Massachusetts Department of Revenue Form 84 Applic

What is the Massachusetts Department Of Revenue Form 84 Applic

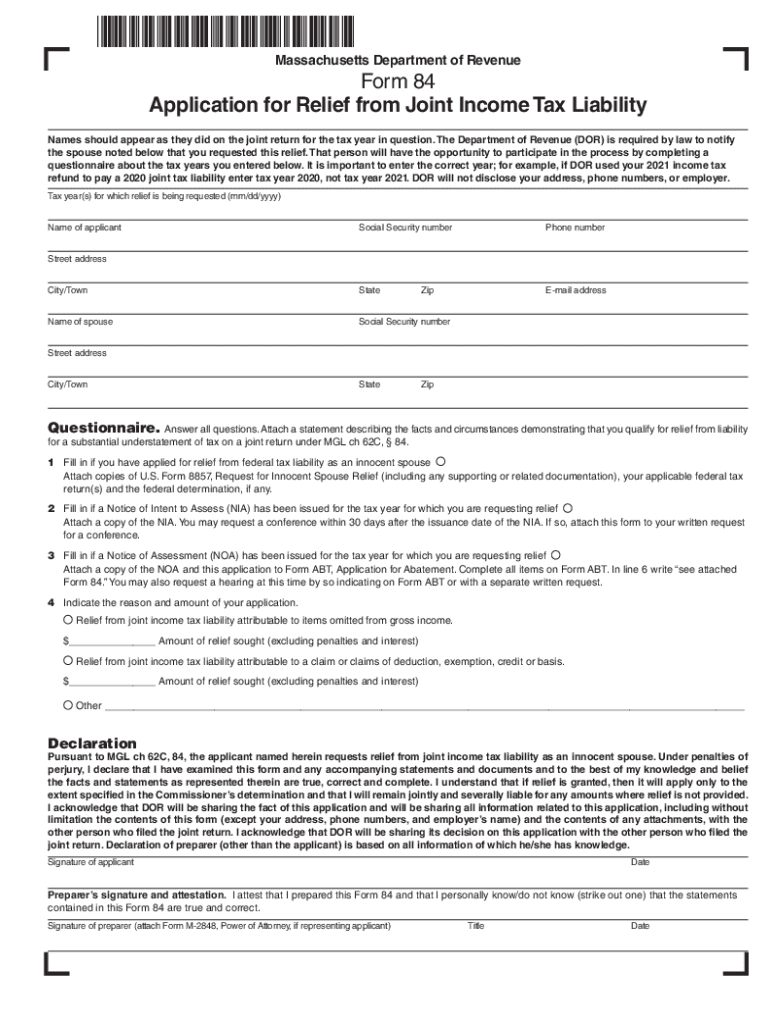

The Massachusetts Department Of Revenue Form 84 Applic is an official document used for applying for certain tax-related benefits or exemptions within the state. This form is crucial for individuals and businesses seeking to establish eligibility for specific tax statuses, such as those related to property tax exemptions or other fiscal considerations. Understanding the purpose of this form is essential for compliance and ensuring that applicants receive the appropriate benefits.

How to use the Massachusetts Department Of Revenue Form 84 Applic

Using the Massachusetts Department Of Revenue Form 84 Applic involves several straightforward steps. First, ensure that you have the correct version of the form, which can be obtained from the Massachusetts Department of Revenue website or through authorized offices. Complete the form by providing accurate information as required, including personal details and any relevant financial data. After filling out the form, review it for accuracy before submission to avoid delays or rejections.

Steps to complete the Massachusetts Department Of Revenue Form 84 Applic

Completing the Massachusetts Department Of Revenue Form 84 Applic requires careful attention to detail. Follow these steps:

- Download or obtain the form from the Massachusetts Department of Revenue.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Provide any required financial information, such as income or property details.

- Review the form for completeness and accuracy.

- Sign and date the form as required.

Legal use of the Massachusetts Department Of Revenue Form 84 Applic

The legal use of the Massachusetts Department Of Revenue Form 84 Applic is essential for ensuring compliance with state tax laws. This form must be filled out accurately and submitted within the designated time frames to avoid penalties. Misuse or incorrect submission of the form can lead to legal repercussions, including fines or denial of benefits. It is advisable to consult legal or tax professionals if there are uncertainties regarding the form's use.

Required Documents

When submitting the Massachusetts Department Of Revenue Form 84 Applic, certain supporting documents may be required. These typically include:

- Proof of identity, such as a driver's license or state ID.

- Documentation supporting claims for exemptions, such as income statements or property tax records.

- Any additional forms or schedules as specified by the Massachusetts Department of Revenue.

Form Submission Methods

The Massachusetts Department Of Revenue Form 84 Applic can be submitted through various methods. Applicants have the option to file the form online, via mail, or in person at designated offices. Each method has its own processing times and requirements, so it is important to choose the one that best suits your needs. Ensure that you keep copies of all submitted documents for your records.

Quick guide on how to complete massachusetts department of revenue form 84 applic

Complete Massachusetts Department Of Revenue Form 84 Applic effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without any holdups. Handle Massachusetts Department Of Revenue Form 84 Applic on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Massachusetts Department Of Revenue Form 84 Applic with ease

- Find Massachusetts Department Of Revenue Form 84 Applic and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to finalize your edits.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Massachusetts Department Of Revenue Form 84 Applic and assure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form 84 applic

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts Department Of Revenue Form 84 Applic?

The Massachusetts Department Of Revenue Form 84 Applic is a form used for specific tax-related purposes in Massachusetts. It allows taxpayers to provide essential information to the Department of Revenue. Understanding this form is crucial for compliance and ensuring timely processing of tax matters.

-

How can airSlate SignNow help with the Massachusetts Department Of Revenue Form 84 Applic?

airSlate SignNow provides a simple and secure platform to electronically sign and send the Massachusetts Department Of Revenue Form 84 Applic. Our solution ensures that your documents are legally binding and can be easily shared with the required authorities. This streamlines the entire process, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the Massachusetts Department Of Revenue Form 84 Applic?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. The cost of using our platform for the Massachusetts Department Of Revenue Form 84 Applic is competitive and designed to provide exceptional value. You can choose a plan that aligns with your document eSigning requirements.

-

What features does airSlate SignNow offer for processing the Massachusetts Department Of Revenue Form 84 Applic?

airSlate SignNow includes features such as secure cloud storage, customizable templates, and real-time tracking for the Massachusetts Department Of Revenue Form 84 Applic. Additionally, you can seamlessly integrate with other applications to enhance productivity. Our platform is designed to meet your needs effectively.

-

Can I integrate airSlate SignNow with other tools while handling the Massachusetts Department Of Revenue Form 84 Applic?

Absolutely! airSlate SignNow supports multiple integrations with popular third-party applications and services. This allows you to easily manage your workflows and enhance collaboration while completing the Massachusetts Department Of Revenue Form 84 Applic. Integrating your tools can signNowly boost your efficiency.

-

What benefits does airSlate SignNow provide for businesses handling the Massachusetts Department Of Revenue Form 84 Applic?

Using airSlate SignNow for the Massachusetts Department Of Revenue Form 84 Applic offers numerous benefits, including faster turnaround times and reduced paperwork. Our user-friendly interface facilitates a seamless signing experience for all parties involved. This means you can focus on your business while we handle the documentation.

-

Is it easy to use airSlate SignNow for the Massachusetts Department Of Revenue Form 84 Applic?

Yes, airSlate SignNow is designed for ease of use, allowing individuals and businesses to easily navigate the platform while managing the Massachusetts Department Of Revenue Form 84 Applic. The intuitive interface and step-by-step guides enhance user experience, making document management straightforward and efficient.

Get more for Massachusetts Department Of Revenue Form 84 Applic

Find out other Massachusetts Department Of Revenue Form 84 Applic

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document