarterly Report For Employees Contract?

Using airSlate SignNow for the Employer’s Quarterly Report For Employees Contract streamlines the eSigning process, reduces paperwork, and minimizes delays in document handling. This ensures timely submissions and helps maintain compliance with state regulations, ultimately saving your business time and money.

Get more for Employer s Quarterly Report For Employees Contract

Find out other Employer s Quarterly Report For Employees Contract

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer