New Jersey Resident Return, Form NJ 1040 2022

What is the New Jersey Resident Return, Form NJ 1040

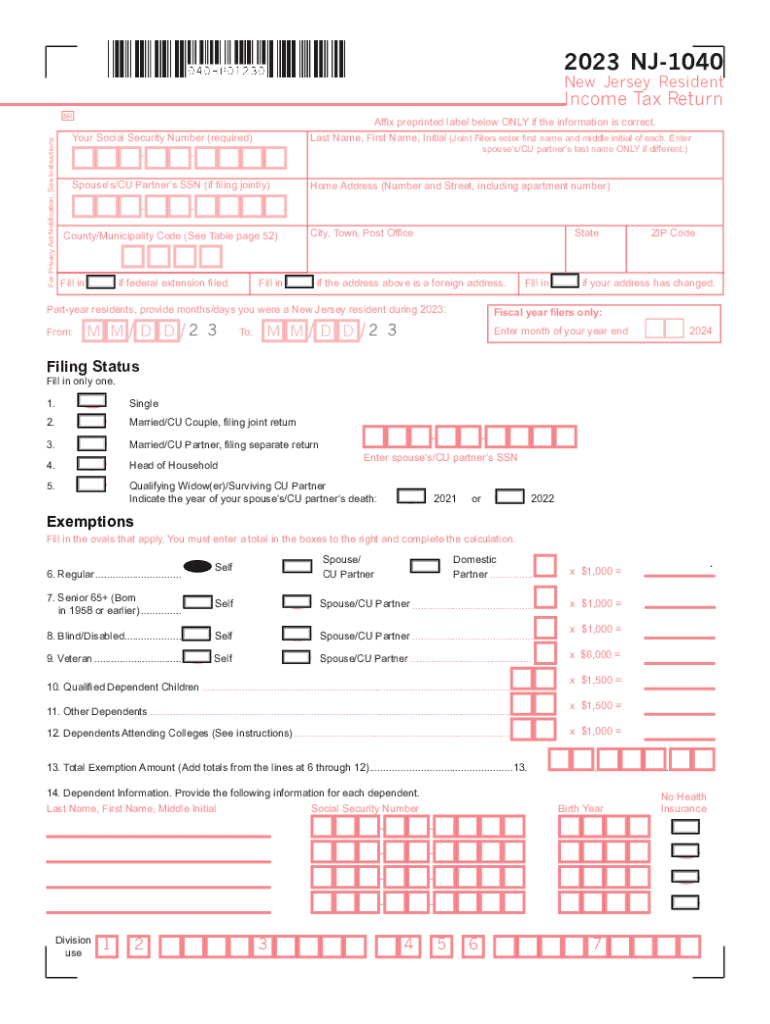

The New Jersey Resident Return, commonly referred to as Form NJ 1040, is the official document used by residents of New Jersey to report their income and calculate their state tax obligations. This form is essential for individuals who earn income while living in New Jersey, as it allows them to accurately declare their earnings and claim any eligible deductions or credits. The NJ 1040 is specifically designed for residents, differentiating it from forms intended for non-residents or part-year residents.

How to obtain the New Jersey Resident Return, Form NJ 1040

To obtain the New Jersey Resident Return, Form NJ 1040, individuals can visit the New Jersey Division of Taxation's official website, where they can download the form in PDF format. Additionally, physical copies of the form may be available at various state offices or public libraries. It is important to ensure that you are using the correct version for the tax year you are filing, as forms may be updated annually.

Steps to complete the New Jersey Resident Return, Form NJ 1040

Completing the New Jersey Resident Return involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, dividends, and any other sources of income.

- Claim deductions and credits for which you qualify, such as property tax deductions or charitable contributions.

- Calculate your total tax liability based on the information provided.

- Sign and date the form before submitting it.

Key elements of the New Jersey Resident Return, Form NJ 1040

Form NJ 1040 includes several key elements that are crucial for accurate tax reporting:

- Personal Information: This section captures your identity and residency details.

- Income Reporting: You must detail all sources of income, including wages and self-employment earnings.

- Deductions and Credits: Eligible deductions can significantly reduce your taxable income, so it's important to identify and claim them.

- Tax Calculation: This section helps determine your tax obligation based on the reported income and applicable rates.

Filing Deadlines / Important Dates

The filing deadline for the New Jersey Resident Return, Form NJ 1040, typically aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these dates, as timely filing can help avoid penalties and interest on unpaid taxes.

Required Documents

When completing the New Jersey Resident Return, several documents are required to ensure accurate reporting:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income.

- Documentation for deductions, including property tax bills and receipts for charitable donations.

Quick guide on how to complete new jersey resident return form nj 1040

Effortlessly Prepare New Jersey Resident Return, Form NJ 1040 on Any Device

Digital document management has gained popularity among both companies and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without interruptions. Manage New Jersey Resident Return, Form NJ 1040 on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign New Jersey Resident Return, Form NJ 1040 without Stress

- Find New Jersey Resident Return, Form NJ 1040 and select Get Form to begin.

- Employ the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign New Jersey Resident Return, Form NJ 1040 while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new jersey resident return form nj 1040

Create this form in 5 minutes!

How to create an eSignature for the new jersey resident return form nj 1040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of using you 1040 with airSlate SignNow?

Using you 1040 with airSlate SignNow allows you to eSign and send important tax documents quickly and securely. With our user-friendly interface, managing your tax forms becomes simpler, ensuring you never miss a deadline.

-

How does airSlate SignNow help streamline the you 1040 filing process?

airSlate SignNow streamlines the you 1040 filing by enabling you to prepare, sign, and send documents electronically. This enhances efficiency and reduces the time spent on paperwork, allowing you to focus on what matters most.

-

What features does airSlate SignNow offer for managing you 1040 documents?

airSlate SignNow offers features such as customizable templates, real-time status tracking, and automatic notifications that enhance your experience in managing you 1040 documents. These tools help you ensure everything is organized and up to date.

-

What is the pricing structure for using airSlate SignNow for you 1040 forms?

The pricing for airSlate SignNow is competitive and tailored to fit different business needs, including a plan specifically designed for handling you 1040 forms. This affordability makes it a cost-effective solution for both small and large businesses.

-

Can I integrate airSlate SignNow with other applications for handling you 1040?

Yes, airSlate SignNow can be integrated with a variety of applications, making the handling of your you 1040 processes seamless. This interoperability ensures you can sync your eSigning activities with your existing workflows.

-

How can airSlate SignNow enhance security for you 1040 transactions?

airSlate SignNow enhances security for your you 1040 transactions by deploying advanced encryption methods and secure access protocols. This ensures that your sensitive documents remain confidential and protected against unauthorized access.

-

What benefits does airSlate SignNow provide for small businesses managing you 1040?

For small businesses managing you 1040, airSlate SignNow offers signNow time savings and cost efficiencies. With our reliable eSigning capabilities, you can reduce administrative burdens and improve productivity, allowing your business to thrive.

Get more for New Jersey Resident Return, Form NJ 1040

- Personal financial statement pdf bank first national form

- Cefi report template form

- Andersplus time sheet form

- Rebny coop sublease bapplicationb douglas elliman property bb form

- Geometry 6 3a worksheet form

- Nystrom world atlas 5th edition pdf form

- Bformb for bpartial paymentb final settlement of iafba bb indian air force indianairforce nic

- Sleep center referral form national jewish health nationaljewish

Find out other New Jersey Resident Return, Form NJ 1040

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online