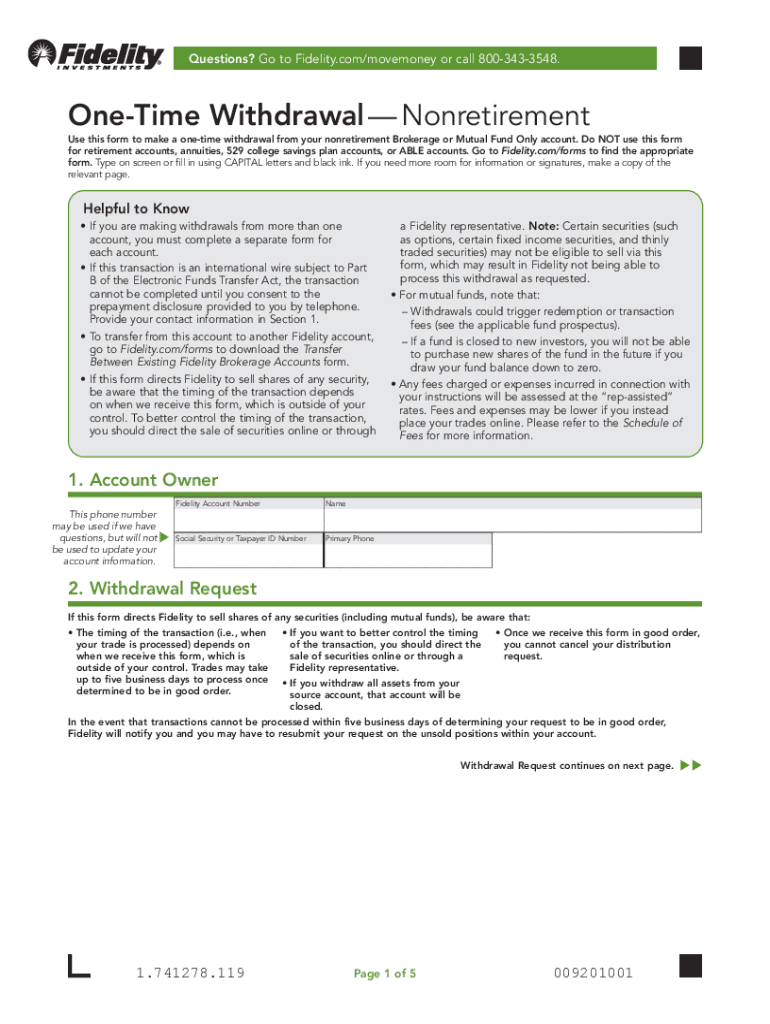

One Time Withdrawal FormNonretirementFidelity Investments Use This Form to Make a One Time Withdrawal from Your Nonretirement Br 2020-2026

Understanding the Fidelity Hardship Withdrawal Form

The Fidelity hardship withdrawal form is specifically designed for individuals who need to access their 401(k) funds under qualifying circumstances. This form allows participants to withdraw money from their retirement savings to cover immediate and pressing financial needs, such as medical expenses, education costs, or to prevent eviction. Understanding the purpose of this form is crucial for anyone considering a hardship withdrawal from their Fidelity 401(k) account.

Eligibility Criteria for Hardship Withdrawals

To qualify for a hardship withdrawal from your Fidelity 401(k), you must meet specific criteria set by the IRS. Generally, you can only withdraw funds for certain expenses, including:

- Medical costs that are not reimbursed by insurance

- Purchase of a primary residence

- Tuition and educational fees

- Preventing eviction or foreclosure

- Funeral expenses

Additionally, you must demonstrate that you have exhausted all other options for funding your needs before applying for a hardship withdrawal.

Steps to Complete the Fidelity Hardship Withdrawal Form

Filling out the Fidelity hardship withdrawal form requires careful attention to detail. Follow these steps to ensure your application is processed smoothly:

- Gather necessary documents that support your financial need.

- Log into your Fidelity account and locate the hardship withdrawal form.

- Complete the form by providing personal information and detailing your hardship.

- Attach any required documentation that verifies your financial situation.

- Submit the form electronically or print it out for mailing.

Ensuring all information is accurate and complete will help avoid delays in processing your withdrawal request.

Required Documents for Submission

When applying for a hardship withdrawal, you must provide specific documentation to validate your request. Commonly required documents include:

- Proof of medical expenses, such as bills or insurance statements

- Documentation of tuition costs, such as invoices from educational institutions

- Lease agreements or eviction notices for housing-related withdrawals

- Death certificates for funeral expenses

Having these documents ready will streamline the application process and support your case for withdrawal.

