1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA Form

What is the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA?

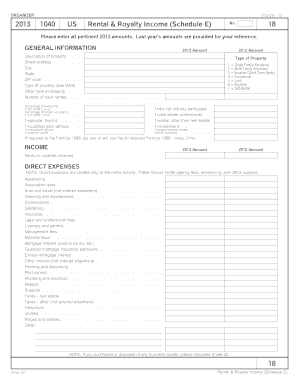

The 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA is a tax form used by individuals to report income and expenses related to rental properties and royalties. This form is essential for taxpayers who earn income from renting out real estate or receiving royalties from intellectual property. It allows for the detailed reporting of various income sources, including residential and commercial rentals, as well as royalties from copyrights, patents, and trademarks.

Steps to complete the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA

Completing the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA involves several steps:

- Gather necessary documents, including rental agreements, income statements, and expense receipts.

- Fill out the identification section, providing your name, address, and Social Security number.

- Report rental income in Part I, detailing the total income received from each property.

- List allowable expenses in Part II, including mortgage interest, property taxes, repairs, and management fees.

- Calculate the net rental income or loss by subtracting total expenses from total income.

- Complete any additional sections relevant to royalties if applicable.

- Review the form for accuracy and ensure all required signatures are included.

How to use the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA

Using the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA effectively requires understanding its structure and purpose. Start by familiarizing yourself with the form's sections, which include income reporting, expense deductions, and net income calculations. Ensure you have all relevant financial information at hand, such as rental agreements and expense receipts. After completing the form, it can be submitted with your federal tax return, either electronically or by mail, depending on your filing preference.

Legal use of the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA

The 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA is legally recognized for reporting rental and royalty income to the IRS. Accurate completion of this form is crucial for compliance with federal tax laws. Misreporting or failing to file can result in penalties or audits. It is important to maintain thorough records of all income and expenses related to rental properties and royalties to support the information reported on the schedule.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA align with the general tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. If you require additional time, you may file for an extension, which generally provides an additional six months. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA, several documents are necessary:

- Rental agreements and leases

- Income statements from rental properties

- Receipts for deductible expenses, such as repairs and maintenance

- Property tax statements

- Mortgage interest statements (Form 1098)

Quick guide on how to complete 1040 us rental amp royalty income schedule e 18 18 ensign cpa

Complete 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct forms and securely save them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA on any device with airSlate SignNow Android or iOS applications and streamline your document-oriented processes today.

The easiest way to modify and eSign 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA without a hassle

- Find 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Decide how you want to share your form—via email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA and guarantee clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040 us rental amp royalty income schedule e 18 18 ensign cpa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA?

The 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA is a tax form that allows individuals to report income or losses from rental real estate and royalties. This form is essential for accurately calculating taxable income, ensuring compliance with IRS regulations. It simplifies the process of filing taxes related to rental properties and ensures that you benefit from all available deductions.

-

How can airSlate SignNow help with the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA?

airSlate SignNow offers a streamlined solution for signing and sending the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA. By utilizing our platform, you can electronically sign documents, saving both time and resources. Our intuitive interface simplifies the document management process, ensuring that your tax forms are completed and submitted efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans to accommodate businesses of all sizes. Our plans include features tailored for easy document signing, including the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA. You can choose a plan that best meets your needs, ensuring you have access to our extensive features without breaking the bank.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions, allowing you to easily manage and send documents like the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA. This integration helps eliminate data entry errors and streamlines your workflow, enhancing efficiency in your financial operations.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features for effective document management, such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the usability of critical documents like the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA, making it easier to access and manage your tax filings.

-

Is my data secure with airSlate SignNow?

Absolutely. airSlate SignNow prioritizes data security and implements robust protocols to protect your information. This is especially important when dealing with sensitive documents like the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA, ensuring that your data remains confidential and secure.

-

What benefits can I expect from using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including the 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA, provides numerous benefits. These include increased efficiency in document processing, enhanced collaboration with tax professionals, and quicker turnaround times for getting documents signed and submitted.

Get more for 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA

Find out other 1040 US Rental & Royalty Income Schedule E 18 18 Ensign CPA

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors