New Jersey Resident Return, Form NJ 1040 New Jersey Resident Return, Form NJ 1040 2022

What is the New Jersey Resident Return, Form NJ 1040

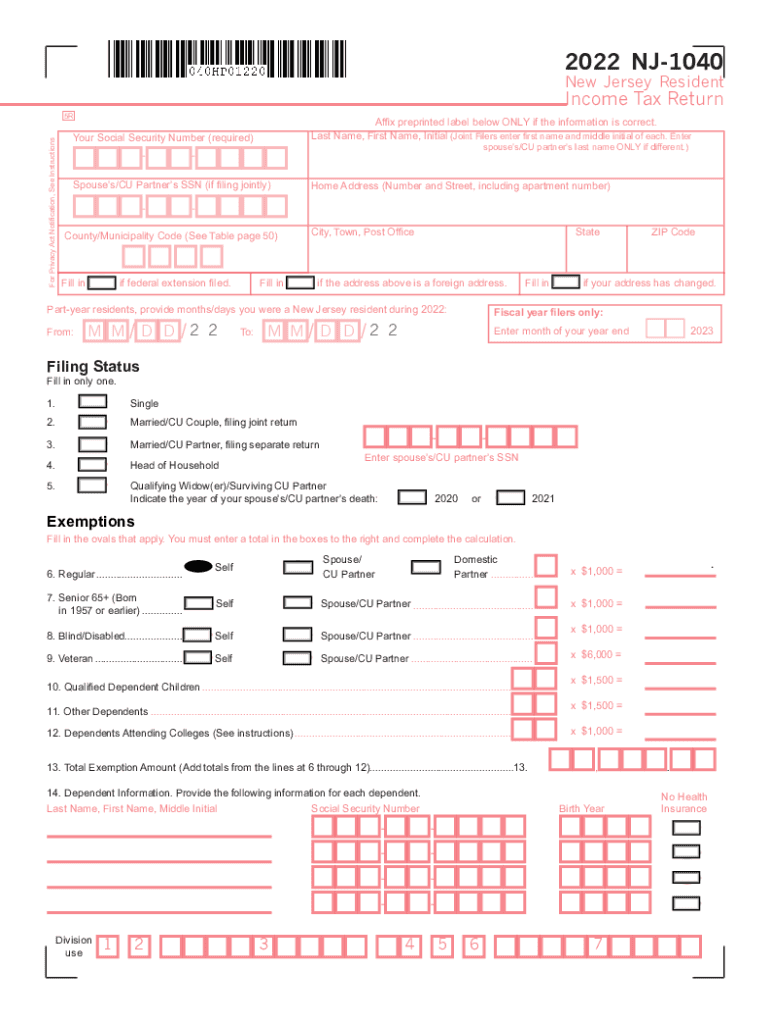

The New Jersey Resident Return, Form NJ 1040, is a tax form used by residents of New Jersey to report their income and calculate their state tax liability. This form is essential for individuals who earn income while residing in the state, as it helps determine the amount of state tax owed or the refund due. The NJ 1040 is specifically designed for residents, distinguishing it from other forms such as the NJ 1040NR, which is for non-residents. Understanding the purpose of this form is crucial for ensuring compliance with state tax laws.

Steps to complete the New Jersey Resident Return, Form NJ 1040

Completing the New Jersey Resident Return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include wages, interest, and dividends.

- Calculate your taxable income by applying any deductions or exemptions available to you.

- Determine your tax liability using the New Jersey tax tables provided in the instructions.

- Complete any additional schedules if required, such as those for credits or special circumstances.

- Review the entire form for accuracy before signing and dating it.

Filing Deadlines / Important Dates

Filing deadlines for the New Jersey Resident Return, Form NJ 1040, are critical to avoid penalties. Typically, the deadline for submitting your NJ 1040 is April fifteenth of the year following the tax year. For the 2022 tax year, the due date is April 18, 2023, due to the weekend and holiday considerations. If you need more time, you may request an extension, but it is important to note that this does not extend the time to pay any taxes owed.

Required Documents

To successfully complete the NJ 1040, you will need several documents that provide proof of income and deductions. Essential documents include:

- W-2 forms from employers showing wages earned.

- 1099 forms for any freelance or contract work.

- Records of other income, such as rental income or interest.

- Documentation for deductions, including mortgage interest statements, property tax bills, and medical expenses.

Legal use of the New Jersey Resident Return, Form NJ 1040

The legal use of the NJ 1040 is governed by state tax laws, which require residents to report their income accurately. Filing this form is not only a legal obligation but also a means to ensure that you are contributing to state services and infrastructure. Failure to file or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications and ensuring compliance is vital for all New Jersey residents.

How to obtain the New Jersey Resident Return, Form NJ 1040

The New Jersey Resident Return, Form NJ 1040, can be obtained through several channels. Residents can download the form directly from the New Jersey Division of Taxation's website. Additionally, physical copies are often available at local tax offices, libraries, and community centers. It is important to ensure that you are using the correct version for the tax year you are filing, as forms may change annually.

Quick guide on how to complete 2022 new jersey resident return form nj 1040 2022 new jersey resident return form nj 1040

Complete New Jersey Resident Return, Form NJ 1040 New Jersey Resident Return, Form NJ 1040 effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed papers, enabling you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage New Jersey Resident Return, Form NJ 1040 New Jersey Resident Return, Form NJ 1040 on any device with airSlate SignNow Android or iOS applications and streamline any document-related processes today.

The easiest way to modify and eSign New Jersey Resident Return, Form NJ 1040 New Jersey Resident Return, Form NJ 1040 without exertion

- Find New Jersey Resident Return, Form NJ 1040 New Jersey Resident Return, Form NJ 1040 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight signNow sections of your documents or mask sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from any chosen device. Edit and eSign New Jersey Resident Return, Form NJ 1040 New Jersey Resident Return, Form NJ 1040 and facilitate excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 new jersey resident return form nj 1040 2022 new jersey resident return form nj 1040

Create this form in 5 minutes!

How to create an eSignature for the 2022 new jersey resident return form nj 1040 2022 new jersey resident return form nj 1040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key components of the NJ 1040 instructions 2022?

The NJ 1040 instructions 2022 provide detailed guidance on how to fill out your New Jersey individual income tax return. This includes information on filing status, exemptions, and deductions as well as specific forms needed. Understanding these components is crucial for accurate tax filing and can help prevent costly mistakes.

-

How can I access the NJ 1040 instructions 2022?

You can access the NJ 1040 instructions 2022 directly on the New Jersey Division of Taxation's website. They provide downloadable PDFs of the instructions along with the forms you need for filing your taxes. It's important to ensure you're using the latest version to comply with current tax regulations.

-

Where can I find help if I have questions about the NJ 1040 instructions 2022?

If you have questions about the NJ 1040 instructions 2022, you can signNow out to the New Jersey Division of Taxation or consult a certified tax professional. Additionally, many online resources, including tax forums and websites, offer support and guidance for filling out your forms correctly. Always ensure that the advice you receive is from credible sources.

-

What benefits does airSlate SignNow offer for eSigning NJ 1040 forms?

AirSlate SignNow streamlines the eSigning process for NJ 1040 forms, allowing you to sign documents digitally with ease. The platform's user-friendly interface ensures a smooth experience, and you can securely send and receive forms from anywhere. This efficiency saves time and enhances convenience, especially during tax season.

-

Is there a cost associated with using airSlate SignNow for NJ 1040 instructions 2022?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan allows businesses to efficiently manage document signing, including NJ 1040 instructions 2022. Investing in this platform can be cost-effective compared to traditional methods of document management.

-

Can I integrate airSlate SignNow with other tools while working on NJ 1040 instructions 2022?

AirSlate SignNow offers seamless integrations with various applications to enhance your workflow. Whether you are using CRM systems, cloud storage, or project management tools, signing documents related to NJ 1040 instructions 2022 becomes more efficient. This capability ensures that all your tools work in harmony to simplify the document management process.

-

What features does airSlate SignNow provide to assist with tax document signing?

AirSlate SignNow provides several features to assist with tax document signing, including template creation, automated reminders, and secure storage. These features ensure that your NJ 1040 forms are signed timely and stored securely. With robust tracking options, you can easily monitor the status of your documents throughout the signing process.

Get more for New Jersey Resident Return, Form NJ 1040 New Jersey Resident Return, Form NJ 1040

Find out other New Jersey Resident Return, Form NJ 1040 New Jersey Resident Return, Form NJ 1040

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter