Nj 1040 V Form 2023-2026

What is the NJ 1040 Form?

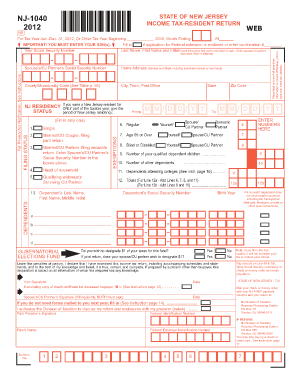

The NJ 1040 form, also known as the New Jersey Resident Income Tax Return, is a tax document used by residents of New Jersey to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, as it helps determine the amount of tax owed or the refund due. The NJ 1040 is specifically designed for residents, ensuring that all applicable state tax credits and deductions are considered.

Steps to Complete the NJ 1040 Form

Completing the NJ 1040 form involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report your income: Include all sources of income, such as wages, dividends, and interest.

- Claim deductions and credits: Identify and apply any eligible state deductions and credits to reduce your taxable income.

- Calculate your tax: Use the provided tax tables to determine your tax liability based on your taxable income.

- Review and sign: Double-check all entries for accuracy, then sign and date the form.

How to Obtain the NJ 1040 Form

The NJ 1040 form can be obtained through several convenient methods. Residents can access the form online by visiting the New Jersey Division of Taxation's website, where it is available as a downloadable PDF. Additionally, printed copies of the NJ 1040 form can be requested by mail or found at local libraries and government offices throughout New Jersey. For those who prefer a digital approach, tax preparation software often includes the NJ 1040 form, allowing for easy completion and submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the NJ 1040 form to avoid penalties. Typically, the deadline for filing the NJ 1040 is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, residents should be mindful of any extensions that may apply, which can provide additional time to file the form, although any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods

Residents have multiple options for submitting the NJ 1040 form. The form can be filed electronically through approved e-filing software, which often provides a streamlined process for submission. Alternatively, individuals may choose to print the completed form and mail it to the New Jersey Division of Taxation. For those who prefer in-person submissions, local tax offices may accept the form directly, although it is advisable to check in advance for specific procedures and hours of operation.

Key Elements of the NJ 1040 Form

The NJ 1040 form includes several key elements that are essential for accurate tax reporting. Important sections consist of personal information, income reporting, deductions, and credits. Additionally, the form features a calculation section to determine the total tax liability. Understanding these components is vital for ensuring that all required information is included and accurately reported, which can help prevent issues during the filing process.

Eligibility Criteria

To file the NJ 1040 form, individuals must meet specific eligibility criteria. Primarily, the form is intended for residents of New Jersey who have earned income during the tax year. This includes individuals who have established residency in the state and have a permanent address. Additionally, those who are part-year residents or have income sourced from New Jersey may also be required to file the NJ 1040, depending on their circumstances. Understanding these eligibility requirements is essential for compliance with state tax laws.

Quick guide on how to complete nj 1040 v form

Effortlessly complete Nj 1040 V Form on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features essential for creating, editing, and electronically signing your documents swiftly and without complications. Manage Nj 1040 V Form on any device using the airSlate SignNow mobile applications for Android or iOS and streamline your document-related tasks today.

How to edit and eSign Nj 1040 V Form effortlessly

- Locate Nj 1040 V Form and click Get Form to begin.

- Utilize the tools we provide to complete your form submission.

- Emphasize pertinent sections of the documents or conceal confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to preserve your modifications.

- Select your preferred method to deliver your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or the need to print new document copies due to errors. airSlate SignNow meets your document management requirements with just a few clicks from any device of your choosing. Edit and eSign Nj 1040 V Form to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj 1040 v form

Create this form in 5 minutes!

How to create an eSignature for the nj 1040 v form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 NJ 1040 form?

The 2023 NJ 1040 form is the state income tax return form used by residents of New Jersey to report their income and calculate their tax liability. It is essential for ensuring compliance with state tax laws and is typically due on April 15th. Completing the 2023 NJ 1040 accurately can help you avoid penalties and maximize your potential refund.

-

How can airSlate SignNow help with the 2023 NJ 1040 filing process?

airSlate SignNow streamlines the process of preparing and signing your 2023 NJ 1040 by allowing you to easily send documents for eSignature. Our platform ensures that all necessary signatures are collected efficiently, reducing the time spent on paperwork. With airSlate SignNow, you can focus on your finances while we handle the document management.

-

What are the pricing options for using airSlate SignNow for the 2023 NJ 1040?

airSlate SignNow offers flexible pricing plans that cater to different business needs, starting with a free trial. Our plans are designed to be cost-effective, ensuring you get the best value while managing your 2023 NJ 1040 and other documents. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for managing the 2023 NJ 1040?

airSlate SignNow provides a range of features to assist with the 2023 NJ 1040, including customizable templates, secure eSignature options, and document tracking. These features help ensure that your tax documents are completed accurately and submitted on time. Additionally, our user-friendly interface makes it easy for anyone to navigate the process.

-

Are there any integrations available with airSlate SignNow for the 2023 NJ 1040?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your 2023 NJ 1040. These integrations allow for automatic data transfer, reducing the risk of errors and saving you time. You can connect your existing tools to streamline your tax preparation process.

-

What are the benefits of using airSlate SignNow for the 2023 NJ 1040?

Using airSlate SignNow for your 2023 NJ 1040 offers numerous benefits, including increased efficiency, enhanced security, and improved collaboration. Our platform allows you to manage your documents from anywhere, ensuring you can work on your taxes at your convenience. Additionally, the eSignature feature ensures that your documents are legally binding and secure.

-

Is airSlate SignNow secure for handling the 2023 NJ 1040?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your 2023 NJ 1040 and other sensitive documents are protected. We utilize advanced encryption and security protocols to safeguard your information. You can trust that your data is safe while using our platform.

Get more for Nj 1040 V Form

- Clla staff scholarship form

- Financial aid forms college of dupage

- Pathway minor declaration form

- Application instructionsdepartment of mathematics osu math form

- Lidr immunology core flow cytometry information s heet

- Phd in rural health sciences application form mercer

- Nphcmgc intake packet oklahoma state university form

- Rules and regulations governing the use of college form

Find out other Nj 1040 V Form

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online