Form Submission Methods

You can submit your Fidelity hardship withdrawal form through various methods, ensuring flexibility based on your preferences. The available submission methods include:

- Online submission through the Fidelity website

- Mailing a printed version of the form to Fidelity's processing center

- In-person submission at a Fidelity branch office

Choosing the right method can depend on how quickly you need the funds and your comfort level with digital versus paper processes.

Fidelity Hardship Withdrawal Terms and Conditions

It is essential to understand the terms and conditions associated with a hardship withdrawal from your Fidelity 401(k). Key points to consider include:

- Withdrawals are subject to income tax and may incur a penalty if you are under age fifty-nine and a half.

- Only the amount necessary to meet your financial need can be withdrawn.

- Future contributions to your 401(k) may be limited for a specified period after a hardship withdrawal.

Reviewing these terms will help you make informed decisions regarding your retirement savings and financial health.

Quick guide on how to complete one time withdrawal formnonretirementfidelity investments use this form to make a one time withdrawal from your nonretirement

Complete One Time Withdrawal FormNonretirementFidelity Investments Use This Form To Make A One time Withdrawal From Your Nonretirement Br effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents promptly without delays. Handle One Time Withdrawal FormNonretirementFidelity Investments Use This Form To Make A One time Withdrawal From Your Nonretirement Br on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to edit and electronically sign One Time Withdrawal FormNonretirementFidelity Investments Use This Form To Make A One time Withdrawal From Your Nonretirement Br with ease

- Obtain One Time Withdrawal FormNonretirementFidelity Investments Use This Form To Make A One time Withdrawal From Your Nonretirement Br and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries exactly the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign One Time Withdrawal FormNonretirementFidelity Investments Use This Form To Make A One time Withdrawal From Your Nonretirement Br and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct one time withdrawal formnonretirementfidelity investments use this form to make a one time withdrawal from your nonretirement

Create this form in 5 minutes!

How to create an eSignature for the one time withdrawal formnonretirementfidelity investments use this form to make a one time withdrawal from your nonretirement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a hardship withdrawal with Fidelity?

A hardship withdrawal with Fidelity allows you to access your retirement funds in cases of serious financial need. This option is typically available to 401(k) plan participants under specific circumstances, such as medical expenses or eviction. Understanding how to initiate a hardship withdrawal with Fidelity is crucial to managing your finances effectively.

-

How can I apply for a hardship withdrawal through Fidelity?

To apply for a hardship withdrawal through Fidelity, you must first determine if you meet the eligibility requirements. Once confirmed, you can complete the application form available on their website or contact their customer service for assistance. Be prepared to provide documentation that supports your financial hardship.

-

Are there any penalties for taking a hardship withdrawal from Fidelity?

Yes, taking a hardship withdrawal from Fidelity may incur penalties, especially if you're under 59½ years of age. Generally, you may face a 10% early withdrawal penalty in addition to regular income taxes on the amount withdrawn. It's essential to review these implications before proceeding with a hardship withdrawal.

-

How does a hardship withdrawal affect my retirement savings with Fidelity?

A hardship withdrawal will reduce the amount saved in your Fidelity retirement account, which could impact your long-term financial goals. Additionally, if you take a withdrawal, you may not be able to contribute to your retirement account for a specific time frame. Consider consulting a financial advisor to understand the full ramifications.

-

What types of financial hardships qualify for a withdrawal from Fidelity?

Fidelity recognizes several types of financial hardships that may qualify for a withdrawal, including medical expenses, funeral costs, and the purchase of a primary residence. Each situation is evaluated based on its circumstances, so it’s important to review the guidelines provided by Fidelity. Ensure your situation aligns with their criteria before applying.

-

Can I take multiple hardship withdrawals from my Fidelity account?

Yes, it is possible to take multiple hardship withdrawals from your Fidelity account; however, each withdrawal must meet the specific criteria outlined in the plan rules. Additionally, excessive withdrawals can diminish your retirement savings and may hinder your financial future. Plan wisely and consider the implications of multiple withdrawals.

-

What documentation is required for a hardship withdrawal from Fidelity?

When applying for a hardship withdrawal from Fidelity, you will typically need to provide documentation that substantiates your financial need. This may include bills, proof of medical expenses, or eviction notices. Ensuring you have the proper documentation can assist in a smoother application process.

Get more for One Time Withdrawal FormNonretirementFidelity Investments Use This Form To Make A One time Withdrawal From Your Nonretirement Br

- Emailing application for examination or employment state of connecticut form

- Marriage officiant 72 hour waiver department of health amp hospitals new dhh louisiana form

- Valmark securities global gift fun d application for form

- Form 27b 6

- Form obd 3

- Beauty pageant event program form

- Dl54a form

- New york general consulting form

Find out other One Time Withdrawal FormNonretirementFidelity Investments Use This Form To Make A One time Withdrawal From Your Nonretirement Br

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself